The Tax-Free Savings Account (TFSA) has grown so much since coming to Canada in 2009. That’s when it was introduced as another option to create tax-free income during retirement. However, it’s expanded beyond that to become an ideal mechanism for building a passive income portfolio.

With your TFSA, you can invest in and receive returns from dividend stocks. You can also use your TFSA to create cash flow. This is especially important in retirement, sure. But right now, with the market at 52-week lows, it’s also a great time to create some much-needed extra cash.

Today, I’m going to go over one passive income stock I’d consider for generating cash in a TFSA.

1 dividend stock for high passive income

If you’re looking to generate significant passive income, then you need to look for the right dividend stock. With the market down, there are a lot of options, but they’re not all good options. So, it’s important to consider what a TFSA investor should look for.

For me, I’d start with real estate investment trusts (REITs). But not just any REIT. Rather, focus on critical real estate which includes things like food, infrastructure, and healthcare. This is why I’m recommending NorthWest Healthcare Properties REIT (TSX:NWH.UN).

NorthWest is a solid choice because we desperately need healthcare facilities. They’ll never close, and are in demand more than ever, especially with the rising, aging population. And yet, as you may have heard, we’re in desperate need of even more in Canada. So, these are facilities you can bank on being needed and growing for decades.

But is it worth it?

The question remains whether NorthWest REIT is the best choice for passive income. It’s new, after all, and has only been around since 2018. Furthermore, it hasn’t grown its dividend since coming on the market. These are all important points to consider.

However, I’d say these factors are worth taking on given the benefits. NorthWest REIT is perfect for TFSA investors seeking passive income because it’s growing. It’s expanding its portfolio around the world, acquiring and picking up every type of healthcare property to manage. This has led to a 14.1 average lease agreement, creating solid long-term cashflow.

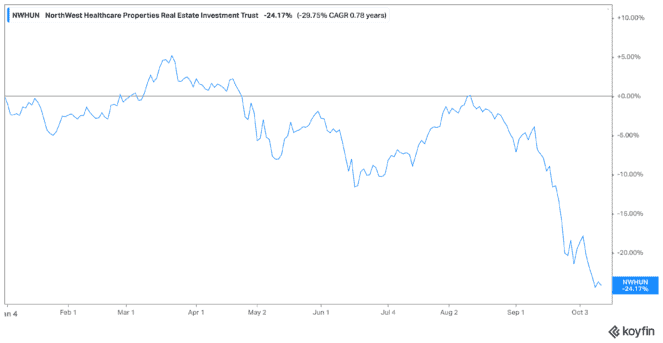

Even with shares down about 20% year-to-date, NorthWest offers protection because it can cover all its debts with just 88.37% of its equity right now. Furthermore, it trades at just 5.69 times earnings and its dividend yield is a generous 7.89%. This all adds up to making the REIT a steal.

Create that cash

If a TFSA investor had $40,000 they wanted to invest in a stock, I would consider NorthWest REIT right now with shares down as they are. You can pick up shares at just $10.09 each, compared to $14.42 at 52-week highs. That growth alone would turn your investment into $57,165!

Plus, for passive income, you could start bringing in $3,171 per year, or $265 per month at these levels! That’s compared to $2,219 per year and about $185 per month at 52-week highs. So, make sure you get in on this deal before it’s gone, and add some defensive stocks to your TFSA passive income portfolio.