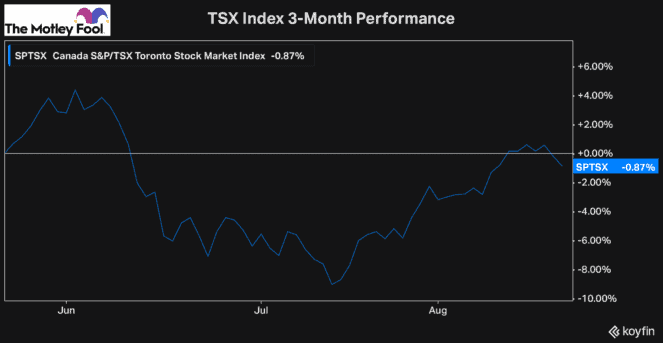

Markets are well known for being volatile, particularly when fear and uncertainty continue to increase. This has been the case so far all year, with markets continuing to bounce around, as investor sentiment changes and economic data conflicts with companies’ earnings reports. But even if you’re worried about a recession on the horizon, there are still plenty of top Canadian stocks you can buy now.

In July, we saw the market beginning to rally off its lows, only for more fear and concern to cause stocks to sell off once again over the last few trading days.

However, while there are some companies that will certainly be impacted by a recession, there are plenty of high-quality businesses with defensive operations that you can not only rely on through a recession but that you can also plan to hold forever.

So, if you’re worried about the impacts of a recession on your portfolio, here are two top Canadian stocks to buy now.

A top Canadian stock to buy as consumers face sky-high inflation

One of the top Canadian stocks to buy for years, and one that continues to be a top pick today in this high-inflation environment, is Dollarama (TSX:DOL).

Dollarama, as well as other discount retailers, have seen a massive increase in demand for their lower-cost goods, as inflation continues to impact consumers’ budgets.

The more prices rise, the more consumers need to find new ways to stretch their budgets, and if a recession were to hit, it would exacerbate the situation even more.

Ever since the last major recession that started back in 2008, Dollarama has seen a massive increase in business. The discount retailer’s total sales have increased over 350%, from roughly $970 million in 2008 to just under $4.5 billion over the last 12 months.

That’s not all, though. Dollarama has also rapidly expanded its store count, improved its merchandising and introduced several price increases, as it continues to gain popularity with consumers.

Therefore, it’s no surprise that over the last few quarters, Dollarama’s sales have continued to grow at more than 10% year over year. And while the company’s costs are increasing as well as a result of higher inflation, Dollarama has done an excellent job ensuring that its profit continues to increase.

Therefore, if you’re worried about a recession and how it may impact your stock portfolio, Dollarama can not only help to protect your capital, it should continue to see strong growth in both its revenue and net income, making it one of the top Canadian stocks to buy today.

A top defensive stock to shore up your portfolio

In addition to Dollarama, another one of the top Canadian stocks to buy now that also happens to be an excellent long-term growth stock is Brookfield Infrastructure Partners (TSX:BIP.UN)(NYSE:BIP).

Brookfield is an ideal stock to own for the long haul but particularly through a recession, because its operations are so defensive. The company owns assets that are essential such as pipelines, utilities, railroad tracks, telecom towers, and more.

In addition, its portfolio is diversified all over the world, which only adds to its reliability and makes it one of the top Canadian stocks you can buy.

Furthermore, because its long-term strategy is to recycle capital, selling off assets that it can get top dollar for and using that cash to buy new, undervalued assets that it’s identified, it’s an incredible long-term growth stock that you can buy and hold for decades.

In addition, the company has a stated goal to increase the distribution it pays to investors by at least 5% each year, making it one of the top Canadian stocks to buy for passive-income seekers.

Over the last four quarters, as inflation has been impacting businesses across numerous industries, Brookfield has grown its sales by at least 25% year over year in each quarter.

More importantly, though, its funds from operations have continued to grow as well, increasing by at least 8% year over year during each of the last four quarters.

Therefore, with its incredible defensive operations and distribution that currently yields 3.4%, there’s no question that Brookfield Infrastructure is one of the top Canadian stocks to buy now.