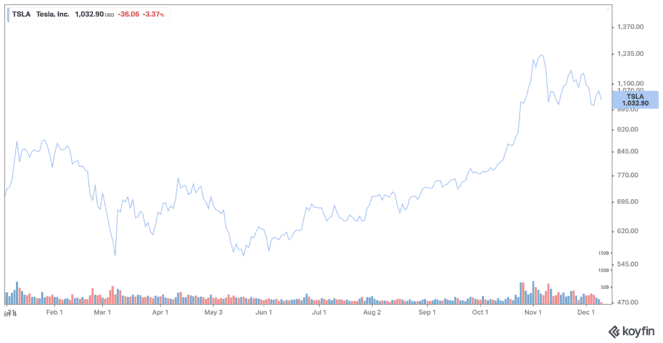

Shares of Tesla recently got hit after the release of two negative news pieces from Reuters and The New York Times. But the stock is still very expensive, with a forward P/E ratio of 128.2. More downside is likely.

Aritzia is cheaper than Tesla

Aritzia (TSX:ATZ), a Canadian growth stock, appears like a much better stock to invest in right now than Tesla. Its forward P/E, at 33.6, is much more reasonable than Tesla’s.

While Aritzia stock has doubled in price since the start of the year, Tesla stock is up “only” 40%.

Aritzia stock still has lots of upside. Let’s take a closer look at this fashion company.

Expansion and shift towards e-commerce

Aritzia is a womenswear retailer that is putting Canada on the map. Many Canadians are familiar with the chain store and its brands, some of which also have their own retail stores separate from the flagship Aritzia stores. As one of the few companies that has practically perfected omnichannel retailing, the company has a unique opportunity to really stand out, as it goes beyond the Canadian market alone.

The American push was a great success. And as the company looks to expand, also reaching out to a male audience through acquisitions or internal designs, the company has room to grow.

Over the past few years, Aritzia has worked hard to move away from its physical activity and optimize its online offerings. Over the past year, the company’s e-commerce revenue grew by 88%. In addition, a greater share of its business now comes from e-commerce channels. In fiscal 2020, 23% of its revenue came from online channels. In fiscal 2021, e-commerce sales now represent 50% of its total revenue.

Aritzia posted strong quarterly results

Aritzia posted better-than-expected results in the second quarter. Sales by fashion retailers outpaced pre-pandemic sales thanks to strong growth in e-commerce in the United States.

Net sales for the second quarter of 2022 came in at $350.1 million — an increase of 74.9% from the second quarter of 2021 and 45.1% from the second quarter of 2020. Comparable store sales increased 60% year over year and 14% from pre-pandemic levels in 2019.

Retail revenues were $219.6 million, 95.3% higher than a year ago and 13.8% compared to two years earlier. E-commerce revenues increased 48.7% in the quarter ended August 29 to $130.4 million. This is an increase of 171.1% compared to the second quarter of 2020.

Meanwhile, adjusted net income was $0.39 per diluted share compared to $0.01 per diluted share in Q2 2021 and $0.18 per diluted share in Q2 2020.

Analysts expected Aritzia to earn $0.21 per share in adjusted earnings on $296.2 million in revenue.

Aritzia raised its financial outlook for the full year to a range of $1.25 billion and $1.3 billion, from the previous outlook of $1.15 billion to $1.2 billion.

Aritzia CEO Brian Hill said, “The strength of our business across all geographies and all channels continues through the start of the third quarter. Looking ahead, expansion in the United States will be a leading driver of our growth.”

A better growth stock than Tesla

Aritzia is an undervalued growth stock that investors may want to support, as it continues to seize the opportunities that present to the company. The shift in focus towards e-commerce could push Aritzia shares to new highs. You might want to stay away from Tesla, as the stock is overvalued and may plunge further.