Oil prices today are soaring once again. But this is just the tip of the iceberg. In fact, after only nine days, March has already brought us a 32% rise in oil prices. At this point, this dramatic surge in prices feels pretty extreme. It may even be getting some investors a little jittery. Have you been thinking of buying energy stocks to get in on this action? Are you wondering if it’s too late? In this article, I’ll discuss AltaGas (TSX:ALA), a Canadian energy infrastructure/utilities company that has been on fire in the last couple of years.

Read on to find out why AltaGas stock might be the best choice for those of you who are looking for a “safer” energy stock.

As crude oil prices heat up, energy stocks are rallying hard

The thing is, even before the recent war-induced rally in oil and natural gas prices, these commodities were already on the upswing. This was being driven by dramatically improving fundamentals after many years of pain. But those years of pain in the cyclical industry world are usually followed by brighter times. In short, the supply/demand mechanism eventually rebalances. So, in the oil and gas industry, years of low prices resulted in chronic underinvestment. This led to lower supply. Add this to the surge in demand as economies are reopening after global lockdowns, and we have a perfect storm. Today’s crude oil price is reflecting this.

So, along with soaring oil and gas prices, we have also seen soaring energy stocks. While many of these stocks are rising off of dirt-cheap valuations, this may cause some of us to pause. Suddenly, we can see more downside after this huge run-up. For those investors that want some exposure to this oil and gas boom, but are wary, AltaGas stock may be the ideal energy stock for you.

AltaGas: A safe utilities business with the upside of an energy infrastructure/LNG business

The beauty about AltaGas is that this company has a nicely diversified revenue stream. First, we have the utilities segment, which accounts for 51% of EBITDA and is the safe and secure portion of the business. The utilities segment provides AltaGas with steady and defensive utilities earnings.

The energy infrastructure segment, or the midstream segment, is the oil and gas exposure. It provides AltaGas with huge growth and upside. It is this segment that is benefiting today from soaring oil prices and soaring natural gas prices. The bright spot of AltaGas’s midstream operations is its global export platform. Through these facilities, AltaGas is exporting record amounts of propane and butane to a variety of Asian markets.

“The midstream business will continue to be centered around our global export platforms which provide access to key west coast North American ports and provide a structural advantage — a 60% advantage over U.S. Gulf coast and a 45% advantage over the Middle East for shipping time savings.”

Randy Crawford, CEO

Why buy AltaGas now?

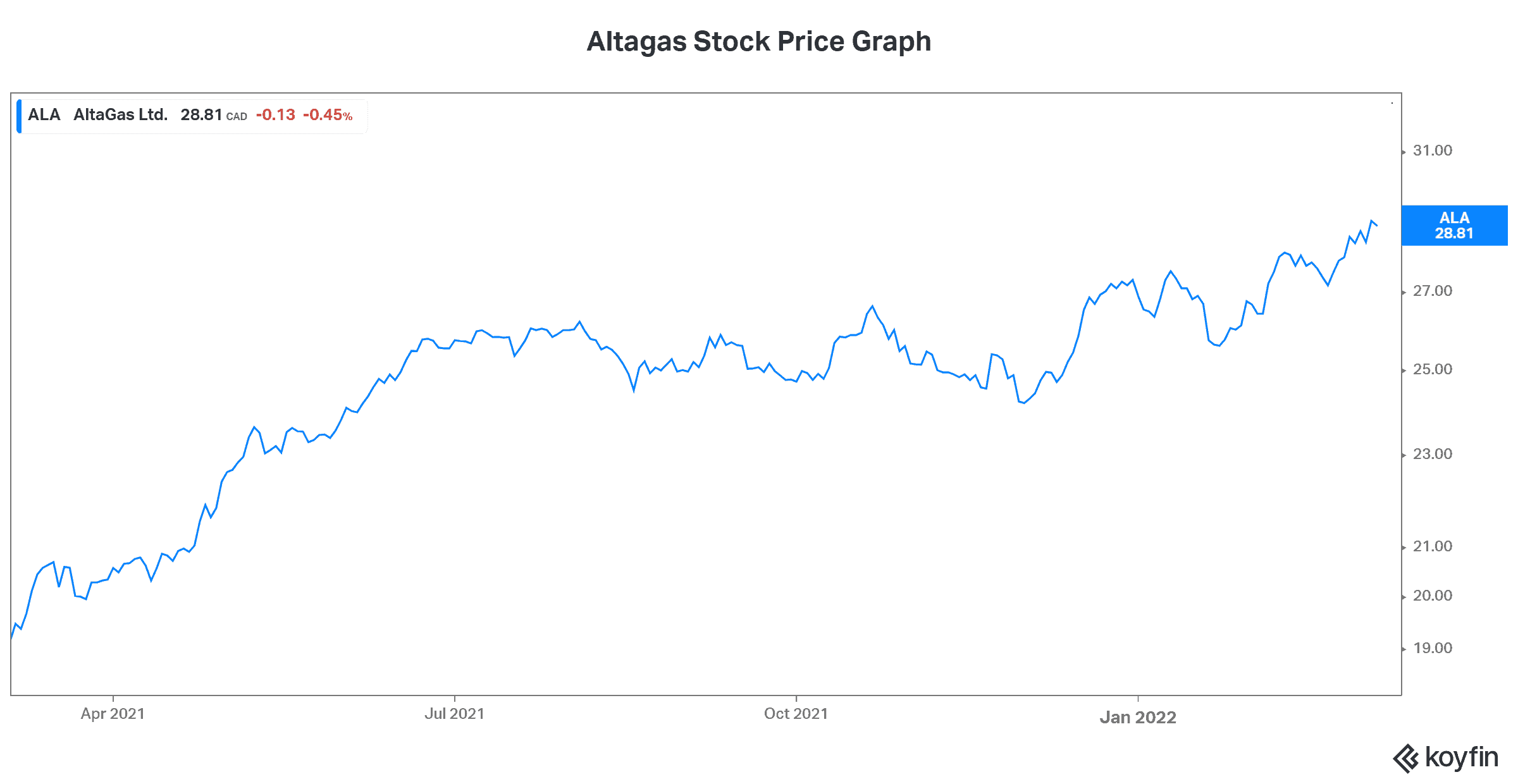

AltaGas stock has risen a lot over the last while. In fact, it’s up over 40% so far in 2022. Yet I still believe that AltaGas has room to move higher. This is easily explained. Simply put, AltaGas’s export business is booming, as the world looks for safe and reliable energy.

Motley Fool: The bottom line

As the crude oil price continues to soar, there’s still time to get in on the upside. Consider AltaGas stock if you’re looking for a “safer” energy stock. It’s yielding a solid 3.7% today, and the business has never looked better.