NYSE:MCD (McDonald's Corporation)

About MCD

McDonald's is the largest restaurant owner-operator in the world, with 2021 system sales of $112 billion across more than 40,000 stores and 119 countries. McDonald's pioneered the franchise model, building its impressive footprint through partnerships with independent restaurant franchisees around the world. The firm earns nearly 60% of its revenue from franchise royalty fees and lease payments, with the remainder coming from company-operated stores across its three core segments: the United States, internationally operated markets, and international developmental/licensed markets. McDonald's owns 55% of the real estate and 80% of the buildings in its franchise system, offering it substantial leverage in maintaining quality standards and consistency.

McDonald's Corporation (NYSE: MCD) Latest News

Dividend Stocks

Why Restaurant Brands International Inc. (TSX:QSR) Stock Could Breach $100 This Year

Investing

All-Day Breakfast Won’t Be the Solution to Tim Hortons’s Problems

Investing

Will All-Day Breakfast Save Tim Hortons?

Investing

Tim Hortons’ Parent Looks to Play Nice

Investing

Have Investors Lost Sight of This Bottom Line?

Investing

MTY Food Group Inc. Goes 1 Acquisition Too Far

Investing

This Tech-Embracing Canadian Growth King Is Making Fast Food Fast Again!

Investing

Think Restaurant Brands International Inc. Needs to Do More? Short its Stock

Investing

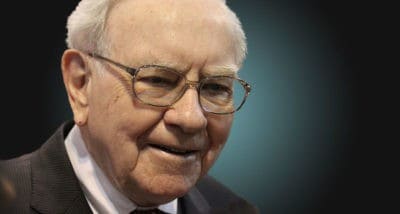

Warren Buffett Is Getting Repaid $3 Billion From This Undervalued Canadian Growth King That’s Ripe for Lift-Off in 2018

Investing

The Real Reason Why Tim Hortons Is Seeing Weak Comps

Investing

Legal Marijuana Could Be a Major Tailwind for This Iconic Canadian Company