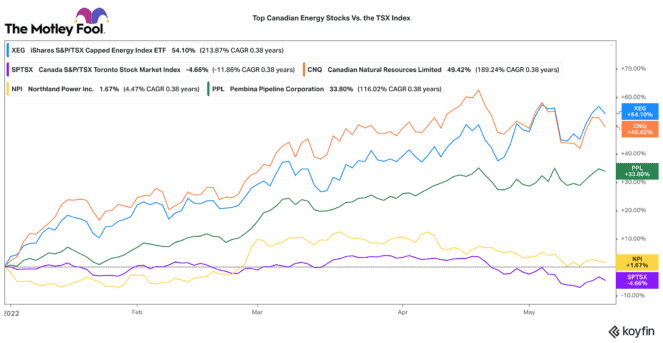

Canadian energy stocks have been on fire in 2022! The S&P/TSX Capped Energy Index, the benchmark for Canadian energy stocks, is up 53% this year alone! Looking back on a one-year basis and that index is up nearly 100%. That is compared to the S&P/TSX Composite Index, which is down 4.7% in 2022 and up only 3.9% over the past year.

Despite the rapid rise, many Canadian energy stocks are still incredibly cheap. With the price of oil trading consistently over US$100, these stocks are earning a huge amount of spare cash.

More dividends to come!

Rather than re-investing into more production, many companies have chosen to return the excess cash back to shareholders. Already, we have seen significant dividend increases and share buybacks. If this trend continues, there are likely massive dividend returns still to be earned.

If you are looking for some quality Canadian energy stocks that pay passive income, here are three to consider today.

CNQ: A top Canadian energy stock

Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ) is one of the best-run companies in the Canadian oil patch. During the March 2020 oil collapse, CNQ was one of the only major energy producers to not halt or lower its dividend. CNQ has incredibly long-life oil and gas reserves. Likewise, it can produce those reserves at a very low cost.

This has afforded CNQ the ability to increase its dividend by a compounded annual rate of 19% over the past decade. In March, it increased its quarterly dividend by 28% to $0.75 per share.

Today, this Canadian energy stock pays a 3.82% dividend yield. It isn’t the cheapest energy stock, but I don’t think you will be disappointed that you paid up for quality.

Pembina Pipeline: A top oil infrastructure stock

Do you like the oil sector but don’t like commodity-related volatility? Then you may want to consider owning Pembina Pipeline (TSX:PPL)(NYSE:PBA).

It is one of the largest midstream and pipeline companies in Western Canada. Most of Pembina’s assets capture contracted streams of cash flows. Like CNQ, it too was able to maintain its elevated dividend in the March crash.

However, it makes a margin spread by selling finished energy products from its midstream plants. As a result, it gets a nice surge in cash flows when oil prices are high. This was reflected in very strong first-quarter results.

This Canadian energy stock pays a 5% dividend yield today. The company plans to hike its dividend later this year, so shareholders should get a nice boost of monthly passive income.

Northland Power: A top Canadian renewable energy stock

If you are completely opposed to Canadian oil stocks, then Northland Power (TSX:NPI) should be on your radar. This Canadian energy stock is one of the largest developers of offshore wind power in the world. It operates several projects in Europe and has a large development pipeline across the world.

Given the European energy crisis, power prices have surged. That has helped bolster Northland’s earnings in the first quarter of 2022. Both sales and adjusted EBITDA increased by a nice mid-teens rate.

The Canadian energy stock pays an attractive, well-covered monthly dividend of $0.10 per share. That equals a 3.15% yield today. For a long-term play on renewable power and a nice, stable dividend, Northland is a solid stock to buy and hold.