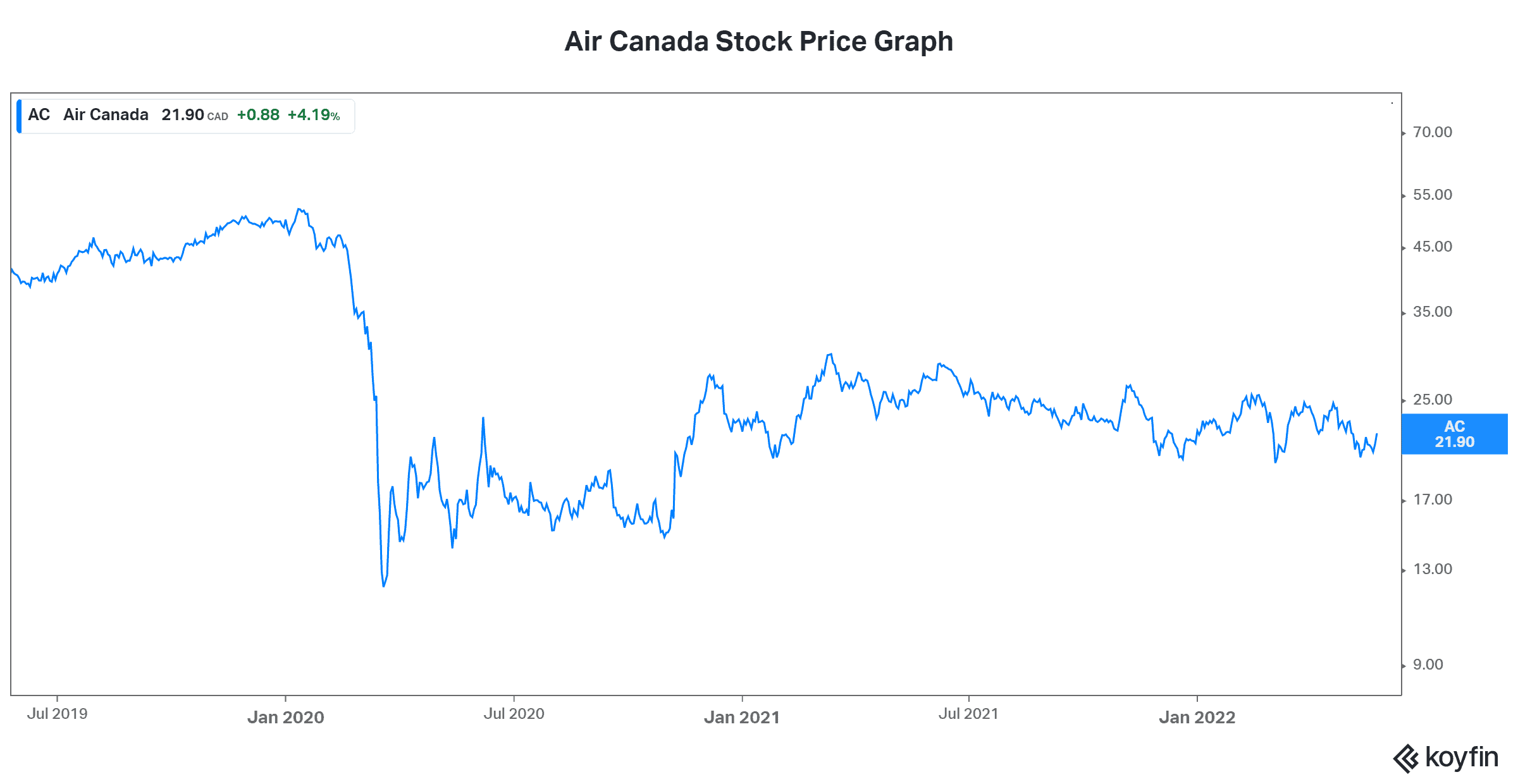

As far as travel stocks go, Air Canada (TSX:AC) is Canada’s biggest and most well known. Before the pandemic, it was flying high. Excellent operational discipline and a strong consumer was supporting rapid cash flow growth. Shareholders were happy, and industry watchers were impressed. Today, after a long pandemic, Air Canada stock is trying to recover.

Is it ready to take off? Or are there new headwinds that have changed the playing field?

Rising fuel prices are expected to cut into Air Canada stock

The most obvious impact that rising oil prices have on Air Canada is the increase in its costs. Clearly, jet fuel makes up a large portion of Air Canada’s total operating expenses. In 2019, when oil prices averaged below $60, aircraft fuel represented 22% of total operating cost. Oil prices are dramatically higher today, at approximately $115. If 22% of your operating expense rises 92%, as oil has done since 2019, that’s hugely negative.

As a result of this cost pressure, Air Canada will inevitably start increasing fares. As management stated on its latest quarterly call, much of this cost increase can be recovered through fares. Yet this does not comfort me when I think about Air Canada stock. Consumers are facing inflation on all fronts — food, gasoline, and even regular everyday products. In my view, it won’t take long until the demand for travel is squashed given this inflationary environment.

So, while we may see a strong uptick in Air Canada’s financials in the shorter term, it doesn’t look good further out in time. Air Canada has seen its stock price languish in the last years due to pandemic uncertainties. I forecast more rough skies ahead — this time due to inflation and rising rates, which I discuss below.

The threat of a recession means new risks to Air Canada

Recessions are real. They come with a lot of pain and hardship. During a recession, the days of easy money and loads of disposable income become a distant memory. Travelling with Air Canada would be low on any list. In fact, we are already seeing the beginnings of wealth destruction in the stock market. The losses that have been absorbed by investors have been significant in 2022. We are all in varying degrees of financial pain, and we know what we have to do in response. We simply have to tighten our purse strings. The fact is that travel stocks don’t do well in a recession.

So, now the question becomes, how likely is it that a recession is coming? Well, the way I see it, rising interest rates equals a recession of some degree. On the flip side, we have seen the effects of falling interest rates over the last many years. It’s monetary policy in its simplest form — falling rates equal an expansionary economy. On the contrary, rising rates equals a contractionary economy. This is where we’re at today. It’s what I see when I consider the medium-term future. It does not bode well for travel stocks like Air Canada stock.

Motley Fool: The bottom line

In conclusion, I don’t believe that Air Canada is about to see its stock price take off. I actually think it will be dead money. The boost that we’ll probably see due to the pent-up demand is real. But I believe it’ll be far outweighed by the strong, negative headwinds that are gaining steam.