Younger investors tend to underestimate the value of time. Instead of chasing lottery tickets with penny stocks, meme stocks, or crypto, a better idea is to take advantage of your longer time horizon. The power of compounding becomes more powerful the longer you’re able to invest.

Investing the Motley Fool way by buying a diversified portfolio of stocks and maintaining a long-term perspective is the way to go. Don’t believe me? Allow me to illustrate using a real-life, historical example of how buying a simple index fund and staying the course could make you a millionaire.

The power of time and compounding

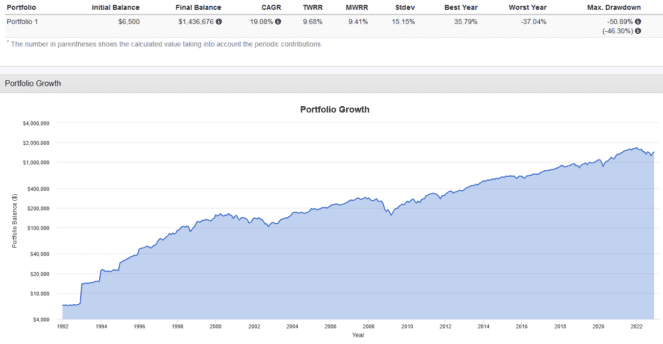

Imagine you started investing back in 1982 as a 25-year-old. You were able to contribute $6,500, which, let’s say, was the annual TFSA contribution limit (just keep in mind that the TFSA didn’t actually come into existence until 2009).

You put it all in an index fund tracking the broad U.S. market and vowed to never sell, reinvest all dividends promptly, and hold for the long term. You also made a commitment to consistently investing another $6,500 every year in January.

Fast forward 30 years to 2022: your humble initial $6,500 investment would have grown to a total of $1,436,676. Your investments on their own earned a 9.68% time-weighted rate of return (TWRR), but thanks to your contributions, your overall compound annual growth rate was 19.08%.

The key to success here was behavioral. By staying invested for the long term, you were able to reap the benefits of compounding, despite numerous stock market corrections, crashes, and bear markets. Reinvesting dividends helped greatly as well.

How do I invest like this?

This strategy only works when your portfolio is diversified. Holding just a few stocks can be dangerous as the risk of bankruptcy or the stock never recovering is significantly higher. A great way to diversify with just a few tickers is via an exchange-traded fund, or ETF.

My favourite ETFs are passively managed ones that track broadly diversified stock market indexes. A great example is iShares Core S&P U.S. Total Market Index ETF (TSX:XUU). This ETF tracks thousands of U.S. stocks from all 11 market sectors and all market caps.

With XUU, there’s no need to try and predict which stocks or sectors will outperform. An investor who makes XUU the core of their portfolio can focus on just three things: buying more consistently, reinvesting dividends, and holding for the long term.

Best of all, XUU costs an expense ratio of just 0.08%. A $10,000 investment in XUU would cost a mere $8 in annual fees. A great strategy here is making XUU the core of your portfolio while supplementing it with a few high-conviction stock picks (and the Fool has some great recommendations there).