Welcome to a series where I break down and compare some of the most popular exchange-traded funds (ETFs) available to Canadian investors!

Canadian investors favouring the most hands-off, passive approach to investing can invest in all-in-one “asset-allocation” ETFs from a variety of fund managers such as Vanguard, BlackRock, and BMO.

Today, we’ll be looking at the 100% stocks version, otherwise known as the “all-equity” ETF portfolio (ending with the suffix “EQT”), suitable for investors with a high risk tolerance.

Up for consideration are Vanguard All-Equity ETF Portfolio (TSX:VEQT), iShares Core Equity ETF Portfolio (TSX:XEQT), and BMO All-Equity ETF (TSX:ZEQT).

VEQT vs. XEQT vs. ZEQT: Fees

The fee charged by an ETF is expressed as the management expense ratio (MER). This is the percentage that is deducted from the ETF’s net asset value (NAV) over time, calculated on an annual basis. For example, an MER of 0.50% means that for every $10,000 invested, the ETF charges a fee of $50 annually.

VEQT has an MER of 0.24% compared to XEQT and ZEQT’s MER of 0.20%. The difference is minuscule (a difference of $4 on a $10,000 portfolio), but if we had to pick a winner, it would either be XEQT or ZEQT.

VEQT vs. XEQT vs. ZEQT: Size

The size of an ETF is very important. Funds with small assets under management (AUM) may have poor liquidity, low trading volume, high bid-ask spreads, and more risk of being delisted due to lack of interest.

VEQT currently has AUM of $2.24 billion, XEQT has AUM of $927 million, and ZEQT has AUM of just $7.02 million. Although all are expected to grow as investors take more interest, VEQT is the most popular ETF right now

VEQT vs. XEQT vs. ZEQT: Holdings

All three ETFs here are considered “funds of funds,” in that their underlying holdings are not stocks, but rather, other ETFs covering various geographies. This makes sense in that XEQT, VEQT, and EQT are intended to be all-in-one portfolios.

VEQT allocates approximately 43% to the U.S. stock market, 31% to the Canadian stock market, 19% to the developed international stock market, and 7% to the emerging international stock market.

XEQT allocates approximately 45% to the U.S. stock market, 25% to the Canadian stock market, 25% to the developed international stock market, and 5% to the emerging international stock market.

ZEQT allocates approximately 46% to the U.S. stock market, 26% to the Canadian stock market, 20% to the developed international stock market, and 8% to the emerging international stock market.

VEQT vs. XEQT vs. ZEQT: Historical performance

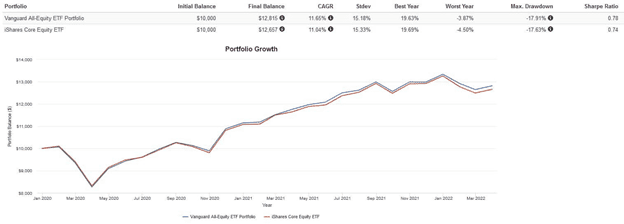

All three funds are quite new, so performance history is rather limited. Nonetheless, a backtest is useful for assessing tracking error and relative performance.

A cautionary statement before we dive in: past performance is no guarantee of future results, which can and will vary. The portfolio returns presented below are hypothetical and backtested. The returns do not reflect trading costs, transaction fees, or taxes.

Here are the trailing returns from 2020 to present. ZEQT was not included, as it has less than a year of performance history:

Here are the annual returns from 2020 to present:

All three ETFs have very similar performance. VEQT had slightly higher returns and volatility, which I attribute to the outperformance of Canadian stocks in 2021 and 2022, which it holds in higher proportions compared to XEQT. However, I do expect performance to be virtually identical in the long run.

The Foolish takeaway

If I had to choose one ETF to buy and hold, it would be XEQT. It has the lowest MER tied with ZEQT but much higher AUM in comparison. The holdings of all three ETFs are very similar and unlikely to cause major differences over time.

So, it really comes down to a coin flip here. Investors can hold either of these three ETFs for the long run and come out very happy. If you’re partial to Vanguard and like the philosophy of lowering fees, VEQT is a great pick. If you’re loyal to BMO, ZEQT is a good choice as well.