If you are a beginner investor, buying and owning dividend stocks for passive income can be a great investment strategy. Who doesn’t like collecting cash dividends on a regular basis?

Stocks are a great way to earn reliable and growing streams of passive income

This is especially true when the stock market is incredibly volatile (like it is today). In fact, owning some dividend stocks is a great way to earn a tangible return, regardless of what happens in the stock market.

If you buy stocks in quality, cash-flowing businesses, you have a high chance of reliably receiving your dividend cheques. If you pick the best businesses, you have a high chance of receiving dividends that actually grow over time.

Get income and capital upside

Keep in mind, no dividend is ever 100% certain. Unlike a bond, companies are not legally obliged to pay dividends. However, the benefit of owning a stock is that you own a piece of an actual business.

Not only do you collect dividends, but you also get to enjoy capital appreciation as that business grows. Bondholders don’t get to participate in the compounding effects of a stock.

Owning stocks is one of the best ways to earn passive income and see your capital appreciate over time. If you are looking for some ultra-safe, quality dividend stocks to own for the long run, here are two to consider today.

A top utility with a long history of dividend growth

Fortis (TSX:FTS)(NYSE:FTS) is a great passive-income stock to hold as an anchor in your investment portfolio. It operates a diverse group of regulated power and natural gas transmission utilities in North America. Power and gas are essential in our modern world. Consequently, Fortis earns a reliable stream of cash flows from its heavily regulated assets.

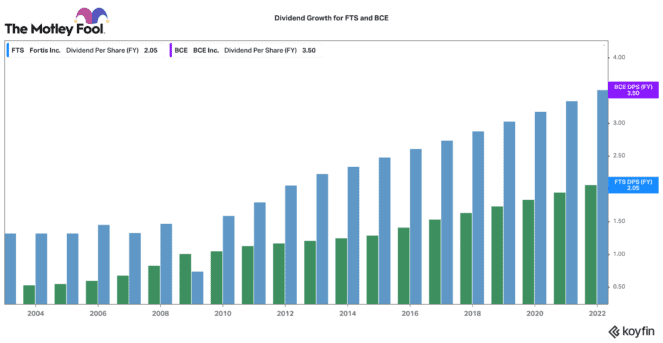

While this business is not growing fast, it is investing in its infrastructure. From this, it is targeting about 6% annual cash flow and dividend-per-unit growth for the next several years. Fortis has a 48-year history of growing its dividend annually. It is one of Canada’s leading Dividend Aristocrats.

Not many companies have that kind of impressive track record. This stock is not cheap. However, it still happens to pay a $0.5275 per share quarterly dividend. On an annual basis, that equals a decent 3.6% dividend yield.

A top telecom for reliable passive income

If you are looking for a more elevated stream of passive income, you may want to consider BCE (TSX:BCE)(NYSE:BCE). With a market capitalization of $57.76 billion, it is Canada’s largest telecommunications services provider.

Being the largest telecom operator provides several advantages such as scale, pricing power, and geographic diversification. Like Fortis, BCE offers essential services like internet and cellular coverage.

It earns relatively consistent annual cash flows that support its attractive 5.88% dividend yield. It pays a $0.92 per share dividend every quarter.

While BCE is not growing very fast, it has a long history of growing its dividends. It has grown its dividend by around 5% annually for the past 10 years. If you are just looking for a reliable passive-income stream to buy, hold, and never sell, BCE stock is as solid as it gets.