TSX:XBB (iShares Core Canadian Universe Bond Index ETF)

About XBB

The investment objective of the Fund is to provide income by replicating, to the extent possible, the performance of the FTSE Canada Universe Bond Index the Index, net of expenses. To achieve its investment objective the fund uses an indexing strategy to achieve its investment objective. Under this strategy, the Fund seeks to replicate the performance of the Index, net of expenses, by employing, directly or indirectly, through investment in one or more exchange-traded funds managed by BlackRock Canada or an affiliate and or through the use of derivatives, a replicating strategy or sampling strategy. A replicating strategy is an investment strategy intended to replicate the performance of the Index by investing, directly or indirectly, primarily in a portfolio of index securities in substantially the same proportions as they are represented in the Index.

iShares Core Canadian Universe Bond Index ETF (TSX: XBB) Latest News

Investing

ZAG vs. VAB vs. XBB: Which Aggregate Bond ETF Is the Better Buy for Canadians?

Investing

ZAG vs. XBB: Which Bond ETF Is the Better Buy for Canadian Investors?

Stocks for Beginners

What 2 Passive Retirement Portfolios May Look Like

Stocks for Beginners

New Investors: Do You Need Bonds in Your Investment Portfolio?

Dividend Stocks

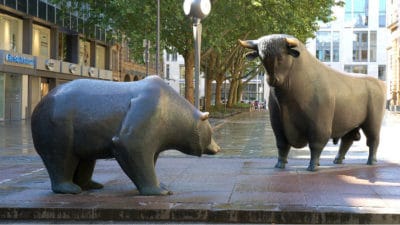

Worried About a Market Crash? Here’s How You Can Protect Your TFSA

Dividend Stocks

3 Ultra-Safe Stocks to Buy Today — Before the Next Crash

Investing

The Real Reason Do-it-Yourself Investing Beats Owning Mutual Funds

Dividend Stocks

Can Your Retirement Survive the Next Crash?

Dividend Stocks

Savers: 3 Smart Moves to Make With Your Income Tax Refund

Dividend Stocks

Worried About a Trump Presidency? Hide Out in These Defensive Stocks

Dividend Stocks

Nervous About Stocks? Hide Out in These Safe-Haven Assets

Investing

Preparing for the Next Market Crash: Why Investors Should Ignore Bonds

1❯