Welcome to a series where I break down and compare some of the most popular exchange-traded funds (ETFs) available to Canadian investors!

Yield-hungry, passive-income investors in 2022 have turned to covered call ETFs as a viable alternative in sideways-trading volatile market conditions. For those of you unfamiliar with how these ETFs work, I highly suggest giving this article a read first.

BMO provides an excellent lineup of covered call ETFs, which hold a variety of different market sectors, as their underlying assets to write covered call against.

The two tickers up for consideration today are BMO Canadian High Dividend Covered Call ETF (TSX:ZWC) and BMO U.S. High Dividend Covered Call ETF (TSX:ZWH). Which one is the better option? Keep reading to find out.

ZWC vs. ZWH: Fees

The fee charged by an ETF is expressed as the management expense ratio (MER). This is the percentage that is deducted from the ETF’s net asset value (NAV) over time and is calculated on an annual basis. For example, an MER of 0.50% means that for every $10,000 invested, the ETF charges a fee of $50 annually.

ZWC has an MER of 0.72% compared to ZWH at 0.71%. The difference between the two is $1 in fees annually on a $10,000 portfolio, making them virtually tied. Still, if we had to pick a winner, the nod goes to ZWH.

ZWC vs. ZWH: Size

The size of an ETF is very important. Funds with small assets under management (AUM) may have poor liquidity, low trading volume, high bid-ask spreads, and more risk of being delisted due to lack of interest.

ZWC has attracted AUM of $1.55 billion, whereas ZWH has AUM of $966 million. Although both are sufficient for a buy-and-hold investor, ZWC is currently the more popular ETF among Canadian investors right now.

ZWC vs. ZWH: Holdings

ZWC holds a portfolio of 35 Canadian stocks selected for their high dividend yields, mostly from the financials (40%), energy (14%), telecom (12%), and utilities (10%) sectors, with an overlay of out-of-the-money calls on 50% of the holdings. The current distribution yield is 5.97%.

ZWH holds 35 Canadian U.S stocks selected for their high dividend yields, mostly from the information technology (24%), financials (14%) and healthcare (14%) sectors, with an overlay of out-of-the-money calls on 50% of the holdings. The current distribution yield is 5.89%.

ZWC vs. ZWH: Historical performance

A cautionary statement before we dive in: past performance is no guarantee of future results, which can and will vary. The portfolio returns presented below are hypothetical and backtested. The returns do not reflect trading costs, transaction fees, or taxes, which can cause drag.

Here are the trailing returns from 2018 to present with all distributions reinvested:

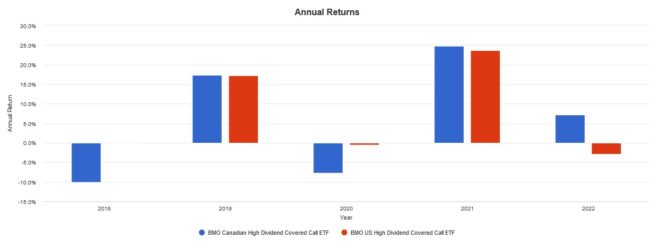

Here are the annual returns from 2018 to present with all distributions reinvested:

ZWH outperformed ZWC, likely due to the bull run of U.S. mega-cap information technology sector stocks in recent years. This trend has reversed in 2022, as the Canadian financial and energy sectors recovered amid high inflation and rising interest rates.

The Foolish takeaway

This is a case where I would buy both ETFs. This way, you can track both high-quality Canadian and U.S. dividend players and take advantage of a volatile market to reap some high options premiums. This strategy has the potential to outperform in a sideways market or produce some high monthly income on a large enough portfolio.