Pinterest (NYSE:PINS) stock jumped 21% in after-hours trading on August 1 after the company released its second-quarter earnings announcement. Revenue rose 9% year over year to $665.9 million but missed analysts’ forecasts by $0.7 million. Adjusted net income plummeted 54% to $77.4 million, or $0.11 per share, which is below projections by $0.07.

Pinterest’s Q2 results were dismal, but its estimate for mid-single-digit revenue growth in the third quarter eased fears of a sharper contraction. It forecasts sequentially modest single-digit increases in operational expenditure.

Elliott Management, which purchased a 9% investment in Pinterest in June, said it boosted that stake to become its single-largest stakeholder. Elliott said Pinterest CEO Bill Ready is the “right leader to oversee Pinterest’s next phase of growth.”

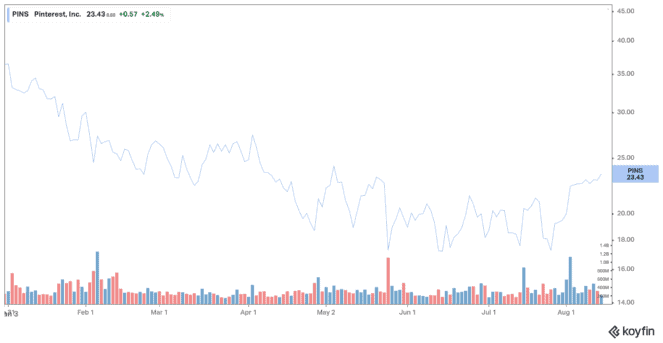

This vote of confidence showed Pinterest’s stock was bottoming out after plummeting 70% since February. Is buying Pinterest stock a safe move?

User growth is unstable

During the pandemic, more people stayed home and explored Pinterest for online buying ideas, cooking, DIY projects, and other hobbies.

Its global monthly active users (MAUs) climbed to 478 million in the first quarter of 2021 but fell to 431 million by the fourth quarter, as lockdown restrictions were removed.

Pinterest completed the second quarter with 433 million MAUs, down 5% from a year earlier but flat from the prior quarter.

Pinterest continued to lose MAUs in the U.S., Canada, and Europe, but it gained more in Latin America and Japan.

Pinterest’s second-quarter revenue from Rest-of-World MAUs was barely 3%. Because these MAUs earn substantially lower average revenues per user (ARPU) than in the U.S., Canada, and Europe, they won’t catch up soon.

On the good side, Pinterest’s ARPU continues to climb year over year in the U.S., Canada, and Europe, suggesting it may offset its dropping MAUs by increasing revenue per user.

To do so, Pinterest hopes to capitalize on its early mover advantage in social buying, which it built by giving “shoppable” pins to companies. Meta Platforms’s Instagram and ByteDance’s TikTok have also promoted shoppable posts. Macroeconomic obstacles slow the expansion of e-commerce.

Pinterest confronts near-term hurdles

Morgenfeld warned that if “economic conditions continue to deteriorate” in the third quarter, revenue growth could be low in the single digits.

Morgenfeld also confirmed Pinterest’s original forecasts for adjusted operating expenses to rise 35-40% for the full year, even as it cools off spending sequentially in the year’s second half.

In the second quarter, Pinterest’s adjusted EBITDA margin declined 15 percentage points year over year to 14% but improved one percentage point sequentially.

Pinterest stock could fall further

Analysts estimate Pinterest’s sales to climb 14% and profitability to fall 20% this year. They estimate revenue and profitability to rise 20% in 2022 as the business stabilizes.

Investors should take these predictions with a grain of salt, as Pinterest faces competitive and macro headwinds in online advertising. At nearly $24 per share, Pinterest trades at 46.7 times next year’s earnings.

For instance, Meta and Alphabet trade at 17.7 and 23.3 times projected earnings. So, Pinterest’s business may be stabilizing, but its stock probably hasn’t bottomed out yet. Investors should watch Pinterest, but it’s hardly a buy.