Practically everything on the TSX today could be considered growth stocks. After all, the TSX itself is still down by 7.12% year to date and 10.75% since the drop started at the beginning of April. That continues to put it within market correction territory.

But when it comes to growth stocks that could soar back and even double by 2023, the list becomes a lot shorter.

Today, I’m going to cover the three growth stocks that I believe could double by next year.

WELL Health stock

WELL Health Technologies (TSX:WELL) is an easy choice if you’re looking for growth stocks to double. WELL Health stock came to prominence at the perfect time. The pandemic sent everyone home, and that led to a surge in virtual healthcare — the company’s specialty.

However, a vaccine and falling market — specifically, the tech sector — led to WELL Health stock falling as well. Yet that’s why it’s now one of the top growth stocks to consider. WELL fell for the wrong reasons. It continued to perform well. It continued to reach record earnings results. And yet shares continued to drop.

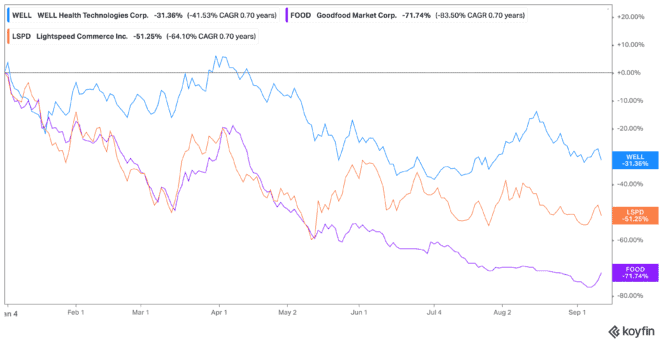

That’s why now it could easily double when investors get back into the market looking for growth. Shares trade at an astounding $3.38 per share. Yet analysts believe it could reach $8.08 by next year. That’s an increase of about 140% as of writing. Down 32% year to date, it’s also in a sector of the health industry that simply isn’t going away anytime soon.

Goodfood stock

Goodfood Market (TSX:FOOD) isn’t as solid as WELL, I would say, but it certainly could be one of the growth stocks to double. That’s because it’s just so cheap. Again, shares climbed during the pandemic, as everyone went home and demand surged. Now, Goodfood stock is attempting to expand its presence — not just in meal kits but with grocery delivery across the country.

The problem today is it’s losing the surge of clients it had during the pandemic. Couple that with rising inflation, and you just don’t see the demand it once had. But again, once inflation gets under control, it’s bound to see a rise in use and share price. And, honestly, it only trades at $1.15 as of writing!

Shares of Goodfood stock are down an incredible 72% year to date, and that’s certainly in oversold territory. In fact, over the last few days shares have started to climb back up, after it dropped below the $1 mark. Now may be the time to get in on Goodfood stock before the doubling it’s likely to have.

Lightspeed stock

Finally, when tech stocks fell, Lightspeed Commerce (TSX:LSPD)(NYSE:LSPD) plunged further after its short-seller selloff. Analyst after analyst said it was overdone. Yet the e-commerce and point-of-sale stock dropped even further. In fact, it remains just above 52-week lows.

The selloff continues to be overdone, with investors taking what gains they could as the market dropped further. I don’t blame them, of course. But now Lightspeed stock offers a stellar opportunity for those seeking growth stocks.

Lightspeed stock is coming out on top, with a number of acquisitions up and running along with strong partnerships. Furthermore, while other e-commerce companies suffer with rising inflation and fewer pandemic restrictions, Lightspeed stock celebrates it. At least the fewer restrictions, as the company can get back to its point-of-sale cash flow with retail and restaurant locations up and running.

Analysts believe it’s one of the growth stocks to outperform in the next year, marking it as a solid buy as it beats earnings estimates. So, while shares are down 52% year to date, they could double to $50 per share by next year.