High-yielding stocks are always very much in demand for passive-income investors. These high yields secure a future of high income streams. They play a large role in retirement planning. In short, they do an excellent job of supplementing retirement income. In fact, they can help secure a very comfortable retirement life.

Without further ado, let me introduce the 6%-yielding stock. It’s a great addition to your retirement portfolio for solid and reliable passive income.

Real estate trusts are ideal for passive income

Northwest Healthcare Properties REIT (TSX:NWH.UN) is a real estate investment trust (REIT) that owns and operates a lucrative portfolio of global healthcare real estate. The fact that the trust’s real estate assets are all in the healthcare industry has many implications. Firstly, this makes Northwest a very defensive holding. The business is defensive and the cash flows generated are steady and stable.

Also, the healthcare industry is one that has very strong long-term, secular growth characteristics. The population is aging in all developed nations and population growth is significant as well. And lastly, there’s one more key benefit to Northwest Healthcare Properties REIT that bears mentioning. This is that Northwest’s revenues are tied to inflation. Essentially, its assets (properties) are long-leased and inflation indexed. This is a very important characteristic. And it’s especially attractive in this environment where inflation is rising fast. We don’t want our retirement savings to be eaten away by inflation. This REIT is a nice hedge to inflation pressures.

Northwest Healthcare REIT: A 6% dividend yield with a solid capital gains history

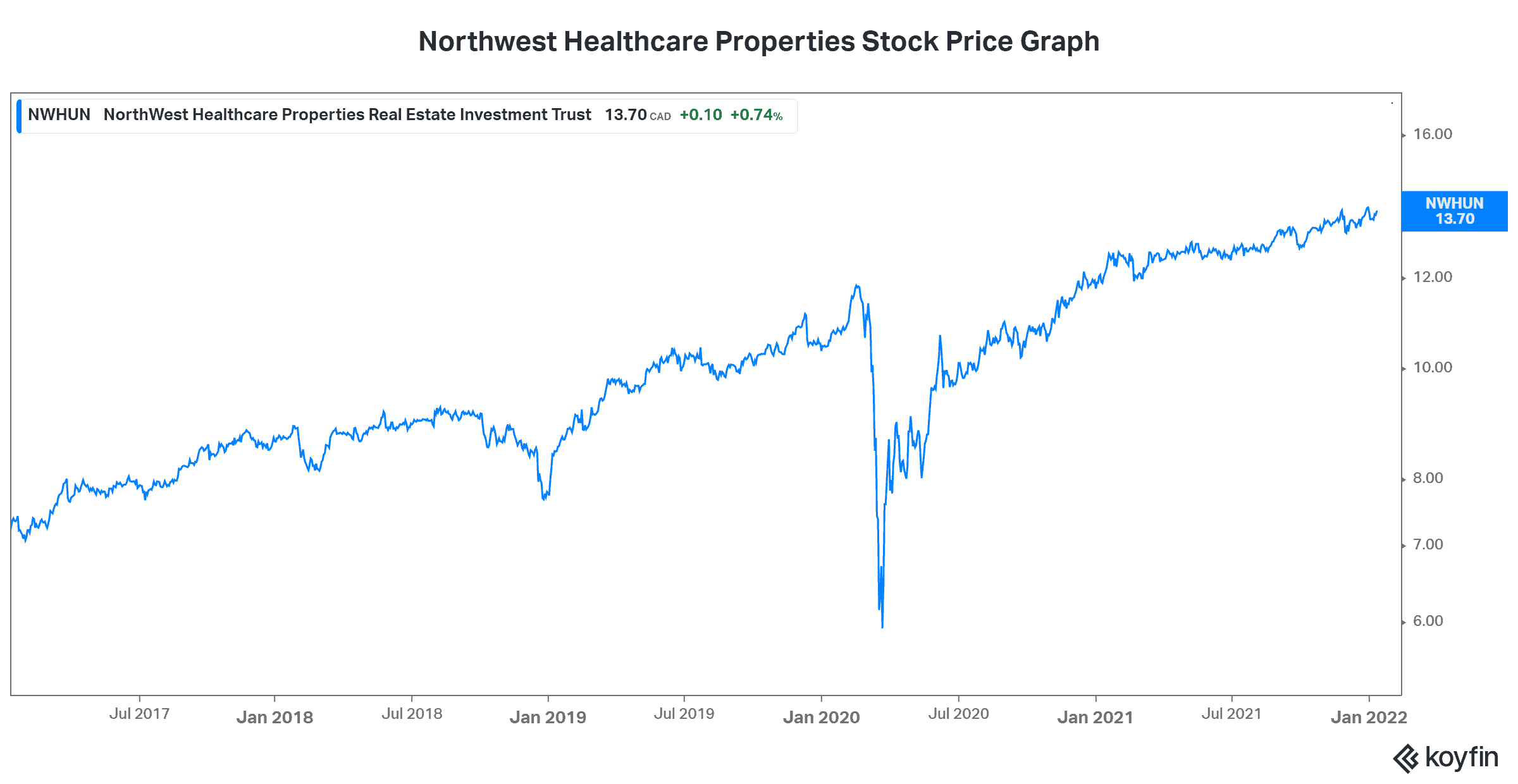

Over the last few years, Northwest Healthcare has proven itself. The stock has been steady and reliable. In fact, in the last three years, Northwest Healthcare Properties stock has risen 32%. Also, and more importantly, Northwest has paid out a fortune in dividends. It’s currently yielding 6%, but this yield has been well above 10% in prior periods when the stock price was lower. I personally love this passive-income profile.

All told, Northwest’s dividend has been steady over the long term. While it hasn’t grown in the last many years, it is, at least, steady and reliable. And if we look at the reason that the dividend has not grown, we can take comfort. In short, Northwest has been expanding big time. Consequently, its net asset value has consistently grown. It currently stands at $13.60, which is 11% higher versus one year ago.

Passive-income investors can rely on Northwest for the long term

So, as I touched upon, a key characteristic of Northwest is the fact that its revenues are inflation indexed. Also, it’s participating in one of the greatest secular trends today: the aging population. With assets all around the world, Northwest is quickly becoming the number one owner of healthcare properties. It’s inextricably linked to the future of healthcare and healthcare trends — both of which are extremely positive.

Motley Fool: The bottom line

Passive-income investors are constantly in search for high-yielding stocks to shore up their income. I know I am. In Northwest Healthcare Properties REIT, we have a 6%-yielding, high-quality, defensive option. I think it has many income-producing years while you sit back and enjoy your pre- or post-retirement life!