Value stocks have really been making a comeback recently. They’ve soared on strong cash flows and recovering environments. And they’ve really stood their grounds as the high-flying tech stocks got pummeled. Teck Resources Ltd. (TSX:TECK.B)(NYSE:TECK) is a prime example of this.

Please read on as I walk through the strong forces that are driving Teck’s B stock (it has a dual-class share structure) higher today and, I think, for the foreseeable future.

Teck.B is a value stock whose time has come

Teck is a $16.5 billion diversified mining, smelting, and refining giant. It has operations in Canada, the U.S., Chile. and Peru. The company has major positions in different base metals markets. It also has a 21% interest in Canada’s Fort Hills oil sands project. These are all huge assets. As a result, the firm is cranking out tons of cash flow.

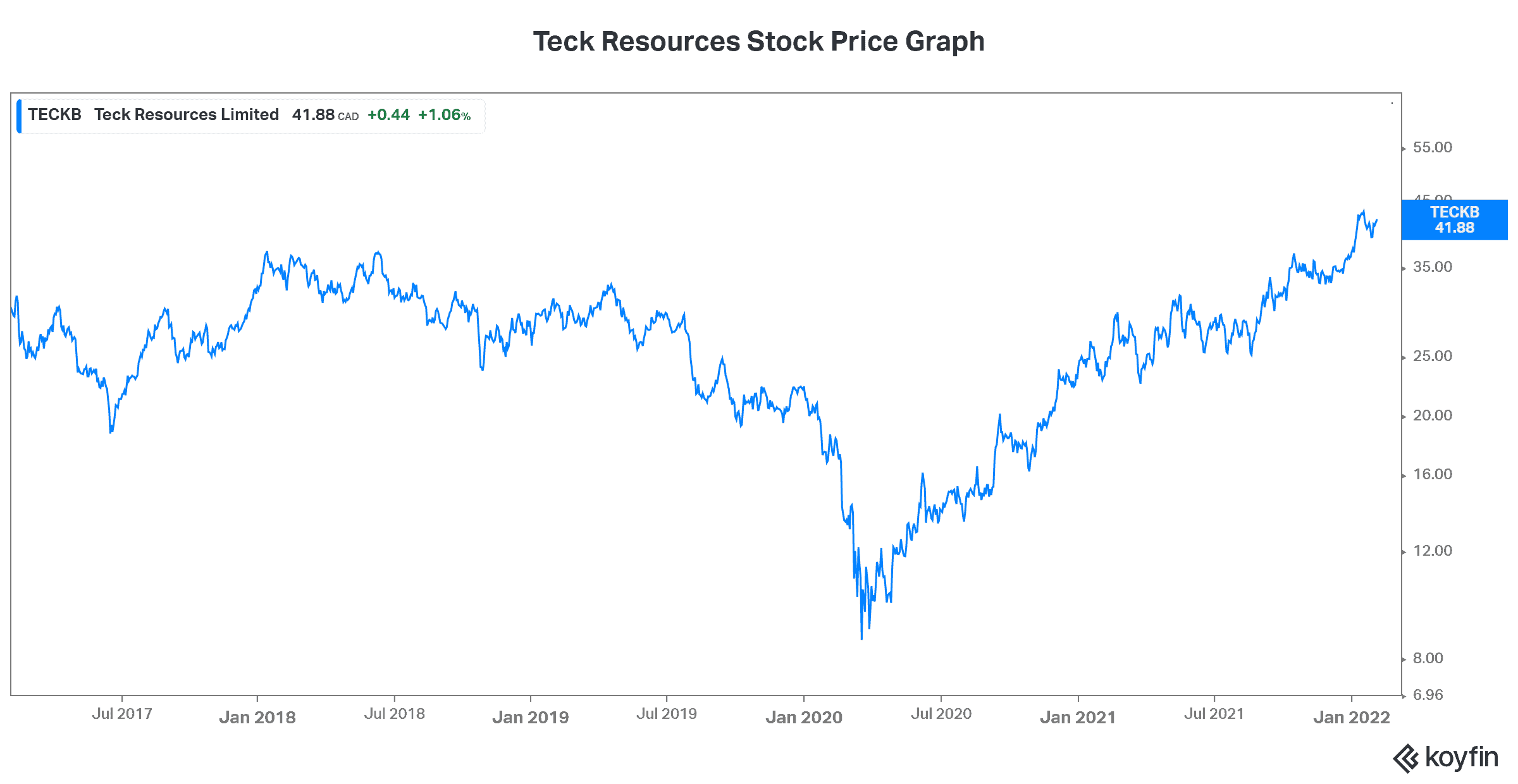

For the longest time, Teck Resources stock was dead money. This was due to the fact that the markets for its commodity were weak. It was also due to real troubles at Teck in the form of a heavily indebted balance sheet. But the recent macroeconomic situation was just the thing that the commodity markets needed to re-balance themselves. It was also the wake-up call that Teck needed to improve its operations and efficiencies, and to drive shareholder value. And that’s exactly what Teck did. Teck’s stock price graph below highlights the success that it’s had in the last few years.

We cannot escape the fact that Teck is a big coal producer (54% of gross profit). Coal is a big polluter. This will therefore certainly weigh on the stock. That being said, management is working hard at investing elsewhere. For example, it’s rapidly growing its copper business. In fact, Teck’s copper business is expected to decrease the company’s reliance on coal. It’ll result in coal making up less than 45% of the company’s gross profit. This is still high, but it’s a significant reduction. In its place, we will see copper production doubling by 2023.

Coal is on the way out. Clean energy is on the way in

Teck has its foot in the economic growth engines of the world. With new copper projects coming onstream in the next few years, Teck’s position will be strengthened. For example, the start of the Quebrada Blanca Phase 2 (QB2) mine in Chile will elevate Teck to one of the world’s major copper producers.

Teck’s QB2 copper mine is the company’s highest priority major growth project. This mine is one of the world’s largest undeveloped copper resources. It has an initial life of 28 years with the potential for further growth. Construction on the mine was sanctioned in December 2018 and first copper production is planned for the second half of 2022.

This focus on copper is a good strategic move for Teck, as copper is one of the most versatile and durable base metals. It’s used extensively in the renewable energy industry. For example, electric vehicles require three times more copper than conventional vehicles. This means that it has a solid long-term growth profile. In short, the trend toward renewables is accelerating rapidly, so it’s a good place to be.

Are dividend increases coming for Teck stock?

Even when the commodity price environment was not so great, Teck was generating impressive cash flows. These cash flows shored up its balance sheet and ensured that it entered better times in a solid position.

Today, cash flows at Teck are soaring to record highs. This is being driven by soaring commodity prices across the board. According to Teck management, the company “considers supplemental shareholder cash flows” at the end of each year. Considering that Teck tripled its EBITDA versus last year, I believe there may be dividend increases coming. The company reports its year-end on February 24.

Motley Fool: the bottom line

Coal and base metals pricing continue to soar, benefitting Teck Resources stock enormously. I mean, the company is increasingly positioning itself in the copper business. As this market benefits from the increased copper demand from the renewables industries, this value stock will continue to prosper.