Russia is invading Ukraine, and this has many far-reaching consequences. Firstly and most importantly, there’s the obvious humanitarian one. But there’s also its effects on global trade and the global economy. Gold is a central piece of this. This metal is a reflection of many things, but mostly, it’s a reflection of the level of anxiety among investors. The gold price is now pushing up against $2,000 as global tensions mount. So as gold approaches all-time highs, consider adding gold stocks like Barrick Gold Corp. (TSX:ABX)(NYSE:GOLD) to your portfolio as a safe haven for your hard-earned money.

Here are the two gold stocks that, in my opinion, would the best safe havens in this time when Russia is causing so much upheaval. They’re operationally and financially sound and they benefit big from the rise in the price of gold.

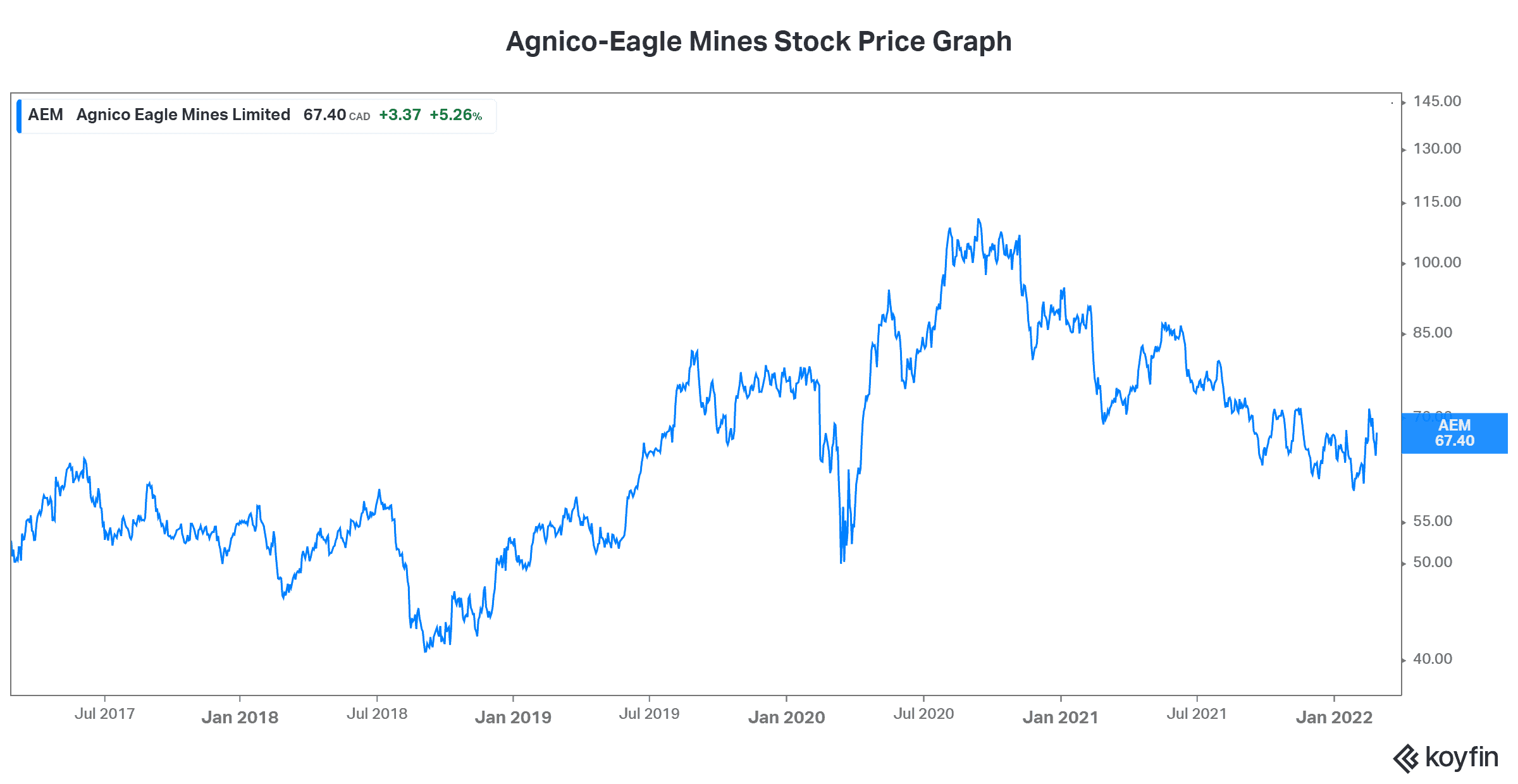

Agnico-Eagle stock: the gold stock for rapid dividend growth

Agnico-Eagle Mines Ltd. (TSX:AEM)(NYSE:AEM) is my favourite gold stock right now. In fact, it’s been my favourite gold stock for some time. This is because of a few distinguishing characteristics. For example, Agnico only does business in safe regions – politically and otherwise. Also, Agnico-Eagle Mines has an industry-leading cost structure, which has translated into strong cash flows and huge dividend increases.

2021 results speak to the success of the company and the industry around it. Cash flow from operations increased more than 10%. Also, on a recent earnings conference call, management spoke about being very optimistic about the future. Reserves are growing, synergies are exceeding expectations, and shareholders are benefiting. For example, Agnico-Eagle just instituted another dividend increase. This time, the dividend increased 14%. In the last five years, Agnico’s dividend has grown at a compound annual growth rate of 30%.

Agnico-Eagle Mines stock price rallied almost 5% yesterday. Additionally, it has rallied 11% in the last month. I think investors are increasingly flocking to this gold stock for its many safe-haven qualities. I also think that with the gold price continuing to rise and dividends continuing to grow, Agnico-Eagle remains a great investment today.

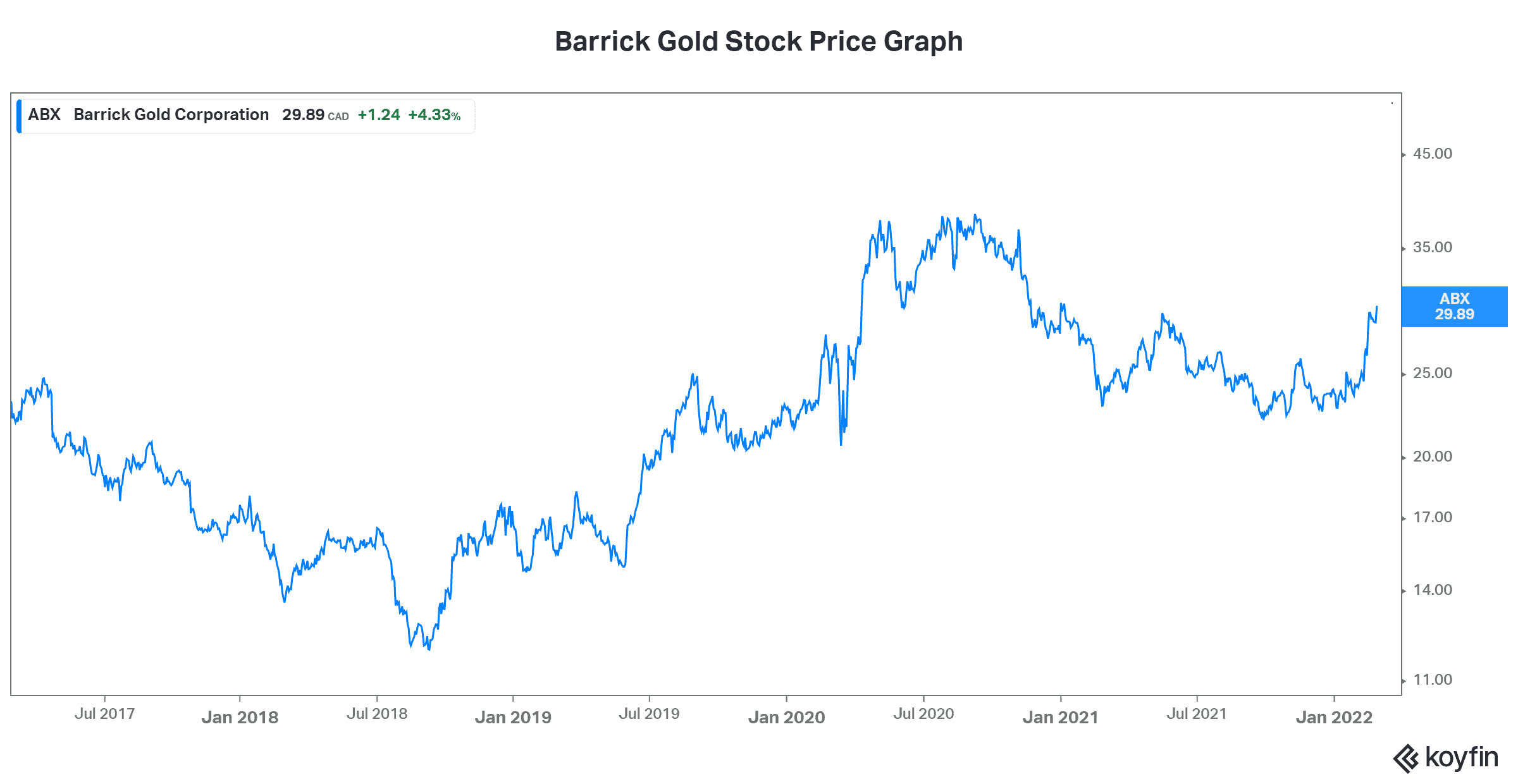

Barrick Gold stock: the gold stock to capture the rising gold price upside

Barrick Gold is one of the largest and most well-known gold stocks on the TSX and globally. It has a market cap of $50 billion. Importantly, it really is the go-to name globally for gold exposure. Barrick Gold stock rose almost 5% yesterday and is up 25% so far in 2022. This demonstrates investors’ flock to safety as the worrisome geopolitical and economic trends intensify.

The assets and operations of Barrick Gold are spread all over the world. This includes some politically risky and unsafe areas, which is something that I don’t like about the company. But it doesn’t change the fact that gold is a safe haven. It also doesn’t change the fact that Barrick Gold is the most top-of-mind gold stock that investors flock to. In short, I think we’ll be needing this safe haven in the coming months.

Motley Fool: the bottom line

The rapid rise is the price of gold has been accelerated in recent days. Rising inflation started it off, and now, Russia is invading Ukraine. These have combined to send the price of gold soaring. As gold approaches all-time highs, we should all consider adding gold stocks to our portfolios. Barrick Gold and Agnico-Eagle are the two stocks that I would add at this time. The coming months will likely be good to them and their shareholders.