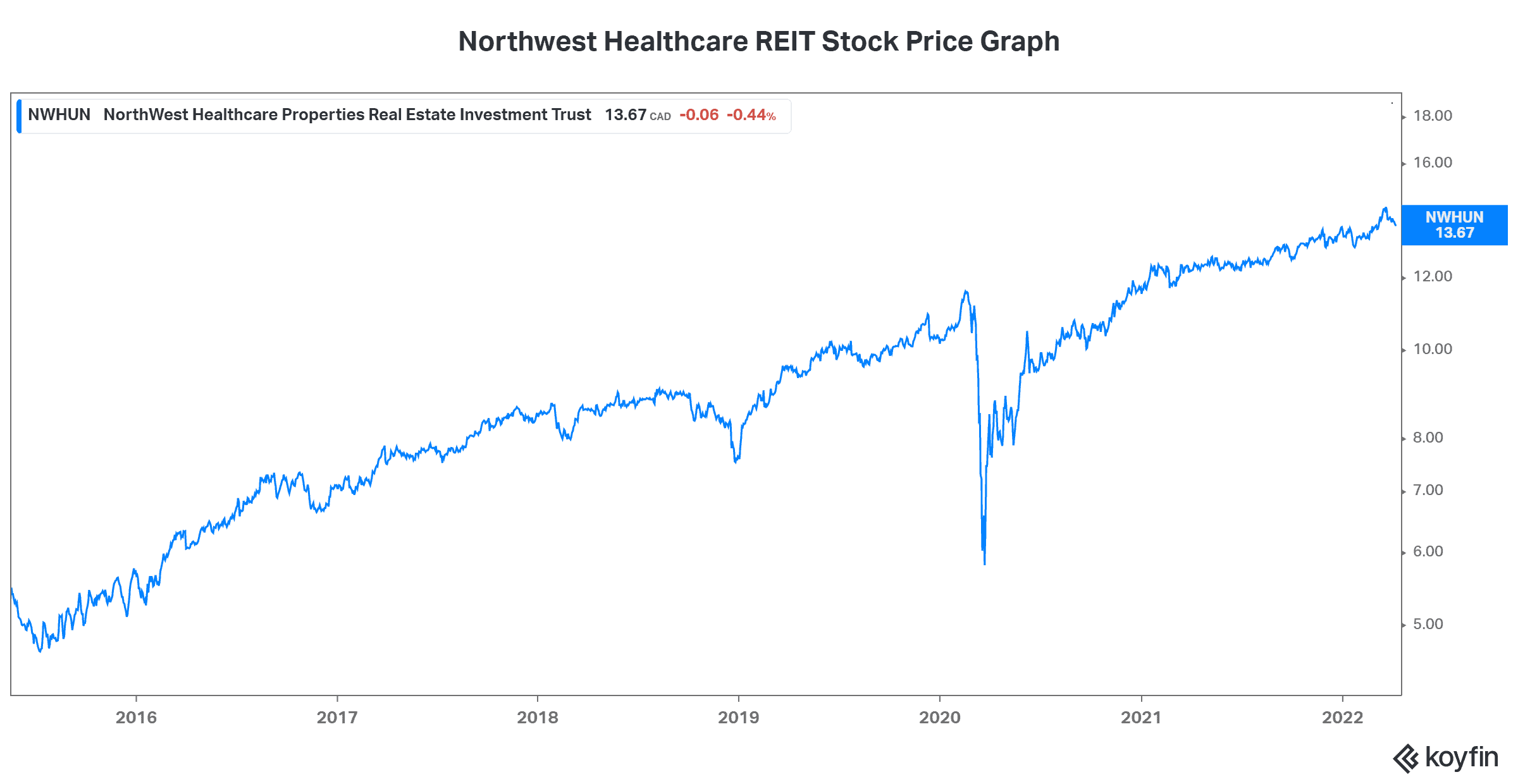

Ideally, when we look for passive income ideas, we want them to be a safe. We want to be able to count on them. This is not always an easy task. Essentially, the higher up you go on the yield scale, the more risk you take. Northwest Healthcare Properties REIT (TSX:NWH.un) is a real estate investment trust (REIT) that owns and operates a lucrative portfolio of global health care real estate assets. It sounds and is a pretty safe bet, but there are headwinds approaching.

We all want yield, but even a top REIT like Northwest Healthcare Properties is facing some new and challenging risks ahead. Let’s look into these risks and how Northwest fares.

Passive income that’s immune to rising inflation

Northwest Healthcare REIT has many factors that insulate it from the risk of inflation. The most important factor is the fact that its revenues are tied to inflation. Essentially, its assets (properties) are long-leased and inflation indexed. This is a very important characteristic. And it’s especially attractive in this environment where inflation is rising fast.

Northwest had revenue of $96.4 million. This represented a 4% growth rate versus last year. Annual 2021 revenue was approximately $375 million, flat versus 2020 and up 19% compared to five years ago. So what we can see here is a steady progression of revenue. As we look ahead, increases in inflation are a real risk that we must consider. We don’t want inflation to eat away at our investments and for Northwest, this risk is largely mitigated. This is partly a function of the fact that the vast majority of its revenue is funded by the government.

A REIT that’s immune to economic shocks

In fact, the majority of Northwest’s revenue in funded directly or indirectly by the government. And this is health care real estate we’re talking about. Demand for it is not affected by fads, or the economy. It is real estate that will be needed in each and every conceivable situation. It’s in place for the long term, and it’s a priority. I mean, if we don’t take care of the health of a society, there’s not much else that’s of importance.

So we can clearly see that Northwest is largely sheltered from economic shocks. Today, its occupancy rate is 97%. This is a clear indication of just how much its business (the business of health care) is defensive and unmoved by economic troubles. Clearly, we can rely on it for our passive income and it’s one of the top ideas. Sadly, if we look at inflation numbers, we can see that the risks to the economy are very present. Happily, Northwest offers a strong dividend yield without too much risk.

Rising interest rates

Interest rates that are on the rise are another headwind that we must contend with. On this front, Northwest doesn’t fare as well. However, it has taken real steps to prepare for the rising cost of capital. Historically, Northwest has been very heavily indebted. It was the only way for the REIT to fund its global expansion and with low interest rates, it worked out extremely well.

In the latest quarter, Northwest is taking steps to reduce its debt load. In fact, it reduced its leverage by 840 basis points in its most recent quarter. Furthermore, the REIT is planning on taking more steps to reduce its leverage even further. This will help mitigate the real risk that rising interest rates place on all companies, but especially REITs.

Motley Fool: the bottom line

Northwest Healthcare REIT is really a gem among REITs, in my opinion. In fact, it’s one of the best passive income ideas I have. It’s sheltered from many of the headwinds headed our way, yet it still provides investors with a very generous dividend yield of 5.9%.