September has been a rollercoaster ride for some of Canada’s top tech stocks, sending share prices tumbling and creating what looks like a potential buying opportunity for long-term investors. The strategy is simple: identify quality companies facing temporary headwinds that the market has overreacted to. This month, two standout candidates have emerged, making them some of the most intriguing undervalued growth stocks on the TSX right now. Let’s dive into why Constellation Software (TSX:CSU) stock and MDA Space (TSX:MDA) could be powerful growth stocks to buy now for your portfolio.

Constellation Software stock: A founder steps back, but strategy remains intact

Constellation Software stock felt like it lost a bit of its magic last week. The stock slid 20% after the iconic founder, Mark Leonard, announced his resignation as president, citing health reasons. For three decades, Leonard was the visionary behind this decentralized software giant, a serial acquirer of niche vertical market businesses. His track record is staggering, turning the company into a wealth-generating machine for investors.

So, is the CSU stock sell-off justified? While a founder’s departure always introduces uncertainty, the transition appears exceptionally smooth. Leonard isn’t disappearing; he’s retaining a board seat. Stepping into the president’s role is Mark Miller, the company’s long-time Chief Operating Officer and a trusted insider for three decades. He knows the playbook inside and out, having co-founded Trapeze Group, which was Constellation’s very first acquisition. The leadership risk seems low.

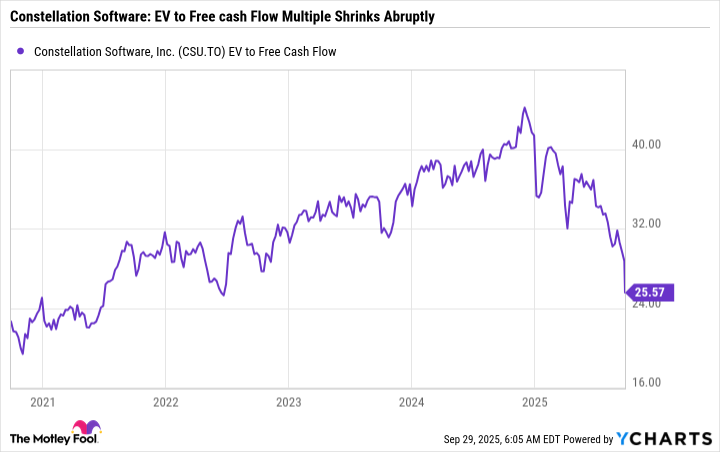

The real story for investors is the valuation. The market is hastily removing a “founder premium” from Constellation Software’s stock price. This has caused Constellation’s enterprise value to free cash flow (or EV/FCF, a key metric that values a company relative to the cash it generates) multiple to plunge from 40 to around 25.

CSU EV to Free Cash Flow data by YCharts

Cash flow is the lifeblood supporting Constellation Software’s acquisitions-led growth strategy. New investors are essentially being offered a chance to buy this stellar tech compounder at a significant discount. With a smooth leadership handoff and its core acquisition strategy intact, Constellation Software stock may never be this cheap again.

MDA Space: A lost EchoStar contract doesn’t sink this satellite star

MDA Space stock hit a different kind of turbulence this month. Its stock fell 26% after a key customer EchoStar, abruptly cancelled a massive $1.8 billion contract as it sold spectrum licenses to Elon Musk-led SpaceX. News like this stings, as it represents a direct hit to future revenue, earnings and cash flow projections. It even sparked talks of investor lawsuits.

However, looking beyond the headline reveals a much healthier picture. First, MDA confirmed it will be compensated for termination costs, and, crucially, it reiterated its full-year 2025 financial guidance. This implies the lost deal doesn’t materially impact its near-term performance. Why? The company’s order backlog remains a formidable $4.6 billion, providing strong revenue visibility for the next two to three years.

In my view, the EchoStar deal loss isn’t a failure of MDA’s technology or execution; it’s a shift in a distressed client’s strategy.

The space race is hotter than ever, and MDA is a well-established leader. In August, the company reported a 54% year-over-year revenue surge for its second quarter, with adjusted earnings before interest, taxes, depreciation, and amortization (adjusted EBITDA) growth at 57%.

Even more compelling is MDA stock’s valuation. The stock now trades at a forward price-to-earnings-to-growth (PEG) ratio of just 0.5. The PEG ratio helps determine if a stock’s price is justified by its earnings growth. A ratio of one is considered fair value, so anything below that suggests the market is significantly discounting the company’s growth potential.

With management forecasting 20% to 30% annual revenue growth for the next five years and a newly expanded factory coming online, this temporary setback looks like a classic buy-the-dip moment on MDA stock. The space industry is accelerating, and MDA has the capacity and contracts to ride the wave.

The Foolish bottom line

Both Constellation Software and MDA Space are facing stumbles that appear temporary in the context of their long-term growth stories. For CSU, the market is adjusting to life after a legendary founder, creating a rare valuation gap. For MDA, a single contract loss has overshadowed a powerful growth trajectory and a packed order book. These September sell-offs may have just opened the door to two of the most promising undervalued growth stocks to buy now for investors with a long-term horizon.