He made billions from investing in outperforming individual stocks, but lately, legendary investor Warren Buffett’s general investment tip for the retail investor has simply been to buy a low-cost, passively managed stock market index – like the S&P 500. Here, we discuss whether individual Canadian investors should invest like Warren Buffett and buy high-quality individual stocks like the Royal Bank of Canada (TSX:RY) or simply buy the entire TSX – a proxy for the broader Canadian stock market.

Firstly, let me state that you can’t directly invest in the entire TSX, but you can buy units in Exchange Traded Funds (ETFs). These funds passively track the S&P/TSX Composite Index, or other indexes, to replicate its performance. Examples of the most liquid TSX Composite index ETFs include the iShares Core S&P/TSX Capped Composite ETF (TSX:XIC) and the BMO S&P/TSX Capped Composite ETF (TSX:ZCN).

Historically, shares in the Royal Bank of Canada (RBC) have generated immense wealth in retirement portfolios and outperformed the entire TSX’s returns by wide margins. Given Wall Street analysts’ five-year earnings growth outlook of 8% per annum for the bank, RBC stock may continue to offer good returns while providing higher passive income yields that boost total portfolio returns.

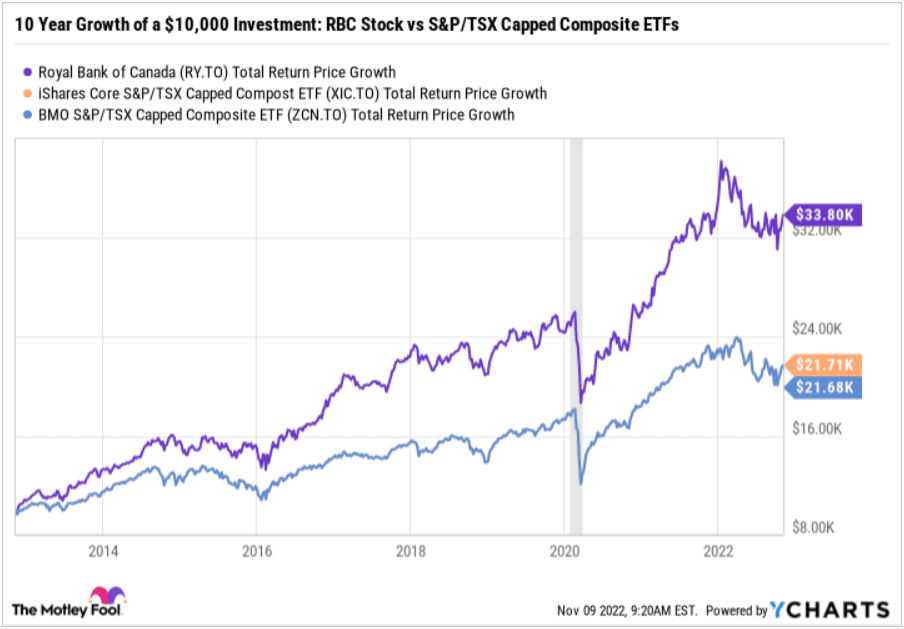

As can be seen above, a hypothetical $10,000 invested in RBC stock 10 years ago would have grown to $33,800, with dividend reinvestment. The same amount invested in the iShares Core S&P/TSX Capped Composite ETF units 10 years ago may have grown to about $21,710 by now. Clearly, the RY stock position could have grown retirement portfolio wealth better than buying the entire TSX. However, there are many considerations to make before investing in RY stock right now.

Thoughts on buying RBC Stock over the entire TSX today

The Royal Bank of Canada is the country’s largest chartered bank with a staggering $179 billion market capitalization. It’s an ideal core holding in a long-term portfolio.

Banks usually earn growing income during periods of rising interest rates. When interest rates are higher, they earn better interest spreads. Interest rates are rising at a record pace in North America right now, and RBC generates more than 84% of its revenue from this geographic region. The bank may report fast-growing profits and achieve its 16% return on equity (ROE) medium-term target with ease. Shares are currently showing strength. However, a potential recession may drag everything and everyone down with it.

Further, RBC stock touts a near 4% dividend yield right now, while the entire TSX’s forward yield is around 3.2%. RBC stock will provide investors with a better shot at passive income. The bank has increased its dividend payout by an average of 7.1% per annum over the past five years and remains committed to growing annual dividends.

That said, buying RY stock (or any other single stock) over the entire TSX will increase company-specific risks in your portfolio. Diversification is usually always necessary to reduce investment risk per unit of return.

Should you buy the entire TSX instead?

Investing in the entire TSX offers instant diversification at low costs, and saves you on research time and expenses. Management Expense Ratios (MERs) of 0.05% to 0.06% on passively managed S&P/TSX Capped Composite ETFs mean one can pay just $6 annually on a $10,000 investment. In exchange, you get the widest access to the whole Canadian stock market.

You should buy the entire TSX if you have low confidence in your idea of which sectors or individual stocks have better chances of outperforming the market during your investment horizon. Buying broad market ETFs will still grant exposure to RY stock, which comprises about 6.3% of the index ETFs’ total net assets.

That said, buying the entire TSX still offers limited diversification. The index exhibits a skewed sector concentration. Financials, Energy, and Industrial stocks comprise 63% of the entire TSX’s 11 economic sectors. Further diversification across sectors may be necessary.

Alternatively, you may employ a core-satellite investing strategy in your stock portfolio. It’s nothing to do with space satellites. You invest a majority of your capital in a low-risk TSX Composite ETF (the core), then spruce up the portfolio with individual stocks (the satellites) you strongly believe in. A subscription to a stock-picking service may help in identifying the best “satellites” that will shoot your portfolio wealth up to desired heights.