TSX stocks are now hitting correction territory. It has not been a pretty or easy year for most Canadian investors. Unfortunately, that is just what comes with investing in a liquid stock market. Buyers and sellers can regularly transact. Periodically, it weighs too far to the seller’s side.

Lots of bad news could keep pushing TSX stocks down

Certainly, there is a lot of bad economic news to worry about. Inflation continues to be a key issue. Central banks continue to be aggressive in trying to slow down the economy. However, if they raise interest rates too high and too quickly, they could push the economy into a recession. The stock market simply does not like this uncertainty, and, consequently, traders start to sell.

Certain top TSX stocks will prosper long term from a market correction

While there is a lot of bad news, it is not always the case on a stock-by-stock basis. A stock is a share in a real business. Certainly, all businesses will be impacted by a recession. Yet truly great businesses can benefit and even profit through a recession.

These types of stocks could rapidly rise once the selling pressure declines. If you are looking for some top ideas to buy and own for when the market recovers, here are two to consider today.

Descartes Systems

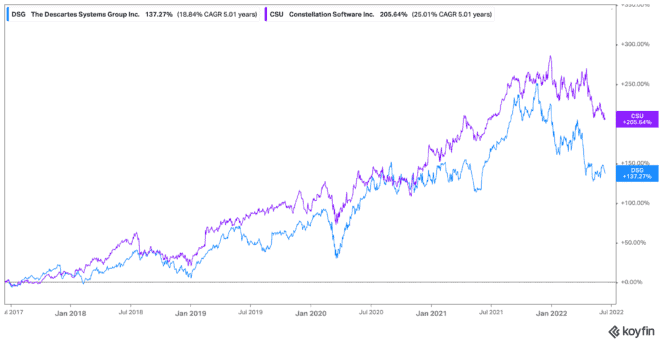

Tech stocks have been under massive pressure in 2022. Many tech stocks overshot their valuations in 2021 and now most are coming back to earth. This is creating an opportunity. One TSX stock I particularly like right now is Descartes Systems (TSX:DSG)(NASDAQ:DSGX). It provides logistics and supply chain management software for the transportation industry.

Considering global supply chain challenges, its services have enjoyed a huge surge in demand. This has fueled +20% quarterly revenue and EBITDA growth for the past year and half. While this growth may regulate back to the mid-teens, the company is generating a tonne of cash.

A recession will certainly affect its business. However, many of its services are crucial and have high recurring revenues. This TSX stock has zero debt and $200 million of net cash. As tech business valuations decline, it can use its strong balance sheet to buy up software acquisitions at discount prices.

Descartes is not the cheapest TSX tech stock. However, it has a resilient business model and could come out of the market selloff as an even stronger, more diversified business.

Constellation Software

Another TSX tech stock that should have significant upside out of the correction is Constellation Software (TSX:CSU). Constellation stock rarely corrects. However, when it does, it has historically been a great buying opportunity.

Despite a recession there are reasons to like this business. It acquires and operates hundreds of niche vertical market software businesses. Generally, these serve a specific purpose for a specific market vertical (like motorhome dealership software). It often serves low competition segments, and its software is essential for day-to-day business operations.

Consequently, it earns reliable recurring revenues and predictable free cash flows. In a recession, Constellation can deploy its spare cash flows into new software businesses at elevated rates of return because prices are cheaper.

As a result, this TSX stock can actually benefit in the long-term from a market decline. While it has seen recent selling pressure, it could see a significant surge, as it delivers strong returns from its contrarian acquisition strategy.