When you’re a new investor, and you’re just beginning to build your portfolio, it’s crucial to focus on finding the best Canadian stocks to buy at the time.

Of course, we always want to invest in the top Canadian stocks, and we always want to invest in stocks that offer the most value.

But when you are first starting out building a portfolio, there could be the urge to buy stocks from each sector and diversify your portfolio. And while that will eventually be the goal over time, what you want to focus on now is finding the best investments to put your capital at the moment.

So, if you’re looking for the top Canadian stocks to buy now, here are two I’d put on your buy list today.

One of the safest Canadian stocks you can buy today

One of the best and safest Canadian stocks you can buy for your portfolio and one that still offers tremendous long-term growth potential is Brookfield Infrastructure Partners (TSX:BIP.UN)(NYSE:BIP).

Brookfield is one of the best long-term investments you can make for several reasons. First off, infrastructure assets tend to be highly defensive businesses. And with Brookfield owning these assets in countries all over the world, its portfolio is well diversified.

But you might be wondering about the kinds of assets it owns. Brookfield owns several different midstream energy and utility assets, both highly defensive and highly crucial to the economy, making it one of the safest Canadian stocks to buy.

In addition, it also owns several transportation infrastructure assets. These include railroads, ports, and toll roads, which are also all highly defensive and crucial to economies.

Lastly, Brookfield owns a tonne of telecommunications assets, such as telecom towers and data storage centres. And because Brookfield is consistently upgrading these assets, increasing their value and the cash flow they generate, the company is constantly looking to find new businesses to expand its portfolio and recycle capital.

So, with the fund aiming to grow investors’ capital by up to 15% annually over the long run, Brookfield is one of the safest and best Canadian growth stocks to buy now.

A top financial stock with incredible growth potential

If you’re looking to buy stocks for your portfolio today, another one of the very best to consider, especially while it trades undervalued, is goeasy (TSX:GSY).

goeasy is a specialty finance company that has seen its business explode in recent years. That’s why it’s one of the best Canadian stocks you can buy.

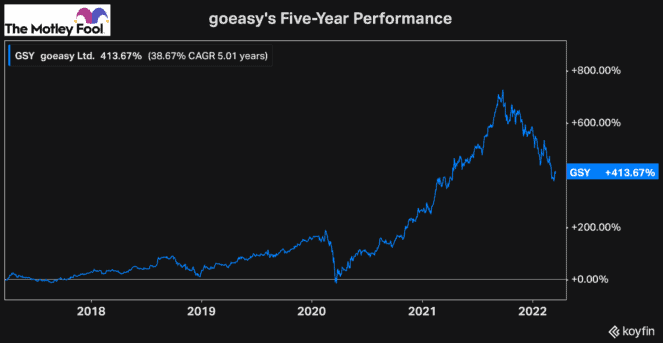

However, goeasy’s incredible growth is just one part of the formula that has allowed the stock to earn investors a total return of more than 400% over the last five years, including the recent pullback it’s seen.

Much of the reason goeasy has been so successful is that it’s managed its portfolio well and kept its bad debt expenses low. And when you look at the returns goeasy can make, coupled with the fact its loan book is so strong, it’s clear why goeasy has been so profitable over the last couple of years.

For example, in just the last three years, its net income has increased by 361%, despite its revenue only growing 67% over that period.

So, with the stock trading roughly 40% off its high and with almost 60% upside to its average analyst target price, goeasy is one of the best Canadian stocks you can buy now.