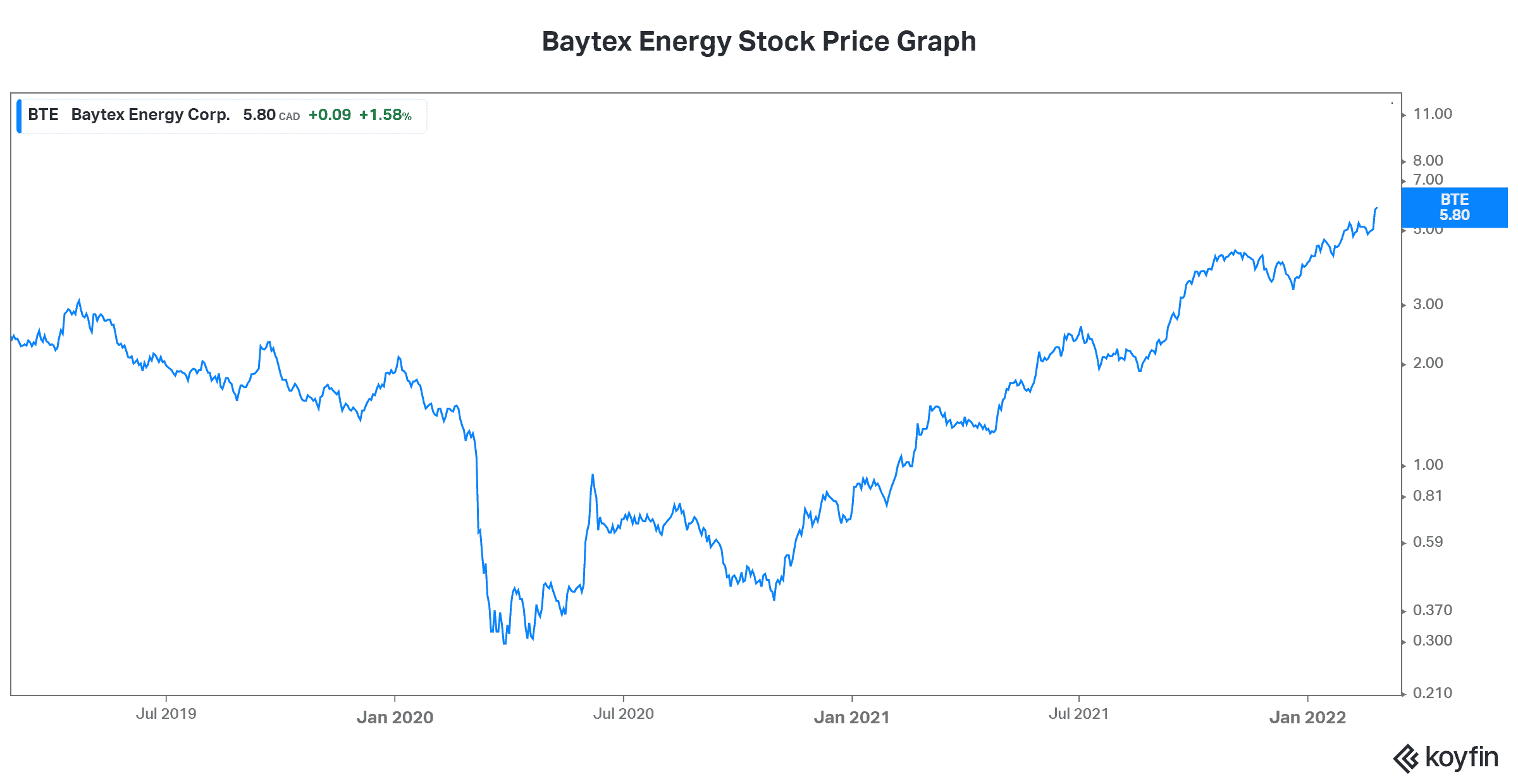

Baytex Energy’s (TSX:BTE)(NYSE:BTE) stock price has increased 16% since the release of the oil and gas company’s 2021 earnings last Friday.

Baytex Energy’s stock price rallies 16% on soaring cash flows

- Adjusted cash flow per share increased 140% to $745 million

- Net debt was reduced by 24% to $1.4 billion

- Q4 production rose 15% to over 80,000 barrels of oil equivalent per day (boe/d)

- Free cash flow increased over 2,000% to $421 million

What happened in 2021 for Baytex Energy?

2021 was a big year for all oil and gas stocks. As we know, the supply/demand environment improved dramatically last year. Consequently, oil and gas prices have shot through the roof, and energy stock prices like Baytex Energy have followed suit. But what makes Baytex special? Well, before this year, Baytex had been drowning under a heavy debt load and a deteriorating financial position. Its very survival was in question. As a result, Baytex Energy saw its stock price sink. Today, the strength in energy prices has changed all of this.

On top of this, Baytex is performing well operationally and practicing capital discipline. All of this is finally bringing Baytex stock price out of the dust. It certainly has a long road of recovery ahead, as it was trading at severely depressed multiples. But soaring oil and gas prices, combined with Baytex’s rapid deleveraging and operational excellence, paid off in 2021.

What did Baytex Energy’s management say?

“We remain intensely focused on capital discipline.”

Edward LaFehr, president and CEO

Clearly, Baytex management is steadfast in their commitment to strengthen the company in this bullish energy cycle. For them, this is the priority. They’re working on recovering the company’s financial position by devoting all free cash flows to debt repayment. Additionally, Baytex is aiming at maximizing free cash flow through operational improvements.

What’s next for Baytex Energy?

2022 and beyond look good for Baytex. Its stock price is finally being revalued and the company is rapidly on its way to increased shareholders returns. In fact, its balance sheet is the strongest it’s been in eight years. As a result, the company will attribute 25% of its free cash flow towards share buybacks starting in Q2 of 2022. For now, the remainder of Baytex’s free cash flow will continue to go toward paying down debt.

Baytex expects to achieve a net debt-to-EBITDA level of one by mid-2023. At that time, management will look to other ways to return capital to shareholders, such as dividends.