This article first appeared on our U.S. website.

For the last three years, no innovation has captivated the attention of Wall Street and everyday investors quite like the evolution of artificial intelligence (AI). Empowering software and systems with the tools to make split-second decisions without the need for human oversight is a game-changer for most industries around the globe, and a technological leap forward that can add US$15.7 trillion to the global economy by 2030, according to the analysts at PwC in Sizing the Prize.

While Nvidia has been the clearest beneficiary of the AI revolution on a nominal-dollar basis – its market value has climbed by US$4.2 trillion since the end of 2022 – the argument can be made that AI-data mining specialist Palantir Technologies (NASDAQ: PLTR) has knocked Nvidia from its pedestal.

Since 2023 began, shares of Palantir have surged by roughly 2,780%, with the company adding well over US$400 billion in market value. It went from being a business of fringe importance in the tech sector to the 20th-largest publicly traded company on U.S. stock exchanges, as of the closing bell on Oct. 24.

With a move of this magnitude, you can be certain that Wall Street and investors are eagerly awaiting Palantir’s third-quarter operating results, which the company will release after the close of trading on Monday, Nov. 3.

Although Palantir has a habit of leaping over the consensus earnings per share (EPS) forecast of analysts — it’s topped expectations by a double-digit percentage in three of the last four quarters — it seems far likelier that Palantir will disappoint Wall Street come Nov. 3.

Palantir’s competitive edge has been on full display

But before investors can look to the future and make predictions, a foundation has to be laid of how we got to a point where Palantir has become one of the most-influential AI stocks on the planet.

The primary catalyst fueling Palantir’s outperformance is the company’s sustainable moat. Specifically, its two core operating segments lack large-scale competition, which means Palantir doesn’t have to concern itself with the idea of other companies siphoning away its contracts or subscriber base.

The historical breadwinner for Palantir is its AI- and machine learning-powered Gotham software-as-a-service (SaaS) platform. Gotham assists the U.S. government and its allies with data collection and analysis, as well as military mission planning and oversight. This segment typically lands four- or five-year deals with federal governments that lead to highly predictable operating cash flow and consistent double-digit sales growth. Gotham is also the reason Palantir became profitable on a recurring basis well ahead of consensus expectations among Wall Street analysts.

The other core SaaS operating segment is Foundry, which caters to businesses. This is a subscription-based service that helps its enterprise clients make sense of their big data to improve supply chains and automate certain operations, to name a small snippet of this platform’s uses.

Palantir is one of Wall Street’s best examples of AI applications transforming and enhancing the capabilities of cloud-based software. But even with an eye-popping growth forecast and a knack for surpassing analyst EPS expectations, Palantir is likely sledding uphill as it prepares to unveil its third-quarter operating results.

Wall Street’s AI darling has a nearly impossible task of impressing investors on Nov. 3

Palantir’s biggest challenge boils down to one word: history.

History tells us that every game-changing innovation and hyped technology dating back more than three decades has navigated its way through an eventual bubble in the early stages of its expansion. Without exception, investors have consistently overestimated the adoption rate and early innings utility of next-big-thing trends, which leads to lofty expectations not being met. When next-big-thing bubbles burst, the companies on the leading edge of these trends often taken the brunt of the punishment.

The one thing Palantir has working in its favor is the relative predictability of its operating cash flow. Multiyear government contracts and a subscription-driven platform with Foundry would likely protect it from a revenue cliff in the event of an AI bubble-bursting event. But this doesn’t mean Palantir’s stock would be out of the woods.

Perhaps the bigger historical hurdle is Palantir’s stratospheric valuation.

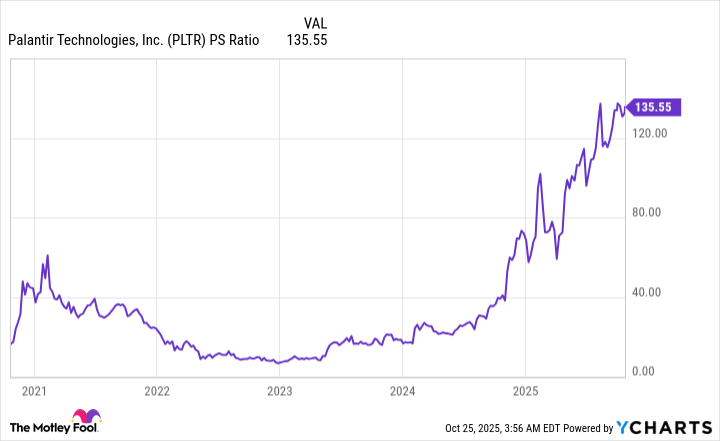

Prior to the bursting of the dot-com bubble, some of the most-influential internet businesses peaked at price-to-sales (P/S) ratios ranging from 30 to 40, with a little bit of wiggle room at the top end. Companies like Cisco Systems, Amazon, and Microsoft were unable to sustain P/S ratios this high over an extended period.

PLTR PS Ratio data by YCharts.

Keeping in mind that no megacap company has ever been able to maintain a P/S ratio above 30, Palantir Technologies closed out Oct. 24 with a P/S ratio approaching 136! There isn’t a revenue or EPS guide imaginable that can satiate the optimism to support a P/S ratio of 136. It would take multiple years of 40%-plus ongoing sales growth just to get Palantir stock down to the P/S ratio range of 30 to 40 that prior bubbles have topped out at.

To make things more complicated, the federal government shutdown has extended well beyond three weeks, as of this writing. Palantir has historically been reliant on Gotham to do its heavy lifting and provide the lion’s share of its operating income. The shutdown is stalling new deal potential in the near-term.

When a stock is priced for perfection, Wall Street and investors will expect nothing less. The problem is, even the best companies trip up or slow down from time to time. Palantir’s astronomical valuation has its stock set up for disappointment come Nov. 3.