This article first appeared on our U.S. website.

Artificial intelligence (AI) remains a hot area to invest in, as seen in Nvidia’s (Nasdaq: NVDA) share price, which is up 35% this year. Two AI businesses to consider are ASML Holding (NASDAQ: ASML) and Advanced Micro Devices (NASDAQ: AMD), since they provide key hardware to the industry.

The former makes cutting-edge lithography machines, which are necessary for producing the advanced microchips that power AI systems. AMD, one of Nvidia’s top competitors, sells AI chips to cloud computing companies such as Microsoft (Nasdaq: MSFT).

ASML and AMD are both strong businesses. But determining which is a better AI investment isn’t simple. So let’s evaluate them in more detail.

ASML’s lithography equipment is essential for manufacturing AI microchips because the technology demands immense computing power. This necessitates shrinking chip components to minuscule dimensions. For instance, a microchip the size of your fingernail contains billions of transistors. ASML’s machines support this.

Although the Dutch company plays an important role in AI, its stock has struggled in 2025, remaining essentially flat through Aug. 6. Part of this is because management anticipates economic uncertainty ahead as a result of factors such as President Donald Trump’s aggressive tariff policies.

Even so, ASML expects 2025 sales to rise 15% over 2024’s 28.3 billion euros (US$33 billion). This is significant since 2024’s revenue represents only a 2.6% year-over-year increase. And so far this year, the company is doing well.

A look into ASML

Through two quarters, revenue stood at US$18 billion, up from the prior year’s US$13.4 billion. Operating income rose to US$5.8 billion from 2024’s US$3.7 billion. This robust growth resulted in net income of US$5.4 billion, a strong increase over the previous year’s US$3.3 billion.

The excellent first-half results were tempered by a third-quarter revenue forecast between US$8.6 billion and US$9.2 billion. This outlook, when compared to the prior year’s sales of US$8.9 billion, suggests the current trend of strong year-over-year growth may be slowing down, which contributed to ASML’s tepid stock performance.

How AMD is faring

Like rival Nvidia, AMD stock is having a stellar year. Shares are up 35% in 2025 through Aug. 6. This performance is understandable following the company’s second-quarter earnings results. The quarter’s revenue reached a record US$7.7 billion, a 32% year-over-year increase.

CEO Lisa Su said, “We are seeing robust demand across our computing and AI product portfolio and are well positioned to deliver significant growth in the second half of the year.” In that second half, AMD expects revenue of US$8.7 billion, a strong increase over the previous year’s US$6.8 billion.

Despite the sales growth, AMD exited the second quarter with an operating loss of US$134 million compared to operating income of US$269 million in the previous year. The substantial drop was due to new U.S. government restrictions introduced earlier this year on the sale of AI chips to China. As a result, AMD could not sell chips it had intended for Chinese customers, forcing the company to write off that inventory by US$800 million.

Yet this makes its second-quarter sales growth all the more impressive. In the quarter, net income was US$872 million, up 229% year over year. Consequently, diluted earnings per share soared 238% to US$0.54 in a boon to shareholders.

AMD is working to get government approval to sell AI chips to China again. When that OK is obtained, the company is in a position to deliver more outsize sales growth.

Deciding between ASML and AMD

AMD’s outstanding performance, its anticipated third-quarter revenue growth, and an eventual return of sales to China point to it being the superior AI stock versus ASML.

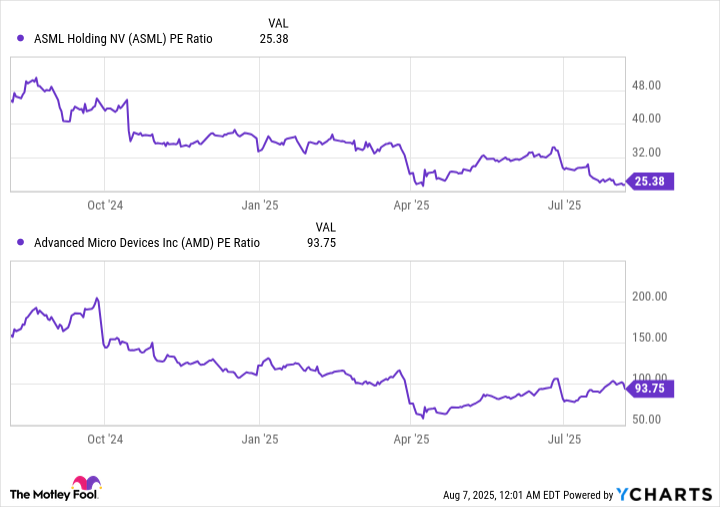

However, an important consideration is share price valuation. The price-to-earnings ratio (P/E) tells you how much investors are willing to pay for a dollar’s worth of earnings based on the trailing 12 months.

Data by YCharts.

The top chart shows ASML’s P/E ratio has declined over the past year, indicating its stock’s valuation has improved. Compared to AMD’s recently rising earnings multiple, as seen in the bottom chart, ASML shares look like a bargain.

ASML’s short-term sales may slow due to the current macroeconomic uncertainty, but over the long run, it’s likely to benefit from the rise of AI. The company sees the technology as a significant chance for growth in semiconductors, similar to previous opportunities like PCs, the internet, and smartphones.

Industry forecasts support ASML’s perspective. The AI sector is projected to grow from US$244 billion in 2025 to US$1 trillion by 2031. While this market growth is a tailwind for both companies, ASML’s attractive valuation makes it look like the more compelling AI stock to buy right now.