Canadian investors continue to look for safe stocks that they can stock up on in their portfolios. Even with the TSX rebounding today, up by about 9% since July 14, there are still a lot of worries going around.

The concerns

Canadian investors are fearful of a few macro trends, and they are not all on this side of the border. The United States Federal Reserve continues to increase interest rates at a strong rate. Inflation remains even higher than it is in Canada. All this points to many economists believing that a recession is likely to occur in the U.S. by the end of 2022 or early 2023.

Now it’s important to note that in Canada, we may skirt by without a recession. But even still, we are heavily reliant on the U.S., so it’s certainly bound to hurt our economy. And it’s almost assuredly going to hurt your investments.

Which is why finding safe stocks can be a way to breathe easy during this stressful period, knowing that eventually your shares will recover. But there’s one area that’s proven popular in the past, that I would now stay away from.

Oil and gas stocks

Oil and gas stocks used to be safe havens for investors. We’ve been reliant on these safe stocks for decades, some for over a century! So even when people started cutting back and consuming less oil and gas, we knew this would recover eventually. But now, it’s different.

It’s not just climate change enthusiasts who are deciding to go green and use less oil and gas. Governments and major institutions the world over are realizing that not only do we need to use less oil and gas, there’s an opportunity here to make money.

And it’s why even the Organization of Petroleum Exporting Countries (OPEC+) stated in a recent report that by 2040, over 90% of the world’s oil and gas will be consumed by lower income countries. Everywhere else will have moved on. And that makes oil and gas companies no longer the safe stocks we formerly thought they were.

1 stock to avoid, 1 stock to buy

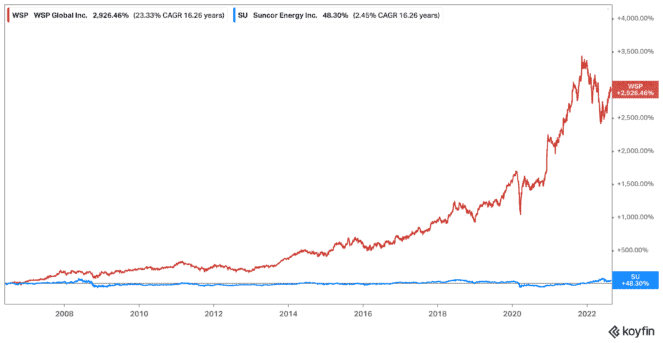

So in this case, there are a few popular oil and gas stocks I would avoid if you’re a long-term investor. Suncor Energy (TSX:SU)(NYSE:SU) is one, and frankly it hasn’t been one of the safe stocks to consider for a while if you’re just looking at performance.

Suncor stock offers a 4.23% dividend yield and trades at 7 times earnings right now. It’s been recovering nicely with higher oil and gas prices, but analysts still didn’t like how it overpaid for acquisitions before the pandemic. And this fully integrated company could get a large awakening when consumers shift to clean energy. If you’re in for a few years, Suncor stock should be a good play. But longer term, I would seriously consider avoiding this company.

SU stock has been super volatile over the last few years with production continually waxing and waning. In fact, the heights we’re seeing now haven’t been seen since 2018. It took almost five years for the company to recover, and it’s still far down from where it was in 2008. So if you’re thinking long term, Suncor stock simply isn’t one of the safe stocks you should hold onto.

Instead, there is certainly an opportunity with clean energy stocks. One I really like right now is WSP Global (TSX:WSP). The company is more expensive trading at 42 times earnings, and has a smaller dividend at 0.94%. But if you’re looking for safe stocks, this is undoubtedly one. Its consultant services are helping guide the world into clean energy infrastructure, and it’s been growing its base by an astounding rate.

Long term, WSP is definitely one of the safe stocks that’s seen far less volatility. Shares peaked in December 2021, and they’re once again flirting with the peak. Yet you can still get a discount while they trade down 13% year to date. Plus, this stock has a long history of growth, with shares up 2,926% in the last two decades!

Bottom line

Energy remains a way to get into safe stocks, but not through oil and gas stocks anymore. Instead, consider a company like WSP stock if you want safety and security that’s going to last. Furthermore, you won’t have to worry about the ups and downs of volatility that continue to plague the industry. So get out while you can.