Economic uncertainty is at its peak, as central banks, including the Bank of Canada, increase interest rates at a record pace to tame stubborn inflation. Stock prices understandably fall as the market increasingly worries about potential recessions resulting from aggressive rate policies. However, such is the time to buy the dips on top TSX dividend-growth stocks and lock in high, reliable income yields.

Recessions, fears of recessions, and rising market pessimism create the perfect environment for dividend-growth investors to shop for the best TSX dividend stocks to buy at more favourable valuations.

Below are two TSX dividend-growth stocks with yields higher than 3% that I’m bullish on right now. These companies will pay you a portion of their income for investing in them. They have long track records of paying growing dividends, even during tough economic times, and their share prices could rise again to reward investors with capital gains.

Toronto-Dominion Bank

Toronto-Dominion Bank (TSX:TD)(NYSE:TD) is one of Canada’s largest chartered banks by depositor base, with growing international operations that could sustain dividend and earnings growth well into the future.

TD Bank stock pays a well-covered quarterly dividend that currently yields 4.3% annually. Management targets paying out a sustainable ratio of 40-50% of the bank’s growing earnings, and the bank has paid uninterrupted dividends for 164 years and counting.

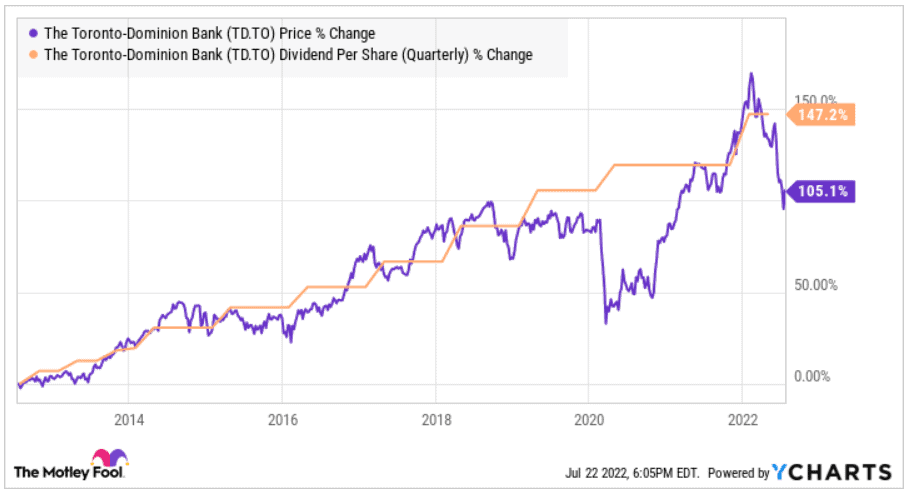

Investors who’d bought TD stock 10 years ago saw the bank increase its quarterly dividend by 147% during the past decade (after adjusting for a two-for-one stock split in 2014). They enjoyed sizeable capital gains, too — TD’s split-adjusted stock price more than doubled.

Why buy TD Bank stock right now?

Although history doesn’t necessarily repeat itself, and past performance won’t predict future returns, investors may still buy TD stock with some confidence today.

TD Bank is well capitalized enough to survive a potential recession. Its latest risk-based total loss-absorbing capital (TLAC) ratio of 30.4% in May exceeded regulatory requirements of 24%.

Building on top of a resilient Canadian retail banking business, TD Bank has strong business growth prospects in the larger United States market through acquisitions. It recently became the largest shareholder in The Charles Schwab Corporation in 2020 and could expand its footprint in southeast America through the acquisition of First Horizon.

Rising interest rates may mean better net interest income generation capacity and expanding business operations may sustain growing net income. Given that recessions are usually short-lived, TD stock investors may expect sustained dividend growth into the future.

Canadian Natural Resources

Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ) is another TSX dividend-growth stock to buy for both reliable income and potential capital gains. The oil and gas giant has one of the most favourable, investor-friendly, capital-return policies in the industry and has grown dividends at a record pace during the past decade.

Record oil prices in 2022 saw the company harvest $3.4 billion in free cash flow during the first quarter. CNQ repurchased shares worth $1.8 billion, paid $0.7 billion in dividends, and reduced its net debt to $13.8 billion.

The lower net debt level is a key consideration for new investors buying CNQ stock right now.

CNQ’s latest capital allocation policy (since July 2021) targets allocating 50% of free cash flow to share repurchases when net debt levels are below $15 billion. Further, the company will also allocate additional free cash flow to shareholders to shareholders when net debt reaches an $8 billion baseline — so dividends could keep growing.

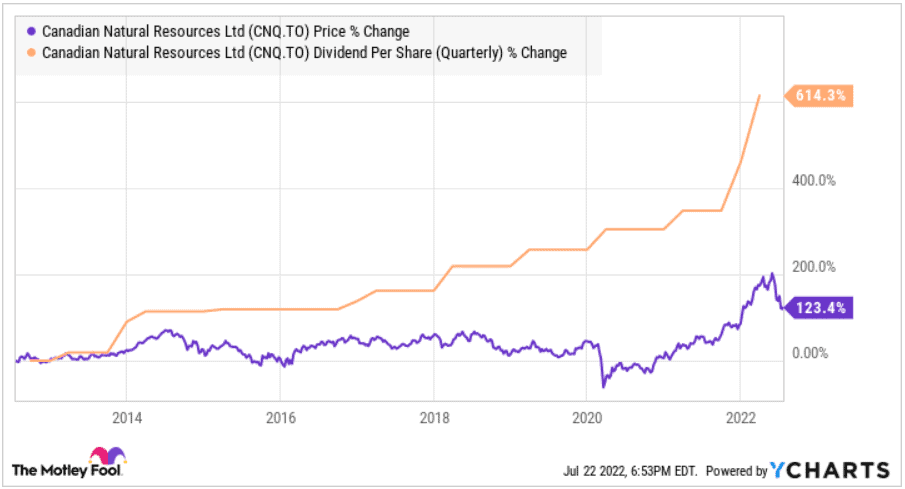

After 22 consecutive years of dividend growth, CNQ pays a $0.75 per share quarterly dividend yielding 4.7% annually. The company increased its dividend by 614% over the past 10 years, and CNQ stock has delivered 123% in capital gains during the same period.

Investors who’d bought CNQ stock 10 years ago have seen the annual dividend yield rise from an initial yield of 2% in 2012 to 11% this year.

Canadian Natural Resources breaks even at Western Texas Intermediate oil prices in the mid-US$30 range. Investors may keep receiving growing dividends if oil prices remain above CNQ’s breakeven range.