Welcome to a weekly series where I break down and compare some of the most popular exchange-traded funds (ETFs) available to Canadian investors!

Canadian investors taking a passive approach to buying domestic stocks generally default to the tried-and-true S&P/TSX 60 Index. Both BlackRock and Horizons provide a set of low-cost, high-liquidity, CAD-denominated ETFs for tracking the S&P/TSX 60.

The two tickers up for consideration today are iShares S&P/TSX 60 Index ETF (TSX:XIU) and Horizons S&P/TSX 60 Index ETF (TSX:HXT). Which one is the better option? Keep reading to find out.

XIU vs HXT: fees

The fee charged by an ETF is expressed as the management expense ratio (MER). This is the percentage that is deducted from the ETF’s net asset value (NAV) over time, calculated on an annual basis. For example, an MER of 0.50% means that for every $10,000 invested, the ETF charges a fee of $50 annually.

XIU has an MER of 0.18% compared to HXT at 0.03% The difference here is around $15 on a $10,000 portfolio, which can add up over the long term, especially as your portfolio gets larger. The clear winner here is HXT, which is as cheap as it gets in the Canadian ETF industry.

XIU vs HXT: size

The size of an ETF is very important. Funds with small assets under management (AUM) may have poor liquidity, low trading volume, high bid-ask spreads, and more risk of being delisted due to lack of interest.

XIU currently has AUM of $13.19 billion, whereas HXT has AUM of $3.92 billion. Although both are sufficient for a buy-and-hold investor, XIU is clearly the more popular one. This is no surprise given that XIU is the oldest ETF listed on the Canadian market!

XIU vs HXT: holdings

XIU directly holds all 60 of the stocks in its underlying index directly. It is as “vanilla” as ETFs get, and doesn’t use any derivatives to achieve notional exposure or wrapper structures to hold other ETFs. When you buy XIU, you get the performance of the underlying 60 stocks net of fees, nothing more.

HXT is unique. Rather than hold another ETF or stocks, HXT buys a derivative called a total return swap from multiple big Canadian bank counterparties to achieve exposure to the S&P/TSX 60. I previously dived deep into its mechanics in this article, so make sure you give it a read.

XIU vs HXT: historical performance

A cautionary statement before we dive in: past performance is no guarantee of future results, which can and will vary. The portfolio returns presented below are hypothetical and backtested. The returns do not reflect trading costs, transaction fees, or taxes, which can cause drag.

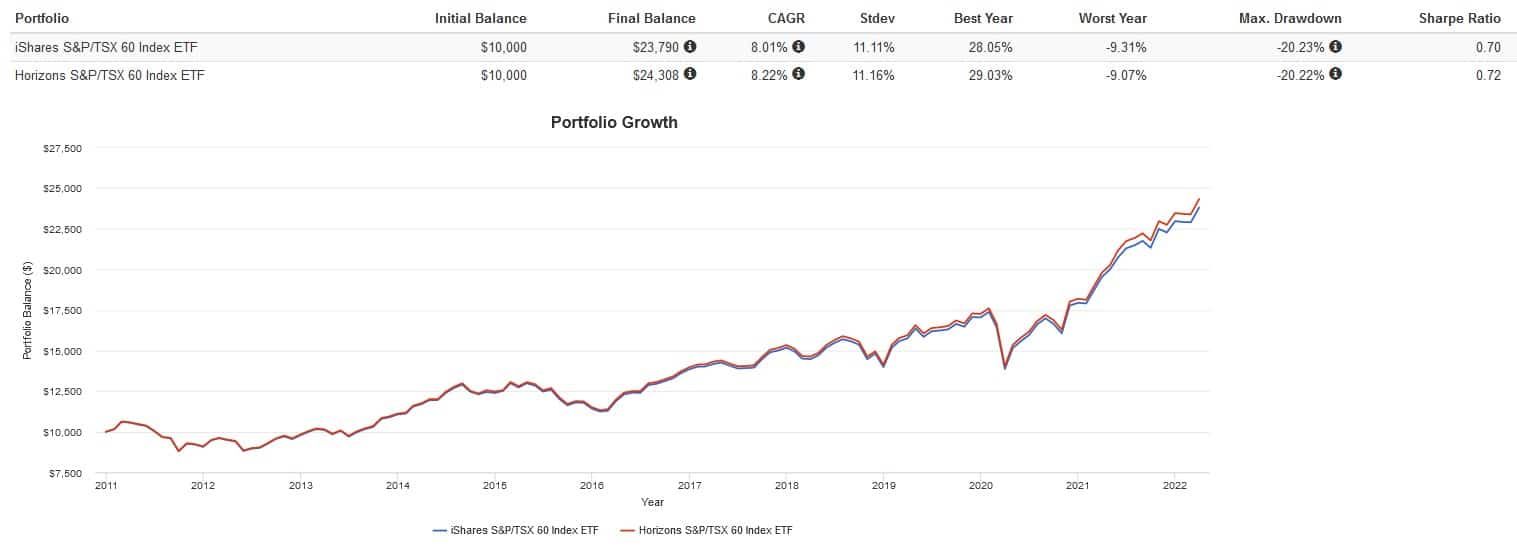

Here are the trailing returns from 2011 to present:

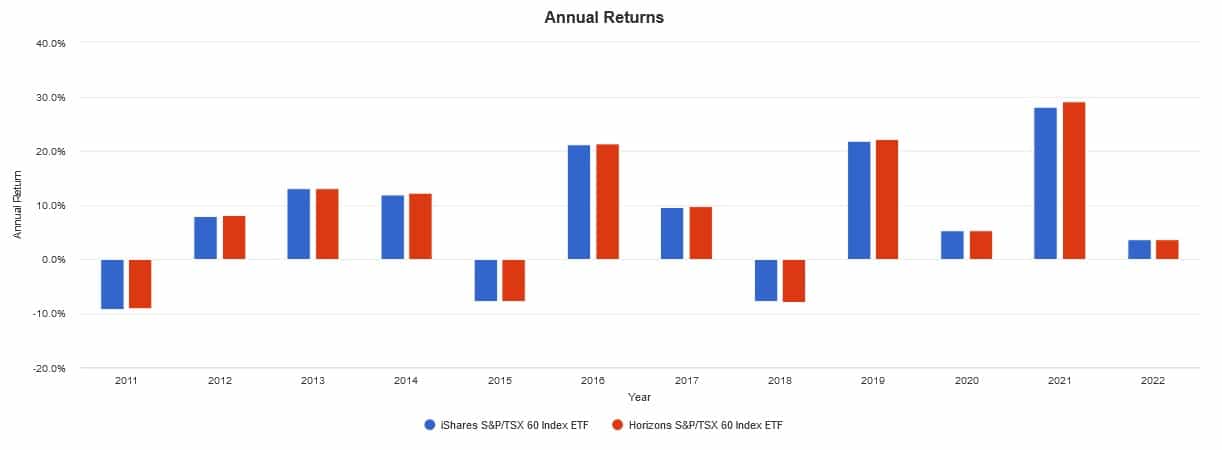

Here are the annual returns from 2011 to present:

Both ETFs have very similar performance, but HXT pulls ahead over time. I attribute this to its much lower MER, which resulted in a lower drag compared to XIU. HXT’s unique swap structure also minimizes tracking error as its total return nature ensures that dividends are perfectly reinvested.

The Foolish takeaway

If I had to pick and choose one ETF to buy and hold, it would be HXT. The much lower MER gives it a significant advantage over XIU. Nowadays, XIU is bought more by institutional investors that require high liquidity and good volume. Moreover, if you’re investing in a taxable account, holding HXT can allow you to avoid paying dividend tax and defer capital gains tax.