You may not realize it, but Canadian do-it-yourself (DIY) stock investors have a massive advantage over big-wig investment managers! It might seem impossible, but you have a strong chance to outperform a majority of professional money managers. Here is why.

You can build a DIY portfolio exactly as you want

Firstly, large-scale investment managers often have a specific mandate. That means their funds must follow a series of guidelines that can limit how and where they can invest. They are constricted by market capitalization, asset class, or geography. For DIY investors, the sky is the limit, and there are endless opportunities as to where to invest.

DIY investors can buy Canadian stocks that money managers can’t

Secondly, many investment funds are just too large to invest in smaller Canadian stocks with huge potential. Given the scale of money involved, many managers just cannot own certain stocks because they are too small. Some companies’ entire market capitalization is smaller than the size of a single institutional position.

As a result, Canadian DIY investors can buy stocks in the early (or even mid-) stages before they are ever on the radar of the big-time money manager.

DIY investors can think long term

Lastly, DIY investors do not need to meet short-term return thresholds. This means you can invest and think long term. Fund managers must hit quarterly and annual return targets or they risk getting sacked.

However, this can lead to a significant amount of churn and trading in their portfolios. This high activity can deliver short-term results. However, over the long term, this type of behaviour can lead to significant market underperformance (especially after expenses/fees, re-investment risk, etc.).

You don’t need a finance degree to succeed at investing

The reality is, you don’t need an MBA or a CFA to be market-beating investor. You don’t need to be a financial expert. However, you do need to be patient, have a strong mental/emotional fortitude, and a curiosity to learn and continually grow. You do need to work hard and make sure you understand the businesses behind the stocks you are buying.

If you can master these traits, it is possible for DIY investors to beat the market. Sometimes all it takes is finding one high-quality, long-lasting winner. One stock that has won and should keep winning for many years ahead is Constellation Software (TSX:CSU).

Constellation Software: A top Canadian growth stock

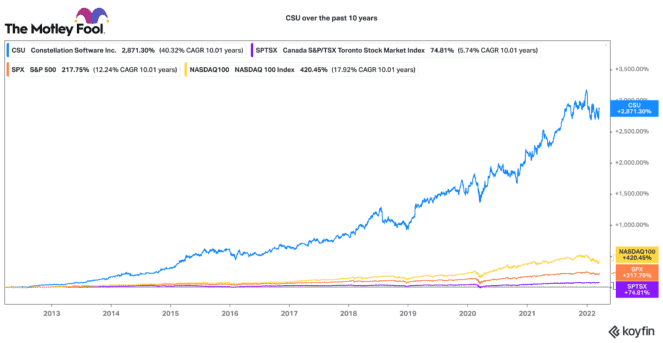

It is a legendary Canadian growth stock. Over the past 10 years, it has delivered a whopping 2,871% total return! With a market capitalization of $45.7 billion, Constellation is not a small company. It has grown by acquiring small, niche-focused vertical market software businesses across the world.

It has thousands of global acquisition opportunities. As it gets larger, it gets the scale and expertise to expand into new markets and even new verticals. Last year, Constellation deployed more than $1.3 billion of capital.

This was its largest capital deployment in history. Consequently, Constellation could see a wave of rising cash flows in the coming years. This top Canadian stock recently pulled back by about 7% from all-time highs. Given its history, any decent pullback has been an incredible buying opportunity.

For a Canadian stock with a top-quality management team, broad opportunities to keep growing, and a reasonable valuation, Constellation is a must-own for DIY investors.