CGI (TSX:GIB.A)(NYSE:GIB), Canada’s $22 billion IT and business consulting services firm, reported better-than-expected earnings results yesterday. This report highlighted the company’s strength and its long-term growth runway.

Please read on as I review CGI’s earnings results in more detail.

CGI earnings: Revenue and earnings growth accelerate as demand soars

Revenue rose 10% in the quarter, as all regions and all segments benefitted from strong demand. For example, U.S. commercial revenue, increased 17% and Canadian revenue increased 11.6%. Similarly, if we look at revenue growth by industry, we find that this is the third consecutive quarter of growth in all industries. Highlights include the Canadian financial services industry, where revenue rose 20%. This industry is attempting to move further into the new age of digitization. It simply must in order to thrive going forward — the cost and revenue efficiencies that come from it make it an easy decision. We can therefore expect this trend to continue.

Moving further down the income statement, we have earnings, which increased nicely, as margins increased. In fact, EPS rose a solid 14%, as CGI continued to improve on efficiencies and operational excellence.

Margins rise as operational efficiencies gain more traction

A clear struggle that CGI has had in the past was with its EBIT margins. They actually came in below 10% at one point some years ago. Today, this all seems like a distant memory. EBIT margins at CGI came in at 16% in the quarter, a 20-basis-point increase versus last year. With this, CGI is seeing stronger cash flows and stronger returns on invested capital (ROIC). In fact, CGI’s ROIC came in at 15.7% in the quarter versus 12.8% last year. This is finally back to pre-pandemic levels.

CGI has a strong outlook as backlog tops $23 billion

CGI’s backlog has been growing nicely over time, and this quarter, it held steady at approximately $23 billion. At 1.3 times revenue, this backlog provides a clear indication that the future is looking bright. Similarly, bookings, which are new orders in the period, were strong. This is all a reflection of the fact that the race to digitize is accelerating, and CGI is participating in it with full force.

In short, clients are clearly increasing their investment in digitization. On the quarterly conference call, CGI’s management highlighted their finding that “over 80% of clients plan to sustain or increase their IT budget.”

This clearly bodes well for CGI and its future as Canada’s leading IT services company with a global presence.

CGI’s results are increasingly looking like growth stock results: Will valuation follow?

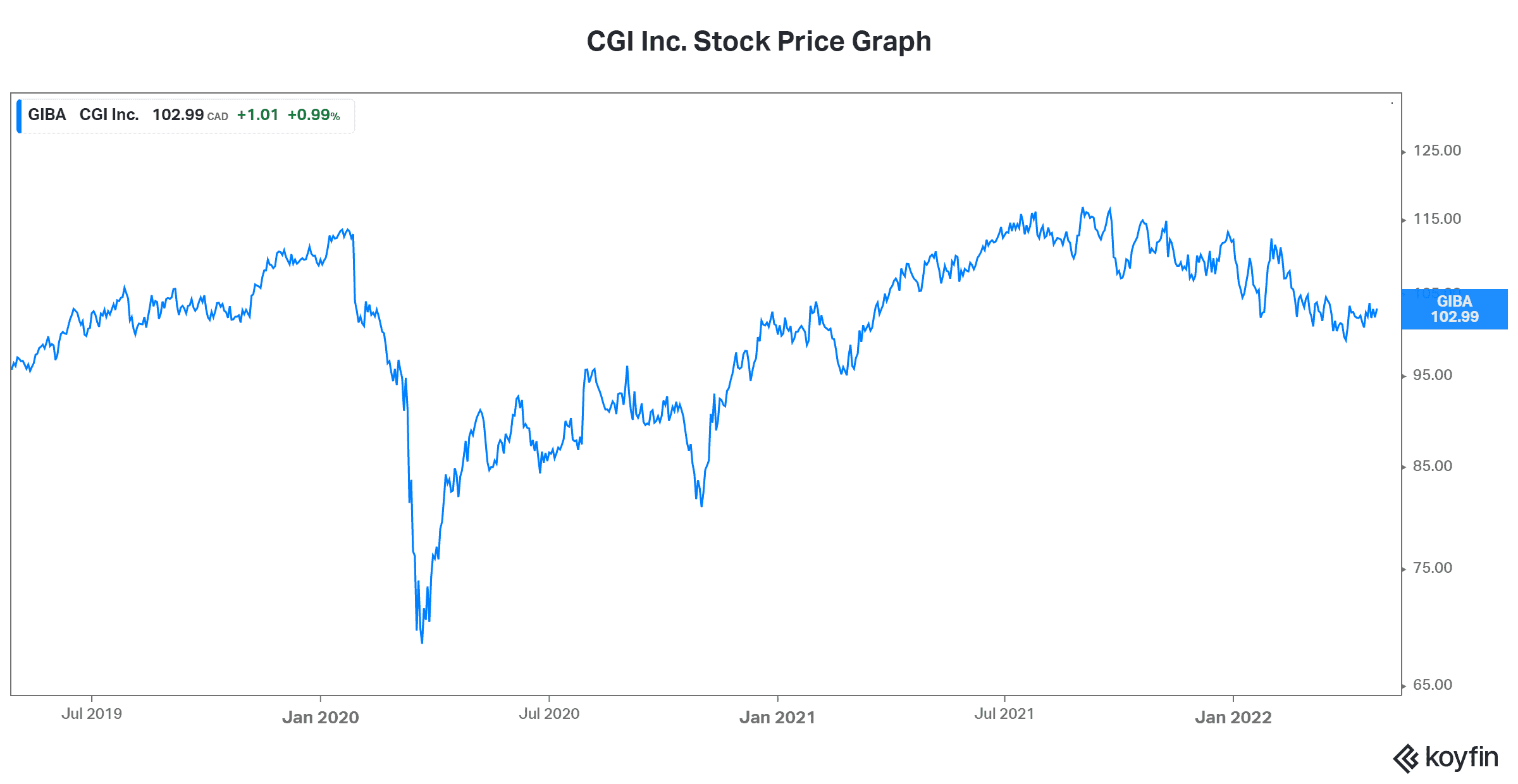

So, revenue growth has hit the double digits, earnings growth has topped 14%, and cash flows are coming in fast and furious. Yet CGI is seeing its stock price trade at a P/E multiple of only 13 times this year’s consensus earnings estimate. Also, it trades at only 3.6 times book value, yet its ROE is almost 20%.

In my view, there’s a clear disconnect between CGI’s financial results and its valuation. Simply put, the price of CGI stock is grossly undervalued.

Motley Fool: The bottom line

CGI doesn’t pay dividends, but its healthy returns on capital indicate that for now, this is the right choice. The IT services market remains highly fragmented. CGI continues to consolidate it, driving earnings and shareholder returns higher. All of this makes CGI stock Canada’s number one tech stock.