Exchange-traded funds (ETFs) are great for expressing a thematic investment strategy. They are an active bet on which market sectors are likely to outperform, such as tech, energy, banking, or even psychedelics!

A lesser-known sector tilt is towards the agricultural industry. This industry produces the food we eat, ensuring that we have the most basic of necessities fulfilled. I would consider it the hidden backbone of the economy as we know it. Without food, everything else grinds to a standstill.

Now, I’m not encouraging you to go out and buy a cattle herd. There’s a better, easier way to invest in this essential industry — iShares Global Agriculture Index ETF (TSX:COW).

The best ETF for Canadian agriculture investors

COW gives Canadian investors easy, one-stop-shop exposure to 37 agriculture industry stocks from developed markets around the world. It seeks to replicate the performance of the Manulife Asset Management Global Agricultural Index, net of fees.

These stocks include those of companies involved in the production of agricultural products, fertilizers and agricultural chemicals, farm machinery, and packaged foods and meats. Around 84.44% of the stocks held are from the U.S., while 9.44% are from Italy, 3.06% from Canada, and 2.70% from Israel. Well-known companies held include Nutrien, Tyson Foods, and Rogers Sugar.

COW currently has assets under management (AUM) of $305 million, which is sufficient for liquidity and trading purposes. The fund will cost you a management expense ratio (MER) of 0.72% a year to hold, which is expensive compared to index funds but not so for a thematic fund. COW also pays a small 12-month trailing distribution yield of 0.68%.

How does it perform?

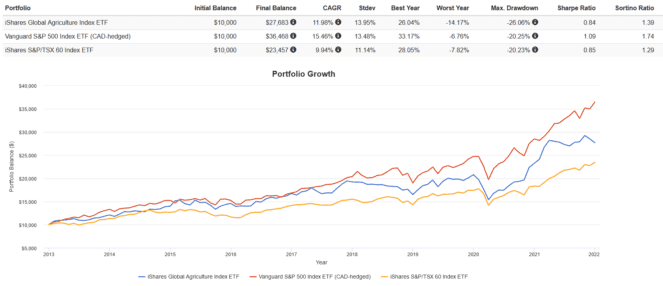

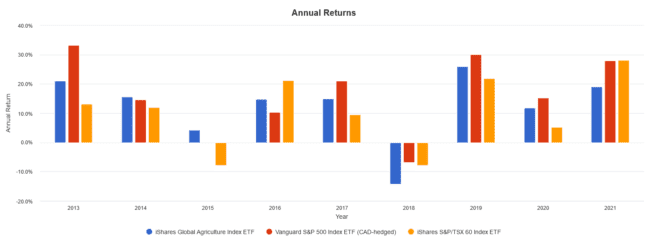

A word of caution: the backtest results provide below are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Hypothetical returns do not reflect trading costs, transaction fees, or actual taxes due on investment returns.

That being said, from 2013 to present, COW has significantly outperformed the S&P/TSX 60 Index, with a higher CAGR, lower volatility, smaller drawdowns, and a better Sharpe ratio, but it underperformed the S&P 500 Index.

The Foolish takeaway

If you have a strong investment thesis around the global agricultural industry, COW may be a good way to express that view. By buying COW, you’re making a bet that the agriculture sector will outperform the broad market. While this could occur during some market cycles, you should also be ready for periods of underperformance and high volatility.

With just 37 holdings all concentrated in one sector, COW isn’t diversified at all and could expose you to more risk than an index fund would. That being said, with more risk usually comes more return. If you are bullish on agriculture and have a long-term perspective, then COW could be an excellent ETF to buy and hold.