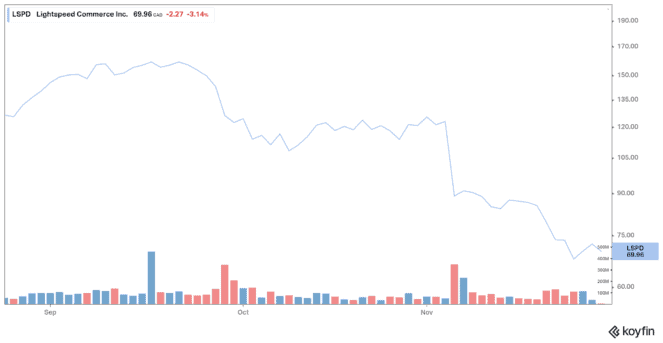

Shares of Lightspeed (TSX:LSPD)(NYSE:LSPD) have plunged approximately 40% so far in November. After hitting a 52-week high in September, the tech stock started falling after the publication of a short-seller’s report in late September. After the company reported its second-quarter results on November 4, Lightspeed stock plunged further, crashing 30% during that day.

The decline in Lightspeed stock price could be explained by the fact that results did not beat estimates by a sufficiently large margin or by the fact that the company did not raise its forecast by a sufficiently significant margin in the eyes of investors. Plus, the market was probably disappointed that Lightspeed reported a wider loss in the second quarter than a year ago, despite a strong increase in revenues. Lightspeed’s results were impacted by pandemic and supply issues. Let’s look at the company’s results in more detail.

Revenue and earnings

Lightspeed’s total revenue almost tripled in the second quarter, coming in at US$133.2 million compared with US$45.5 million in the prior-year quarter.

Strong organic growth and recent acquisitions drove revenue growth in the quarter ended September 30. Subscription revenue came in at US$59.4 million, up 132%, while transaction-based revenue was US$65 million, up 320%. GTV (gross transaction volume) increased 123% year over year to US$18.8 billion.

Lightspeed posted a net loss of US$59.1 million in Q2 2022, which is larger than the net loss of US$19.5 million it reported in Q2 2021. The adjusted loss amounted to US$11.1 million, or US$0.08 per share, up from an adjusted net loss of US$4.6 million, or US$0.05 per share, a year earlier.

Those results beat analysts’ expectations, as they expected revenue of US$123 million and a loss of US$0.09 per share.

Fiscal 2022 outlook raised

Lightspeed CEO Dax Dasilva noted that several key performance indicators of the company have just reached historic levels.

Lightspeed chief financial and operations officer Brandon Nussey said, “Lightspeed achieved solid results this quarter on the back of strong GTV growth, an increased Payments Penetration Rate and growing software adoption. While the rate of global economic recovery is expected to be uneven, overall our core business drivers remain strong.”

The company has raised revenue guidance for the full year. Revenue is now expected to be in the range of US$520 million to US$535 million for fiscal 2022, rather than the US$510 million to US$530 million previously forecasted. However, its losses are expected to be larger, between US$40 million and US$45 million, whereas they were previously estimated at US$35 million.

The company indicated that the pace and timing of the onboarding of new customers, the increase in its market share, and more normal supply and macroeconomic conditions should allow it to recover in the first quarter of fiscal year 2023.

Lightspeed is facing some challenges associated with the business transition, but those are expected to disappear in the next two quarters. Lightspeed still looks like a strong company. Investors who buy Lightspeed stock now could make big gains as concerns regarding the business are fading.