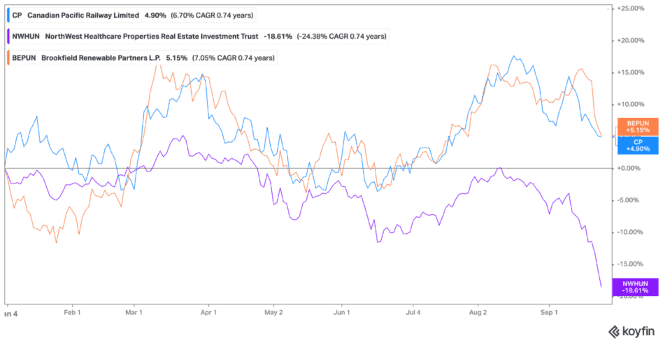

The TSX today continues to fall into market correction territory, with shares down about 12% year to date. It’s even worse if you look at 52-week highs. In this case, the market is now down by a whopping 17% as of writing.

But while this definitely is stressful in the short term, long term I’m buying up more and more TSX stocks. Especially of these three stocks that I own now, and will continue to buy more of in the years to come.

NorthWest REIT

NorthWest Healthcare Properties REIT (TSX:NWH.UN) is one of my favourite TSX stocks. Shares have fallen so far that it’s solidly in value territory, trading at just 6.7 times earnings. It offers a whopping 7.18% dividend yield as well right now! Something we haven’t seen for years.

This of course comes with the trade off that shares of NorthWest stock have come down by over 20% from peak levels in 2022. Even so, this is a strong purchase I would consider for long-term investors. And not just for its dividend yield.

NorthWest stock has been increasing its revenue to record levels as it acquires more healthcare properties. These properties are diverse in that they’re in every area of healthcare, and around the world. As its footprint expands, it’s likely to be one of the best real estate investment trusts (REIT) on the TSX today.

Brookfield Renewable

Another of the TSX stocks I’m continuously buying is Brookfield Renewable Partners LP (TSX:BEP.UN)(NYSE:BEP). Brookfield Renewable stock is another solid long-term hold. It’s already seeing major growth with European countries moving away from Russian oil, and towards renewable energy. With renewable sources, these countries will no longer depend on outside sources for power.

Brookfield Renewable stock is similar to NorthWest stock because of its diversification. It owns practically every type of renewable power source in locations around the world. It too is making strong acquisitions, all of which feed the company’s strong dividend yield.

That yield is at 3.59% as of writing, with shares down about 10% from 52-week highs. And a lot of that devaluation has come in the last few months, with investors still concerned about the market. Yet long-term investors need not worry. In fact, they should rejoice! You can still lock in incredible dividends at an incredible price before a major boom in this renewable energy sector.

CP Rail

Finally, Canadian Pacific Railway (TSX:CP)(NYSE:CP) may not be the dividend grower it once was, but that comes with other growth – namely, with the expansion of its railway to include Kansas City Southern. In fact, shares of CP stock have really only come down in the last month as the market shifts, but there’s nothing the company has been doing wrong.

Without question, CP stock has been doing everything right! After going through a major overhaul to bring down costs, it’s moving towards the future. The railroad reinvigorated its rail network, and is now adding onto it. Furthermore, it’s partnering with companies to move towards renewable energy as well as add hydrogen fuel-cell rail engines.

All this proves that despite being an old, venerable railway company (141 years), CP stock can still find ways to innovate. Which is why I’ll continue to buy it up, even with shares down 10% in the last two months. Because honestly, when the merger with Kansas City gets underway, revenue is likely to explode, along with its share price.