Now is the opportunity of a lifetime — the one that we all wanted to be a part of back in 2020. We’re still going through inflation, a bear market, and potentially even a recession. Yet there could soon be a rebound in the markets of epic proportions — one that would change these valuable companies into incredible growth stocks.

But that opportunity isn’t going to last forever. And what’s great is that you’re buying companies you can look back on and know you made strong purchases. These aren’t meme stocks, retail stocks, or tech companies that could sink in the future. This is why each of these TSX stocks are ones Motley Fool investors should consider before the summer comes to an end.

CIBC

The Big Six banks remain down among TSX stocks, but that’s why you need to look back on the history of these stocks. Each came back to pre-drop prices within a year’s time. That means we’re due for these growth stocks to start making a comeback.

This is why I refer to them as growth stocks, especially Canadian Imperial Bank of Commerce (TSX:CM)(NYSE:CM). This is the cheapest of the Big Six banks in terms of share price thanks to its stock split. And with an incredibly high dividend, it’s likely investors looking for growth stocks will go there first.

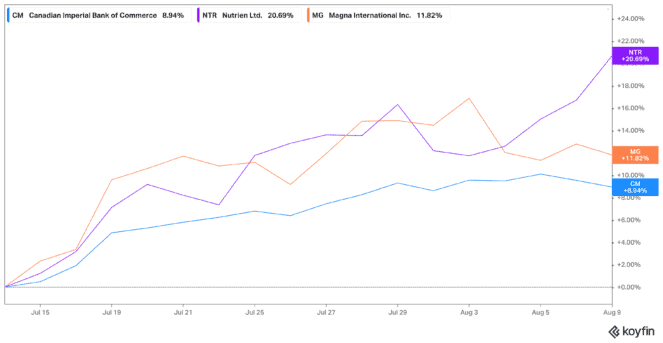

Right now, CIBC remains down by 10.33% on the TSX today year to date. However, it’s also up a whopping 9% in the last month alone. So, now could be the time to lock in its price-to-earnings ratio of 9.16 and 5.09% dividend while Motley Fool investors still can.

Nutrien

Yes, this was one of the growth stocks we witnessed climb and fall in the early days of 2022. But there are positives to Nutrien (TSX:NTR)(NYSE:NTR) since then. The growth came from new investors seeking out potash companies that benefitted from the sanctions against Russia. Now, there is a lot of attention on Nutrien, and investors may be looking to TSX stocks like it once again.

That’s especially during a market rebound, because the basis of Nutrien stock hasn’t changed. It’s still an incredible company growing organically and through acquisitions. It’s invested in an e-commerce space that allows the ability to order online, even during the pandemic. Further, it now has new agreements due to those aforementioned sanctions that could last years with new companies.

And yet, shares of Nutrien stock are down 21% year to date, trading at 11.34 times earnings. However, shares have climbed 21% in the last month alone with this rebounding market. So, again it’s another of the growth stocks Motley Fool investors can buy long term at a great rate, and lock in a dividend of 2.28% while you’re at it.

Magna

Finally, Magna International (TSX:MG)(NYSE:MGA) may take more time to recover, but it’s one where it’ll be worth the wait. Magna stock has partnerships with the largest car manufacturers in North America, and partnerships with global businesses to move cars into the future of electric vehicles. But let’s be clear, there are still ways to benefit from that move today.

Magna provides car parts, and that includes electric parts, even from internal combustion engine vehicles. But right now, the company is going through supply-chain issues that led to a slowing of production. During the last quarter, lockdowns in China slowed its supply chain. With those out of the way, even the next quarter could show a big bounce back.

As for now, it remains a huge deal among growth stocks. It’s one of the TSX stocks that could explode in the next year and beyond with the move to clean energy vehicles. And yet today, it trades down 21% year to date but is already up 12% in the last month alone. Plus, you get a bonus 2.91% dividend yield to look forward to. So, buy it before it climbs higher this summer.