Colliers International Group (TSX:CIGI)(NASDAQ:CIGI) continued to deliver very strong results in its first quarter of 2022. Colliers released its earnings yesterday morning, and the stock rose by nearly 4% in the day.

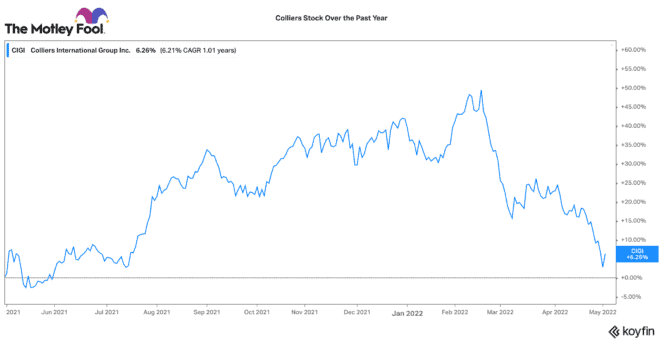

It has not exactly been a pretty year for Colliers’s shareholders. Its stock has declined 25.5% since the start of 2022. This is a stark contrast to 2021 where Colliers stock soared over 40%. 2021 was a banner year both operationally and for the stock. Yet recent economic headwinds (inflation, a slowdown in growth, and rising interest rates) are causing investors to pull away from the name.

Despite these concerns, there are reasons to be optimistic about Colliers, especially at today’s price. Over the past 27 years, it has grown to become a leading firm in commercial real estate advisory, consulting, brokerage, engineering, and investment management.

Under the leadership of CEO Jay Hennick, this real estate stock has delivered 17% compounded annual stock returns over the past 10 years.

The company delivered a solid first quarter of 2022 with the following financial results:

- Revenues increased year over year by 29% to US$1 billion.

- Adjusted EBITDA increased year over year by 32% to US$121.5 million.

- Adjusted EBITDA margin rose from 11.9% to 12.1%.

- Adjusted earnings per share increased year over year by 38% to US$1.44.

- GAAP diluted earnings per share decreased year over year by -480%.

Colliers beat expectations in Q1

All around, it looks like an impressive quarter. Colliers beat analysts’ consensus estimates for revenues of US$902 million and earnings per share of US$1.21. Investors may note the massive decline in GAAP earnings per share. It was largely due to a US$26 million loss related to the disposal of its Russian operations, which it immediately closed after Russia attacked Ukraine. Fortunately, this was a non-core region for Colliers International.

It saw strength across all its business categories. Most noteworthy, leasing grew 32%, and investment management revenues nearly doubled with 93% growth. Many businesses are returning to the office. Colliers benefitted from an active leasing environment, particularly in North America.

Organic growth and a large acquisition pipeline

The company had an active quarter for acquisitions. It added two affiliate operations in the United States and further expanded its engineering platform in the southern U.S. Likewise, after the quarter it completed the acquisition of Colliers Italy and Antirion (a European asset management firm). Colliers believes it could deploy more than $400 million of capital in 2022. This would be a record year of capital deployment if that sum is achieved.

A solid 2022 outlook update

Despite the acquisitions, the company maintained a strong balance sheet with $230 million in cash and a net leverage ratio of 0.9 times. Over 50% of Colliers adjusted earnings are recurring, so its debt is very well covered.

Despite the broader economic despair in the market, Colliers increased its 2022 outlook. It projects low teens revenue growth (with mid- to high single-digit organic growth), strong EBITDA margin improvement, and high-teens adjusted earnings-per-share growth. All in all, Colliers does not appear to be overly fazed by macro-economic fears.

The bottom line on Colliers stock

For a stock that has a long history of compounding returns, the recent decline in Colliers’s valuation makes it an attractive stock today. It has a great management team, a diversified business, and attractive operational fundamentals that make it a great stock to buy, tuck away, and never sell.