Growth stocks can be great buys if you treat them as they should be treated. In this case, I mean finding those TSX stocks that offer you long-term growth over short-term gains.

It’s been proven time and again that over time a stock with strong fundamental drivers will see you make more than with one crazy growth stock. But there’s also a way to find a balance. Looking towards the next decade, what are the companies that could soar by 2032? For me, I’d say it comes down to these three growth stocks.

Magna stock

Magna International (TSX:MG)(NYSE:MGA) is an amazing opportunity for investors to consider when looking at growth stocks. Supply-chain demands have hampered the car manufacturer, but there is going to be an ever-growing need for auto gear in the present and near future.

Magna stock is one of the growth stocks set to soar thanks to the electric vehicle (EV) revolution. And it’s already here, with many seeking out EVs as gas prices soar higher. Yet the company also provides income from its partnerships with internal combustion engine vehicles as well. So you get a wonderful transition stock.

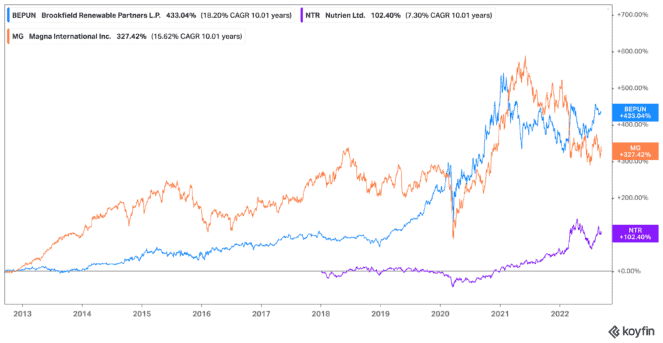

Shares of Magna stock are down 25% year to date, so you can also lock in a dividend yield of 3.11% as of writing. And if history is any indication, you could then look forward to a further compound annual growth rate of 15.6% in the next decade.

Nutrien stock

Nutrien (TSX:NTR)(NYSE:NTR) doesn’t have the history that Magna does, but it’s certainly one of the growth stocks I’d consider these days. The company is through its early high-growth phase, which is a good thing in my books. After climbing to all-time highs and dropping back thanks to sanctions against Russian potash, Nutrien stock is in an enviable position for the next few decades.

The world only has so much arable land, making Nutrien stock one of the companies whose products will be a necessity if we hope to continue producing food. But it’s more than that. Nutrien continues to be one of the top growth stocks as it consolidates a fractured industry, and expands its e-commerce solutions.

Shares are still up by 28% year to date, but it trades at 7.4 times earnings, making it within value territory. So you can lock in Nutrien stock and its low prices while also adding a 2.05% dividend yield.

Brookfield Renewable

It’s not only EVs that are exploding right now, but clean energy in general. That’s why Brookfield Renewable Partners LP (TSX:BEP.UN)(NYSE:BEP) continues to be one of my top choices. Brookfield stock invests in renewable assets around the world, and has been signing on even more in the last few years. Especially as sanctions against Russia compel European countries to create their own power sources.

Yet again, with rising inflation and interest rates, the performance hasn’t been as amazing as we’d hoped. But that’s not due to last long, with Brookfield stock likely to become one of the top growth stocks for investors in the next decade as the world shifts to clean energy.

Shares are up 11.4% year to date, so investors can lock in a 3.26% dividend yield, get a defensive stock in their portfolio, and look forward to even more growth. How much growth? Brookfield stock currently has a decade-long CAGR of 18.2%!