When you find a stock that can grow significantly, it’s an excellent investment. But even better than finding a stock that can grow significantly once is finding top Canadian stocks to buy that can double your money consistently over the long run.

Thanks to compound interest and using the Rule of 72, we know that for a stock to double its value in five years, it needs to grow at a compounded annual growth rate (CAGR) of roughly 15%. That’s a significant amount.

So, for a company to double its value, and therefore your investment, in just five years is a difficult task. However, it’s not impossible, and several Canadian stocks have achieved these impressive returns.

If you’ve got cash to invest, and you’re looking for some of the best Canadian stocks you can buy, here are three companies that typically double investors’ money every five years.

A top Canadian real estate stock to buy

Investing in real estate is one of the best industries to put your capital to work, and over the last few years, residential real estate in Canada, for the most part, has provided investors with excellent returns.

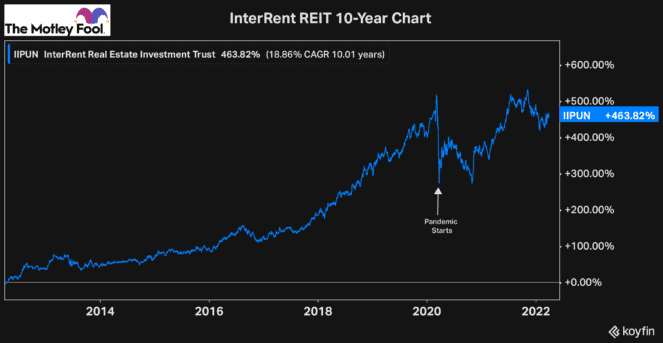

However, one of the best Canadian stocks to buy that’s been growing investors’ capital significantly is InterRent REIT (TSX:IIP.UN). Over the last five years, it’s earned investors a CAGR of 18.87%, or a total return of 137%. And over the last 10 years, it’s earned a CAGR of 18.86% for a total return of 463%.

These results are truly impressive. But what’s even more impressive about InterRent is how simple its strategy is and how consistent the REIT has been. It continues to create tonnes of value for unitholders by expanding its portfolio with investments in undervalued assets or by upgrading its existing assets to grow the cash flow its portfolio is yielding.

The stock has had ups and downs in the short run, but, as you can see by its 10-year chart, it’s an excellent long-term investment. If you’re looking for high-quality Canadian stocks to buy that can grow consistently for years, InterRent is one of the best.

A top retail stock to buy now

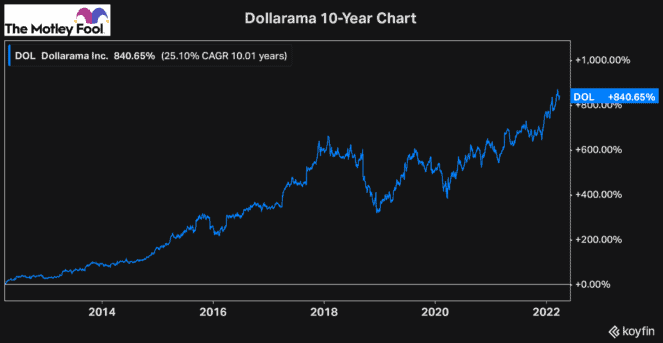

Another of the best Canadian stocks to buy, and one that has proven to perform well, no matter how the economy is performing, is Dollarama (TSX:DOL). Dollarama has earned investors a 16% CAGR over the last five years for a total return of 110%. Furthermore, it’s grown its value at a 25.1% CAGR over the last 10 years, which is a total return of 841%.

Dollarama has done an incredible job of executing well and growing its business, as the trend among Canadian consumers to get the most bang for their buck continues to grow. We’ve seen consumers increase their discretionary income for years by saving cash on essential items they need to buy.

And with inflation now ramping up considerably, Dollarama could continue to see an uptick in sales. So, it’s not surprising that when Dollarama reported earnings this morning, quarterly sales were up 11% on strong demand.

For years, Dollarama has continued to find ways to grow both its sales and its income, and the company is showing no signs of slowing down, making it one of the best Canadian stocks to buy today.

A top long-term growth stock

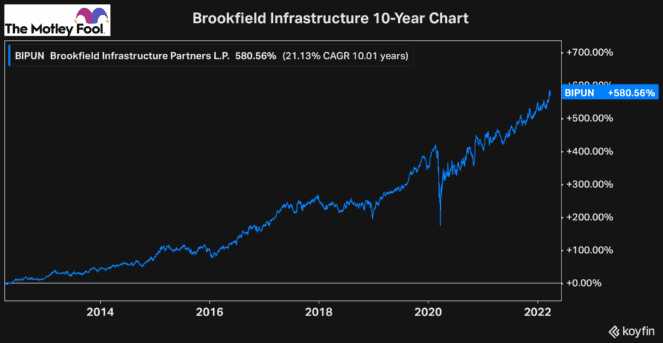

Brookfield Infrastructure Partners (TSX:BIP.UN)(NYSE:BIP) is one of the best Canadian stocks to buy because of the defensive assets it owns but also the long-term growth it offers.

So, it’s no surprise that over the last five years, Brookfield has earned a CAGR of 16.27% for a total return of 113%. In addition, over the last 10 years, it’s grown at a CAGR of 21.2%, earning investors a total return of 584%.

Brookfield’s defensive infrastructure assets are diversified worldwide, and the fund has proven to consistently find new investments that allow it to grow investors’ capital.

If you’re looking for high-quality Canadian stocks you can buy with confidence and hold for years, Brookfield Infrastructure Partners is one of the best investments to consider.