Retirement planning is not an easy task. It takes plenty of patience. But the reward for RRSP investors is significant. This reward comes when your financial security falls into place. In turn, it leaves room to focus on the other parts of retirement. The parts that are, let’s face it, way more enjoyable. In this Motley Fool article, I list three dividend stocks that have very generous yields of over 5%. They’re worth considering as you set yourself up for income in retirement. While the RRSP deadline is not until March 1, it’s never too early to start planning.

Without further ado, here are three stocks yielding over 5%.

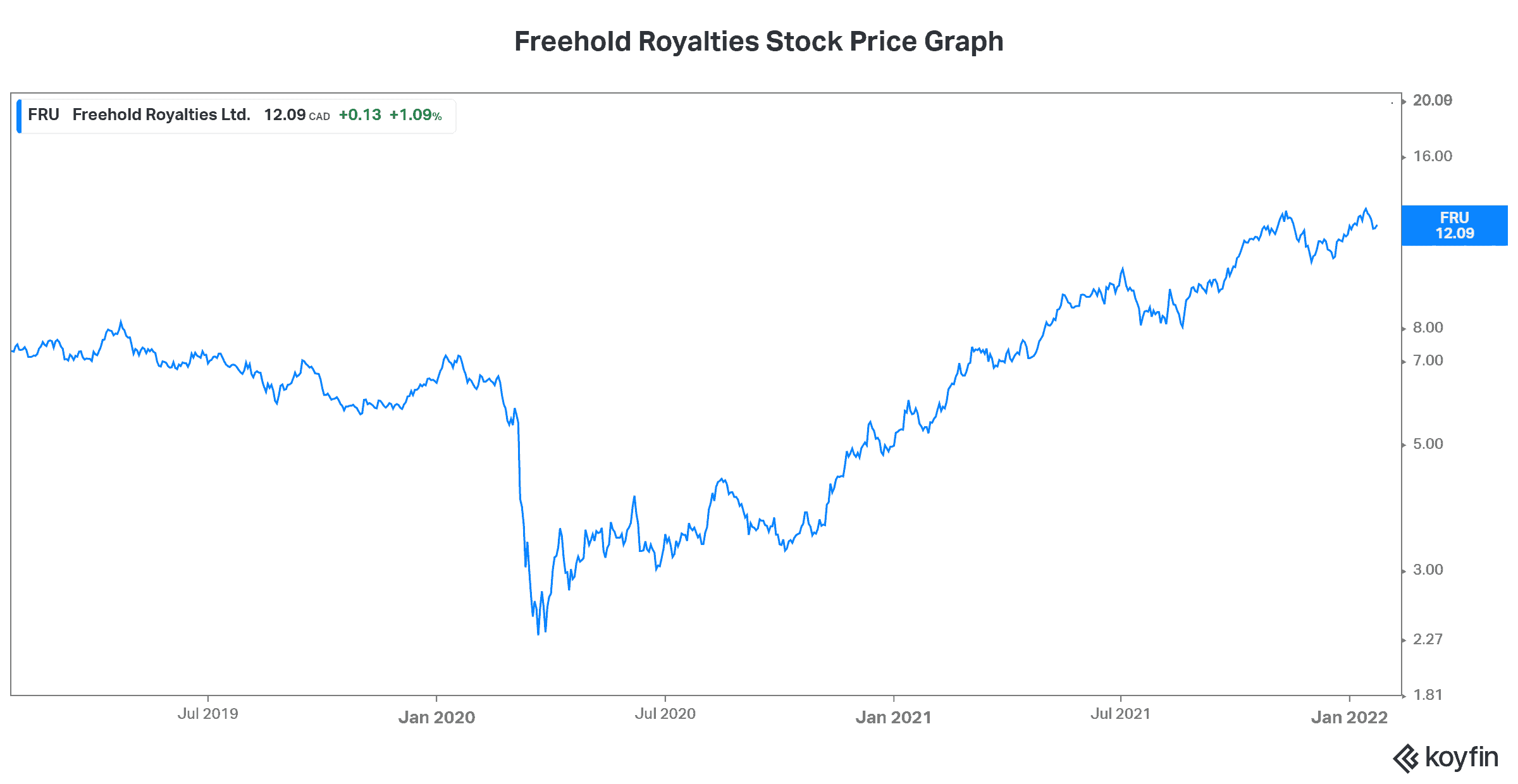

RRSP stock #1: Freehold Royalties is a dividend stock benefitting from the oil and gas industry

Freehold Royalties Ltd. (TSX:FRU) is a Canadian oil and gas company engaged in the production and development of oil and natural gas. It’s different than other energy companies because it’s a royalty. What that means is that there’s less risk involved with this name. Freehold collects royalties from other companies who are actually taking on the exploration and production risks.

Right now, Freehold Royalties is yielding a very attractive 6%. This stock has spent years in the dumps along with the rest of the energy industry. However, in 2021 and beyond, it’s coming back, also like the rest of the energy industry. The reason that I like Freehold is for its yield, of course. But also because with Freehold, investors are essentially making a bet on the Canadian oil and gas industry – without taking on any real company-specific risk. Freehold owns a bunch of royalties scattered across Western Canada. It has no capital or funding requirements. It simply collects a portion of revenues earned.

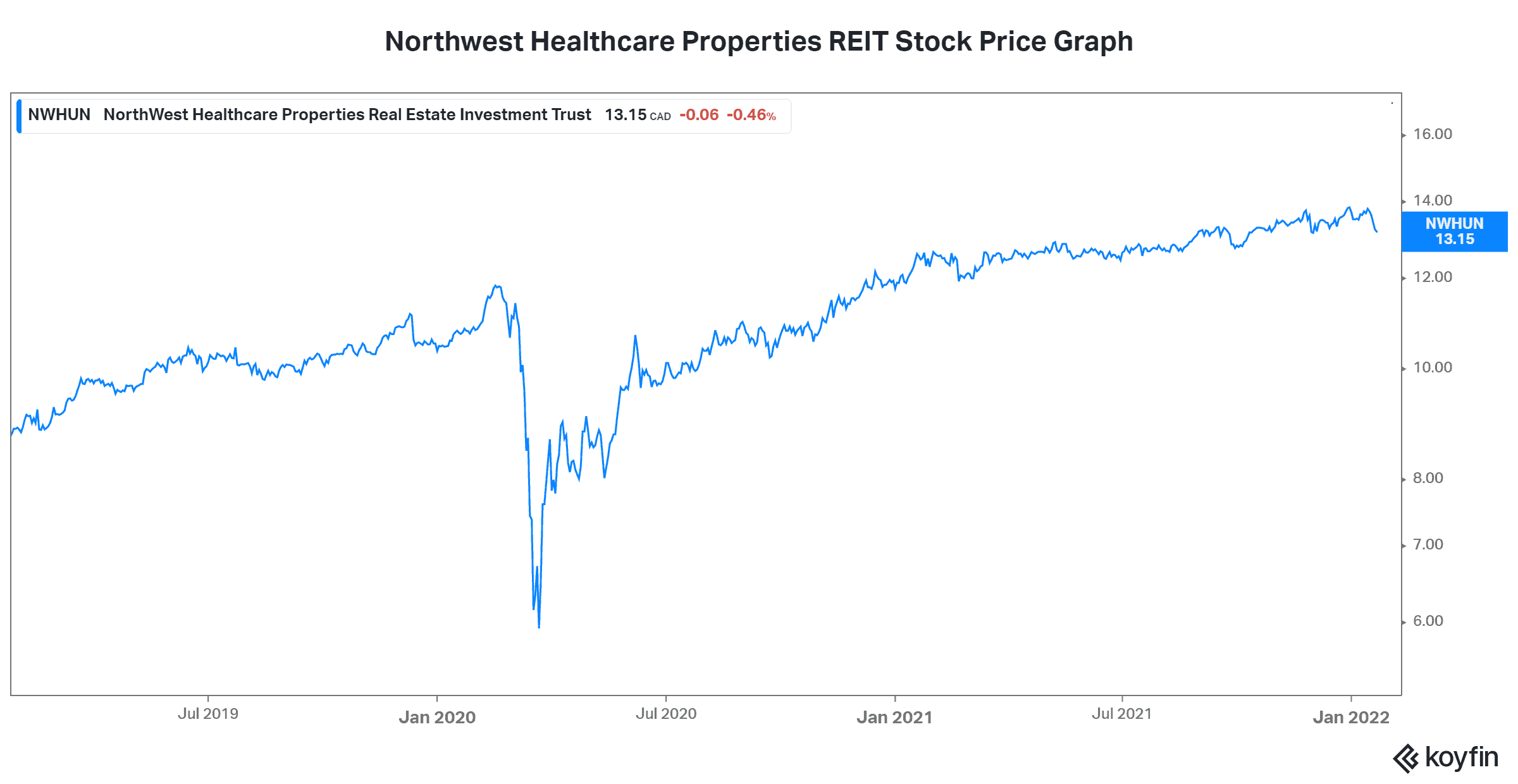

RRSP stock #2: Northwest Healthcare Properties REIT is a dividend stock benefitting from the aging population

Medical real estate is a booming area of real estate these days. The aging population, along with increased testing and procedures, is driving this. Northwest Healthcare Properties REIT (TSX:NWH.UN) is a real estate investment trust (REIT) that owns and operates a lucrative portfolio of global healthcare real estate assets.

Northwest is currently yielding an attractive 6.13%. I view this income as extremely safe and reliable for a variety of reasons. First, as I said, Northwest is in the medical real estate business. It’s a stable business that’s growing along with the aging population. Second, Northwest’s revenues are tied to inflation. This means that inflation won’t eat away at your income over time. Lastly, Northwest has a stable dividend history. While it hasn’t grown in the last few years, it is at least steady and reliable. This leaves you with a solid option whether you invest before the RRSP deadline or not.

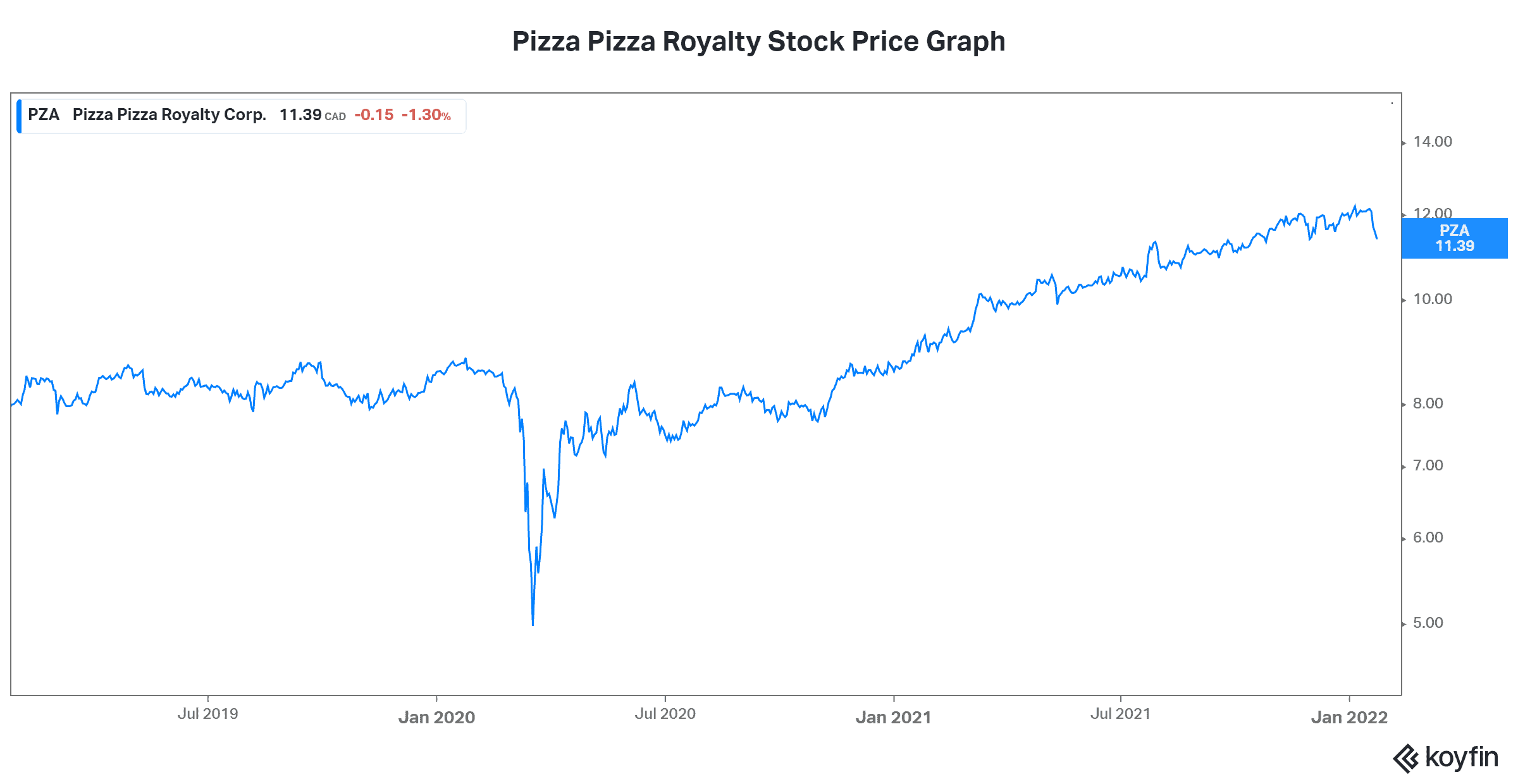

RRSP stock #3: Pizza Pizza Royalty

The last stock on my list today is another royalty play. This means it’s a relatively low-risk way to secure solid RRSP income. The Pizza Pizza Royalty Corp. (TSX:PZA) restaurants are franchises. This means that the franchisee operates as an independent business. In turn, Pizza Pizza Royalty simply collects royalty income without incurring operating expenses. Pizza Pizza dominates the pizza quick service restaurant segment in Ontario. It also has locations across Canada, from the west to the east. It has been a staple in its segment for many years now.

Pizza Pizza is characterized by its high dividend yield of 6.4%. It’s also characterized by its low debt and steady cash flows throughout the years. In fact, these cash flows have been so steady that Pizza Pizza has raised its dividend numerous times in the last few years.

Motley Fool: The bottom line

RRSP investors, you should consider these top dividends stocks to help you prepare for retirement. They’re high-yield stocks that have a level of safety that’s inherent in their royalty and investment trust business models. In fact, the dividend stocks listed in this Motley Fool article can surely help you achieve your retirement goals. The RRSP deadline is March 1, so you still have time to ensure that you maximize your RRSP contributions.