Welcome to a series where I break down and compare some of the most popular exchange-traded funds (ETFs) available to Canadian investors!

Canadian investors taking a passive approach to buying dividend stocks can pick their own, but an easier and more hands-off approach is through using an ETF. BlackRock provides a set of low-cost, high-liquidity ETFs that offer exposure to a portfolio of great Canadian dividend stocks.

The three tickers up for consideration today are iShares S&P/TSX Composite High Dividend Index ETF (TSX:XEI), iShares S&P/TSX Dividend Aristocrats Index ETF (TSX:CDZ), and iShares Canadian Select Dividend Index ETF (TSX:XDV). Which one is the better option? Keep reading to find out.

XEI vs. CDZ vs. XDV: Fees

The fee charged by an ETF is expressed as the management expense ratio (MER). This is the percentage that is deducted from the ETF’s net asset value (NAV) over time and is calculated on an annual basis. For example, an MER of 0.50% means that for every $10,000 invested, the ETF charges a fee of $50 annually.

XEI has an MER of 0.22% compared to CDZ at 0.66% and XDV at 0.55%. XEI is by far the cheapest ETF. Generally, MERs above 0.50% are considered pricey, especially for passive index funds.

XEI vs. CDZ vs. XDV: Size

The size of an ETF is very important. Funds with small assets under management (AUM) may have poor liquidity, low trading volume, high bid-ask spreads, and more risk of being delisted due to lack of interest.

XEI currently has AUM of $1.65 billion compared to CDZ at $1.03 billion and XDV at $1.76 billion. Although all three are more than sufficient for long-term buy-and-hold investors, XDV is currently the most popular of the trio right now.

XEI vs. CDZ vs. XDV: Holdings

XEI tracks the S&P/TSX Composite High Dividend Index, which holds a total of 75 stocks selected for high yields. The majority of the ETF is concentrated in the energy (30.36%), financials (29.46%), telecommunications (14.81%), and utilities (13.96%) sectors. The current distribution yield is 3.56%.

CDZ tracks the S&P/TSX Canadian Dividend Aristocrats Index, which holds 94 stocks that have increased dividends for at least five consecutive years. Compared to XEI, CDZ is less concentrated in financials (23.31%) and energy (15.80%), with real estate (11.78%) coming in third. The current distribution yield is 3.36%.

XDV tracks the Dow Jones Canada Select Dividend Index, which holds 30 stocks selected for above-average dividend growth, yield, and payout ratio. Compared to XEI and CDZ, XDV is heavily concentrated in financial stocks (54.69%), with communications (12.09%) and utilities (12.07%) coming in second and third. The current distribution yield is 3.76%.

XEI vs. CDZ vs. XDV: Historical performance

A cautionary statement before we dive in: past performance is no guarantee of future results, which can and will vary. The portfolio returns presented below are hypothetical and backtested. The returns do not reflect trading costs, transaction fees, or taxes, which can cause drag.

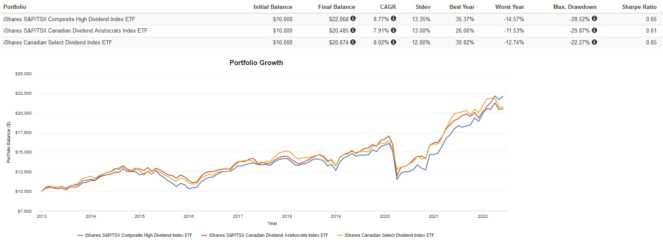

Here are the trailing returns from 2013 to present:

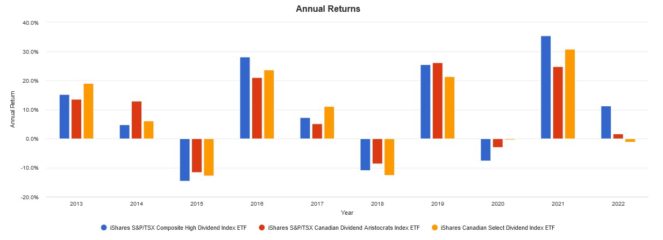

Here are the annual returns from 2013 to present:

All three ETFs performed very similar with some differences. Overall, XEI came out on top, but this was due to its outperformance so far in 2022. Thanks to its high proportion of energy stocks, XEI was protected from the market selloff this year as commodity prices soared. As the macroeconomic environment changes, CDZ and XDV could pull ahead again.

The Foolish takeaway

If I had to choose one ETF to buy and hold, it would be XEI. Despite the higher concentration of energy stocks, it is still more diversified compared to XDV (which only holds 30 most financial stocks), and cheaper compared to CDZ (which charges a high 0.66% MER). That being said, if you prefer Dividend Aristocrats or dividend growth, either CDZ or XDV could be a great option.