Dividend stocks — they’re invaluable. They supply us with income that can fund our retirement. They also supplement our wages. I think it’s the best “side hustle” out there. To passively earn money through no real effort … well. it’s the dream of many of the top investors. And it’s totally achievable. In this article, I present Northwest Healthcare Properties REIT (TSX:NWH.UN), a real estate investment trust (REIT) that owns and operates a lucrative portfolio of global healthcare real estate. It’s a top dividend stock to get your money working for you. In fact, it’s one of the best dividend stocks in Canada.

“If you don’t find a way to make money while you sleep, you will work until you die”

This quote is one of Warren Buffett’s most eye-opening quotes. It’s simple. We don’t want to work for the rest of our lives. We can’t even if we wanted to. That’s why it’s so necessary to get our money working for us. Investing provides this opportunity for us. Let’s focus on choosing the right stocks. Let’s always try to become more informed.

Northwest Healthcare Properties is a safe bet in order to achieve this. This is because of the many distinguishing factors of the REIT. For example, Northwest’s clients (tenants) are all in the healthcare industry. This is a highly defensive industry that’s experiencing very positive growth trends due to the simple fact that the global population is aging. Also, Northwest’s revenues are tied to inflation. This is especially important in today’s environment. I mean, inflation risks are high after record government stimulus and now rising energy prices.

Northwest Healthcare Properties: A top dividend stock to own for the long term

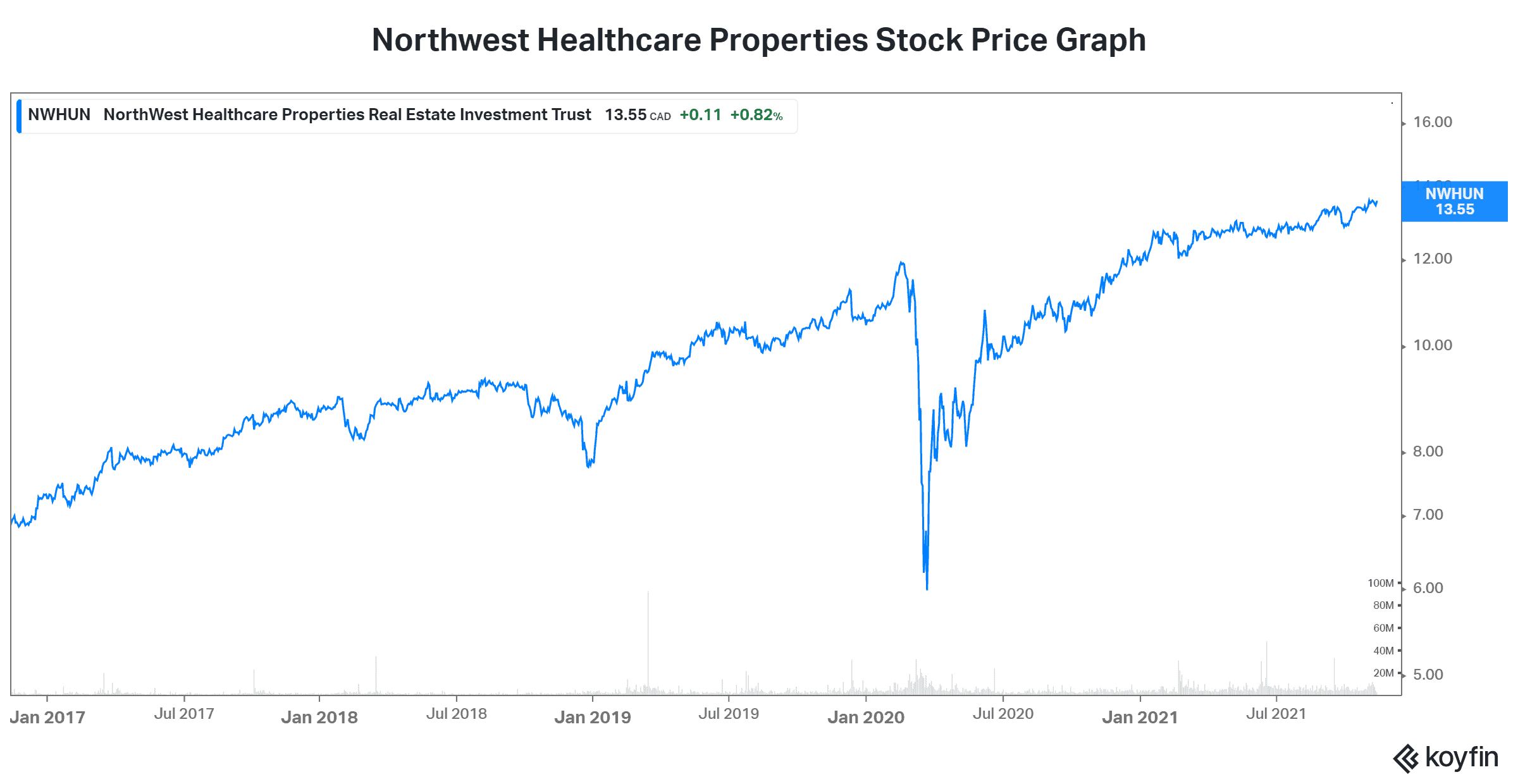

So, Northwest Healthcare Properties has proven itself. The stock has been steady and reliable. In fact, in the last three years, Northwest Healthcare Properties stock has risen 26%. Also, and more importantly, Northwest has paid out a fortune in dividends. It’s currently yielding 6%, but this yield has been above 8% in prior years when the stock price was lower.

All told, Northwest’s dividend has been steady over the long term. And this is a valuable attribute that long-term investors like Warren Buffett appreciate. While it hasn’t grown in the last many years, it is, at least, steady and reliable. And if we look at the reason that the dividend has not grown, we can take comfort. In short, Northwest has been expanding big time. Consequently, its net asset value has consistently grown. It currently stands at $13.60, which is 11% higher versus one year ago.

A dividend stock that makes money while you sleep

So, to sum it up, Northwest Healthcare Properties is a top dividend stock to get your money working for you. Its defensive business and stable financials make it so. Not only will it make money while you’re sleeping, but it’ll also facilitate a good sleep. The last thing we want is to buy a stock that keeps us up at night. This goes against a key part of Warren Buffett’s investing principles. We want to invest, not gamble.

Motley Fool: The bottom line

Northwest Healthcare Properties stock is a good stock to work for you while you rest. Its healthcare property assets have a long-life of steady and consistent growth ahead. The defensive characteristics of this top dividend stock will have you making money AND sleeping like a baby. It’s one of the best dividend stocks in Canada today.