Telus (TSX:T)(NYSE:TU), Hydro One (TSX:H), and Shopify (TSX:SHOP)(NYSE:SHOP) are three top stocks to buy in April.

Telus

The telecom stock is up about 8% year to date.

In 2021, Telus launched a new reporting structure with two segments, Telus Technology Solutions, called TTech, and its Digital Customer Experience segment, called Telus International (DLCX).

Telus reported its Q4 2021 financial results in February. TTech’s operating revenue increased $231 million, or 6.4% year over year. Other mobile products and services increased by 5%, landline products and services increased by 12%, and Telus Health increased by 18%. Q4 revenue for Telus International grew by 36%. Overall, Telus’s consolidated revenues grew by 20%.

Continuing its offerings from Telus Health, Telus launched its Virtual Pharmacy service in January, which allows users to book appointments for video or phone consultations at the pharmacy with a licensed pharmacist through the company’s mobile app.

On March 29, Telus Health announced the acquisition of Sprout Wellness Solutions, a Toronto-based provider of holistic digital health and wellness solutions.

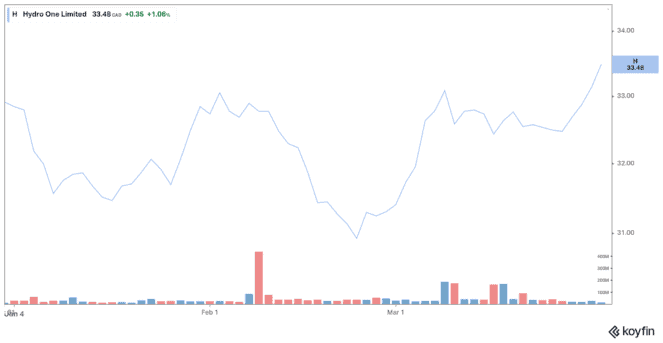

Hydro One

Hydro One is one of Ontario’s largest utility companies, with more than 1.5 million customers. Providing electricity to the nation’s most populous province is a formula for steady and expanding cash flow. Its low-risk business model and lower capital-expenditure requirements provide more stability to its finances. That’s why this utility stock is one of the top stocks to buy in April.

Hydro One is a great stock to hold to protect your portfolio from a continued selloff and an economic downturn. The company holds a monopoly share of Ontario’s transmission lines. It is poised to continue raking in sizable profits, even as the tides turn against the broader stock market. The 3.3% dividend yield is also quite interesting.

Hydro One recently announced a new pilot project to bring high-speed internet access to as many as 1,450 homes and businesses in the municipality of Brighton in the county of Northumberland.

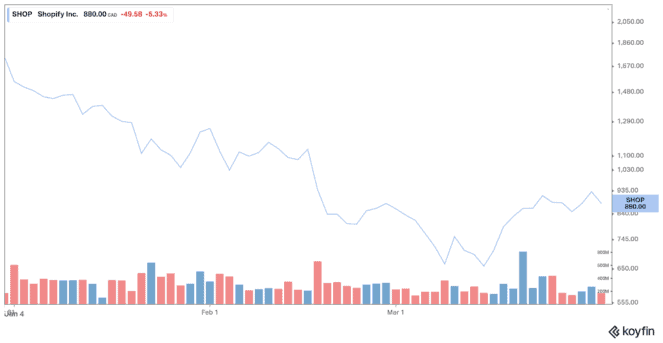

Shopify

If you invest for the longer term, Shopify is one of the top stocks to buy.

Shopify’s annual revenue has grown at a rapid rate since going public in 2015. The e-commerce platform’s revenue has grown more than 4,000% over the past 12 months.

Shopify has grown quickly, because it is benefitting from the trend of direct-to-consumer (DTC) online sellers worldwide. Shopify’s business model is to offer subscriptions for businesses and individuals to easily create a website and start selling things online. It also has an app marketplace, where other companies can offer services to its e-commerce merchants, and it has its own payment service called Shopify Payments.

The long-term thesis behind Shopify is the belief in e-commerce. The market could be worth up to $6 trillion by 2024. Now, that’s global, but nonetheless, being a pretty big player in this market is a good place to be. When it comes to U.S. e-commerce, Shopify has been the number two player for several years now, but it continues to grow. The company has increased its market share in e-commerce by growing its GMV faster than other tech stocks.