You don’t need a big reserve to start investing in stocks. You just need to be disciplined and can start with a small sum. Beginning your stock investing journey with dividend names is one of the best ways. It is a relatively safer strategy and outperforms in volatile markets.

Here are some of the TSX stocks that look attractive to start investing for a stable passive income.

Canadian Natural Resources

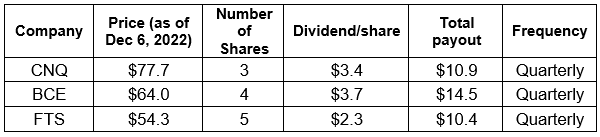

When it comes to dividend investing, energy stocks are not as reliable as utilities or Canadian banks. However, the country’s biggest energy stock, Canadian Natural Resources (TSX:CNQ), stands taller than its peers. It has increased shareholder payouts for the last 24 consecutive years. CNQ currently yields 4.4%, which is in line with its peer TSX energy stocks. So, if you invest $250 in CNQ stock, it will make $11 in dividends annually. As the company increases profits, it will likely increase dividends as well.

Along with handsome dividends, CNQ offers attractive growth prospects. Higher oil and gas prices remarkably boosted its earnings in the last few years. As a result, the stock has soared a massive 55% in the last 12 months and 400% since the pandemic.

Canadian Natural looks well placed to deliver decent dividend growth for the next few years, given its balance sheet strength. Thanks to rallying oil and gas prices, energy-producing companies are seeing enormous earnings growth this year. And this windfall cash is making way for deleveraging and shareholder returns.

BCE

BCE (TSX:BCE) is Canada’s biggest telecom company by market cap. Its stable dividends and less-volatile stock make it an attractive bet for conservative investors.

Like utilities, telecom companies derive a large portion of their earnings from regulated operations. This makes their earnings much more stable and uncorrelated with business cycles. BCE has increased its revenues and earnings by 2% compounded annually, in the last 10 years. Such slow-but-steady financial growth is common in telecom, facilitating stability.

BCE stock currently yields 5.8%, higher than broader markets. It has a long payment history and offers decent dividend reliability. In the last 12 months, BCE stock has returned 4%, but in the last decade, it has returned 10% compounded annually, including dividends. Over the long term, dividends make a significant contribution to shareholder returns.

Moreover, BCE notably increased its capital spending on network infrastructure and 5G rollout in the last few years. Investors could reap the benefits of this in the next few years with faster earnings growth and higher dividends.

Fortis

Fortis (TSX:FTS) is one of the most stable, dividend-paying names in the Canadian markets. It currently yields 4% and has paid dividends for the last 49 consecutive years. It has seen several market downturns and recessions and has kept its dividend-growth streak intact.

If the interest rate hike cycle slows or pauses next year, it could be a big positive for utility stocks. FTS stock is still trading 15% lower from its annual highs in April 2022. It could rally back to those levels if macro challenges subside.

Fortis aims to increase its dividend by 4-6% annually for the next few years. Considering its stable earnings and dividends, investors can expect lower double-digit returns in the long term.

Bottom line

Investing $250 in these TSX stocks will make around $13 annually in dividends. If you can invest the same amount for the long term, the reserve will be around $125,000 at the end of 15 years, based on historical returns.