The start of the new year means Canadian investors get to contribute a fresh $6,000 to their Tax-Free Savings Account (TFSA). Likewise, you can recontribute any contribution space withdrawn from your TFSA in 2021 (so long as it is within the $81,500 total contribution limit). There are several rules to follow when doing this, so be sure to talk with a tax specialist, a financial advisor, or the Canada Revenue Agency (CRA) first.

The TFSA is the best account for compounding investment returns

The TFSA is a great tool for compounding wealth. There is no other registered account in Canada that has zero tax liability. The TFSA enables Canadians to compound their investment returns quicker, because they don’t have to share a piece of the profits, income, or interest with the CRA. That is why filling up your TFSA contribution space is the best place to start building an investment portfolio.

We all have $6,000 of new contribution space for 2022. If you are looking for some diverse ideas to invest in, here are three Canadian stocks that look interesting today.

A top income stock for a TFSA

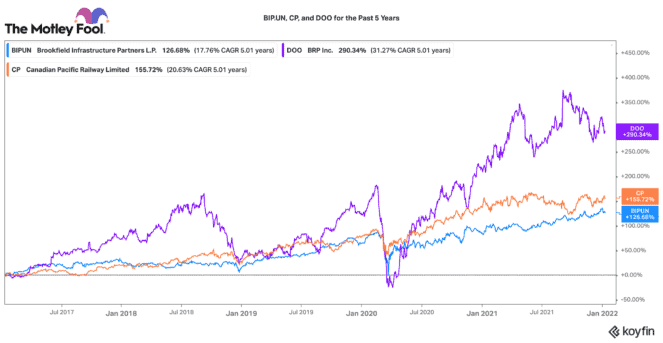

Brookfield Infrastructure Partners (TSX:BIP.UN)(NYSE:BIP) is a great TFSA stock, because it is growing faster than a utility, but it has defensive, utility-like characteristics. It owns and operates a diversified portfolio of essential assets that include ports, railroads, transmission lines, pipelines, midstream operations, cell towers, and data centres.

It is great for beginner investors, because its portfolio provides diversification in and of itself. Likewise, its assets are largely contracted or regulated, so its streams of cash flow are reliable. This helps support an attractive 3.5% dividend.

Over the past decade, it has grown that dividend by a 10% compounded annual rate. That may slow going forward, but the company’s organic and acquisition pipeline should still sustain solid low-teens annual total returns for many years ahead.

A top TSX value stock

Another great stock for a new TFSA portfolio is Canadian Pacific Railway (TSX:CP)(NYSE:CP). This may not be the most exciting business, but it has compounded annual average returns of 20% over the past 10 years. That rate has soundly beat the TSX Index in that time. Railroads are essential to the economy and impossible to duplicate or replace. Consequently, CP has a solid natural competitive moat.

Canadian Pacific is finalizing the acquisition of Kansas City Southern railroad. This will expand CP’s rail network from Canada all the way to Mexico. This should give it a unique competitive advantage and create new growth avenues for the business. CP has a top management team, which should likely continue to deliver steady returns going forward.

A growth stock at a fair price

If you are looking for a more growth-focused TFSA stock, BRP (TSX:DOO)(NASDAQ:DOOO) looks interesting. Over the past five years, BRP stock has risen 277%. That is a compounded annual return of 30%! Yet, for a top growth stock, it is cheap. It trades with a price-to-earnings ratio under 10. If you want growth at a very fair price, this is certainly the stock.

BRP manufactures and distributes recreational and marine vehicles. It has market-leading brands like Ski-Doo, Sea-Doo, and Can-Am. Recreational vehicles have been in high-demand since the pandemic, and this has been fueling very strong earnings.

It has faced some supply chain challenges, but those are largely temporary and passing. The company has a solid balance sheet and has aggressively bought back stock over the years. For a well-managed, compounding growth stock, BRP is a great pick for a new TFSA portfolio.