Natural gas is one of the most interesting and promising commodities today. While it’s been around forever, it’s never faced as exciting dynamics and opportunities. Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ) is a well-diversified stock that has increasing exposure to natural gas. It’s the largest and safest energy stock to buy today. But while it’s one of the best on the Toronto Stock Exchange (TSX), CNQ stock is not the only stock to buy for exposure to natural gas.

North American natural gas heads overseas

First, let’s review why I’m so bullish on natural gas.

The world is starving for energy. Both developing countries like China as well as developed nations like Europe are teetering on an energy crisis situation. They’re facing low energy supply issues coupled with strong demand. At the same time, North America has finally brought liquified natural gas (LNG) plans to fruition. This means that the infrastructure now exists to bring North American natural gas to the globe.

This comparatively cheap, clean, and reliable energy source is in hot demand around the globe. It’s no wonder, considering the alternatives. Renewable energy is still the ultimate goal, but for now, natural gas is the second-best thing.

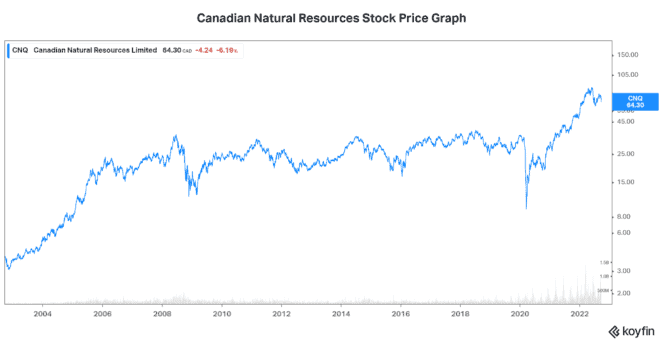

Canadian Natural Resources stock: A top Canadian energy name with rising natural gas production

As a diversified oil and gas company, Canadian Natural has held up better than most. Its dividend has increased every year for the last 20 years. Furthermore, its dividend has grown at a compound annual growth rate (CAGR) of 22% over this period. That’s pretty impressive for a “volatile” commodity stock like CNQ.

Today, CNQ continues to generate record cash flows as oil and gas prices remain high. The company has been strategically adjusting its production in response to commodity markets. As a result, its natural gas production has been on the rise. In its latest quarter, natural gas production accounted for 29% of total production. Last year, it accounted for 24% of total production.

This intentional shift toward natural gas production was driven by strong natural gas fundamentals, as previously discussed. This is evidenced in Canadian Natural’s realized natural gas price in the quarter, which was 51% higher versus last year. It was also 30% higher than the Canadian natural gas pricing benchmark. This is the price that natural gas sales in Canada receive.

But Canadian Natural, like so many other producers, has gained access to higher pricing for its natural gas. Exporting their natural gas to the U.S. and globally has allowed this to happen. U.S. benchmark pricing and LNG pricing is significantly higher. 37% of Canadian Natural’s diverse natural gas portfolio is being exported — thus receiving significantly higher pricing.

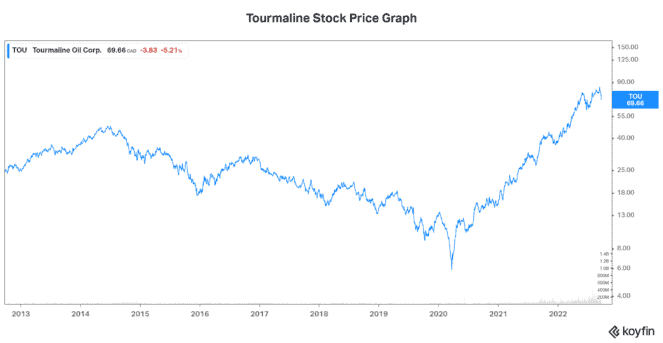

Tourmaline (TOU) stock: The ultimate in natural gas exposure

Unlike Canadian Natural Resources stock, Tourmaline Oil (TSX:TOU) stock is much more tied to natural gas. This is due to the simple fact that approximately 90% of Tourmaline’s production is comprised of natural gas. It is, in fact, the largest natural gas producer in Canada.

Soaring natural gas prices have changed the fortune of natural gas stocks like Tourmaline. To be clear, record cash flows and dividends have become the norm. As the North American natural gas industry becomes increasingly linked to global demand, I expect that this will only intensify.

Thankfully, Tourmaline has taken steps to benefit from this. Simply put, its natural gas is making its way to the global market. It’s helping to meet the soaring global demand for natural gas. For example, the company has an LNG deal with the biggest LNG exporter in the United States. This gives Tourmaline access to the Gulf Coast LNG export market. The deal gives Tourmaline exposure to JKM prices (the Northeast Asian LNG price), which remain quite high.

Motley Fool: The bottom line

In closing, I would like to reiterate my view that natural gas is one of the most exciting commodities today. Consider buying CNQ stock and/or TOU stock in order to gain exposure to this.