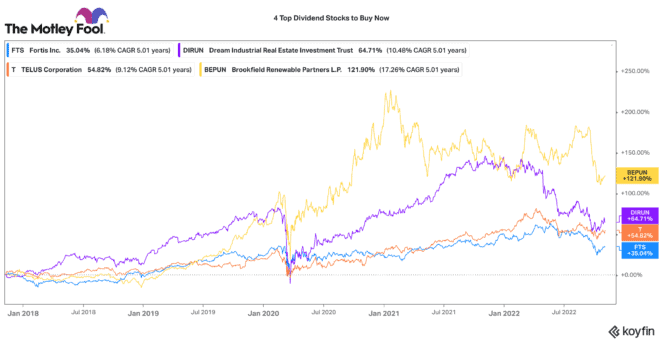

Even though the stock market is down, bear markets tend to be the smartest time to buy dividend stocks. Stock prices and valuations decline and, inversely, dividend yields rise.

So, if you can be patient through the bear market, it can be a great buying opportunity for a long-term investment. If you’ve got $400, here are four top income stocks to consider buying right now.

TELUS: A top stock for dividend growth

TELUS (TSX:T) is a really defensive way to get income and some growth. As Canada’s second-largest telecommunications provider, it captures very reliable income from its contracted data and cellular services.

TELUS just announced third quarter (Q3) results. Revenues, adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization), and net earnings per share rose 10%, 11%, and 48%, respectively. Free cash flows grew by 63%! TELUS increased its quarterly dividend by 7.2% in the quarter!

Today, this dividend stock yields 4.9%. It has a great history of high-single-digit dividend growth (which is likely to continue). Likewise, all its digital verticals and recent acquisitions should continue to drive solid earnings growth ahead.

Dream Industrial REIT: A highly undervalued dividend stock

Real estate has been killed in 2022. Yet that is where some deep value lies. A dividend stock like Dream Industrial REIT (TSX:DIR.UN) is down over 35% in 2022. Today, it trades with a substantial 6.3% dividend yield.

Despite poor market sentiment, this real estate investment trust (REIT) continues to perform very well. In its recent third quarter, net rental income increased over 20%, and its net asset value rose 18.7% to $17.05 per share. Adjusted funds from operation increased close to 7%.

Demand for industrial properties remains very strong, and that continues to support outsized rental rate growth. This is largely offsetting the effects of rising interest rates. You can buy this REIT at a +30% discount to its private market value, and that presents an absolute bargain for smart investors today.

Fortis: A top defensive stock

Fortis (TSX:FTS) stock is down over 12% this year. It’s not often you can buy this defensive dividend stock with a dividend yield over 4.2%. Its 10-year average dividend yield is closer to 3.8%.

Fortis has a network of regulated transmission utilities that span across North America. The regulated revenues provide an attractive baseline for returns. The electric grid will continue to expand, as the world electrifies vehicles, heating, and manufacturing. That provides a large capital growth opportunity for Fortis.

This dividend stock has a 49-year history of growing its dividend annually. Today, Fortis offers a good valuation with a long runway to mid-single-digit dividend growth for many years ahead.

Brookfield Renewables: A growth and income stock

If you want exposure to a top green energy producer, Brookfield Renewable Partners (TSX:BEP.UN) should be on the top of your list. Its stock is down over 11% in 2022, and it trades with a rare yield above 4%.

This company is one of the largest pure-play renewable power producers in the world. It operates 23 gigawatts of power. Given global energy security worries, demand for renewable and alternative power should only keep growing for the coming years. It has over 100 gigawatts in its project development pipeline.

This stock has a nine-year history of growing its dividend annually by a 6% average rate. For a stock with long secular growth tailwinds, a low-risk operating profile, and attractive income, Brookfield Renewable is a great stock to pick up today.