Oil prices have been the shocker of 2021. Currently trading at approximately $85, they’ve brought the oil and gas sector back to life. For example, energy stocks like Suncor Energy (TSX:SU)(NYSE:SU) are roaring back to life. But rising oil prices bring all energy stocks higher with it. As oil prices today show no signs of stopping, Motley Fool readers should consider beefing up on their holdings in this sector.

Given this very favourable backdrop, here are three energy stocks to buy now for a big upside.

Oil prices have more than doubled vs. last year, but this cycle is far from over

Oil prices today are trading at almost $85. It’s a situation that may have seemed implausible just one year ago, but here we are. Years of chronic underinvestment in oil and gas production and resources have brought us here. We need only return to the basic supply/demand economic theory to explain this. Lower investments led to lower supply. This is a big plus for oil prices.

On top of this, demand is rising as the pandemic draws to a close. Higher demand also leads to higher oil prices. In short, what we have here is the perfect storm – the combination of lower supply and higher demand is powerful. We need only look at oil prices today to see this in action.

With many analysts calling for $100+ oil as the high point, this upcycle is likely in the early stages. So as previously mentioned, it’s largely the result of systemic underinvestment in oil and gas production over many years. There’s no easy fix for this type of situation. It takes time to rebalance supply. With demand rising fast, this macro imbalance shows no signs of correcting any time soon.

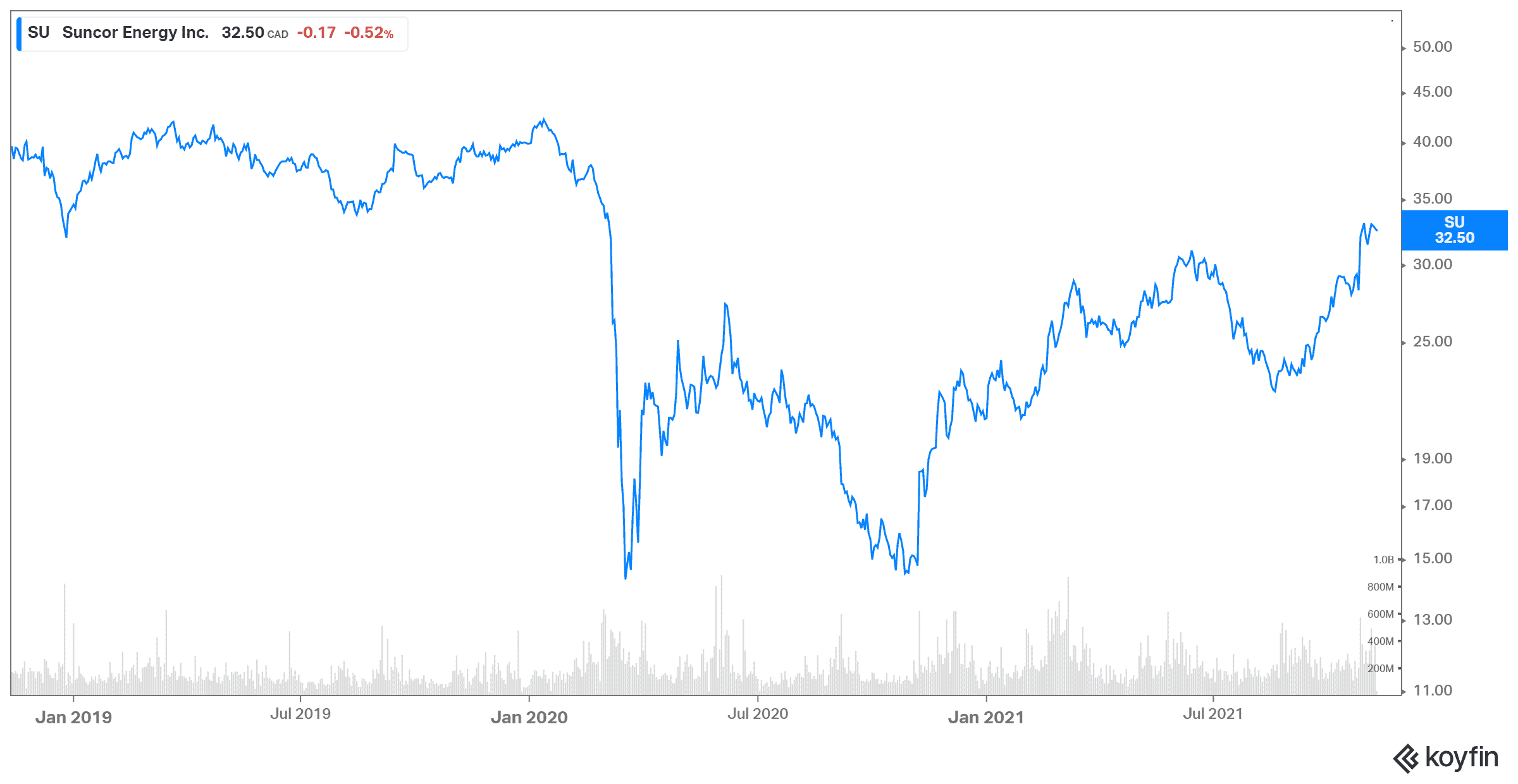

Suncor Energy: The go-to energy stock as oil prices soar

As Canada’s leading integrated oil and gas stock, Suncor stock is a favourite among investors. And this makes sense. In fact, it makes big dollars too! Suncor stock has a generous dividend yield of over 5%. Also, it’s rallied strongly in the last year and is up almost 55%.

I remember not too long ago when Suncor was an investor darling. It was difficult to find anything negative written about the stock. It was trading above $50, and the widely held opinion was that it would rise “forever.” Well, that overly optimistic attitude was reflected in the stock’s valuation. As you know, it fell hard from that $50 plus level. Today, we are a long way from those days. What we have in Suncor is an undervalued gem that’s churning out tons of cash flow. It’s also securing its long-term future and viability.

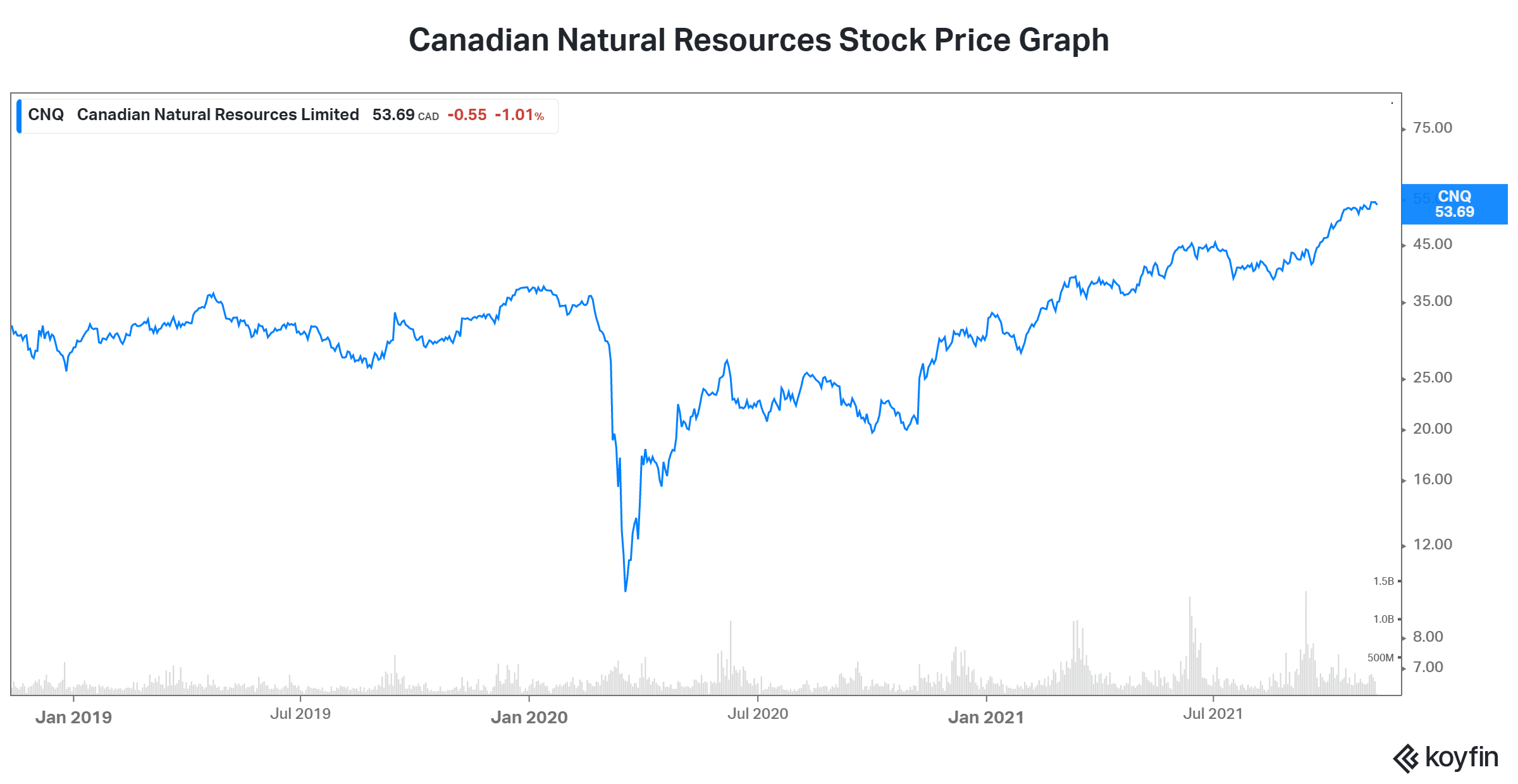

Canadian Natural Resources: Another top energy stock benefitting from strong oil prices

Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ) is Canada’s best-in-class oil and gas stock. Its long-life, low-decline assets are a gem. They require comparatively low capital expenditures and provide a high degree of predictability. Its asset base is resilient, diversified, and flexible.

Rising oil prices have and will continue to fall to Canadian Natural Resources’ bottom line. In turn, they’ll also fall to CNQ shareholders. The company has a history of 21 years of growing its dividend at a compound annual growth rate of 20%. This year, another 11% increase was announced. Canadian Natural Resources stock has not surprisingly been outperforming.

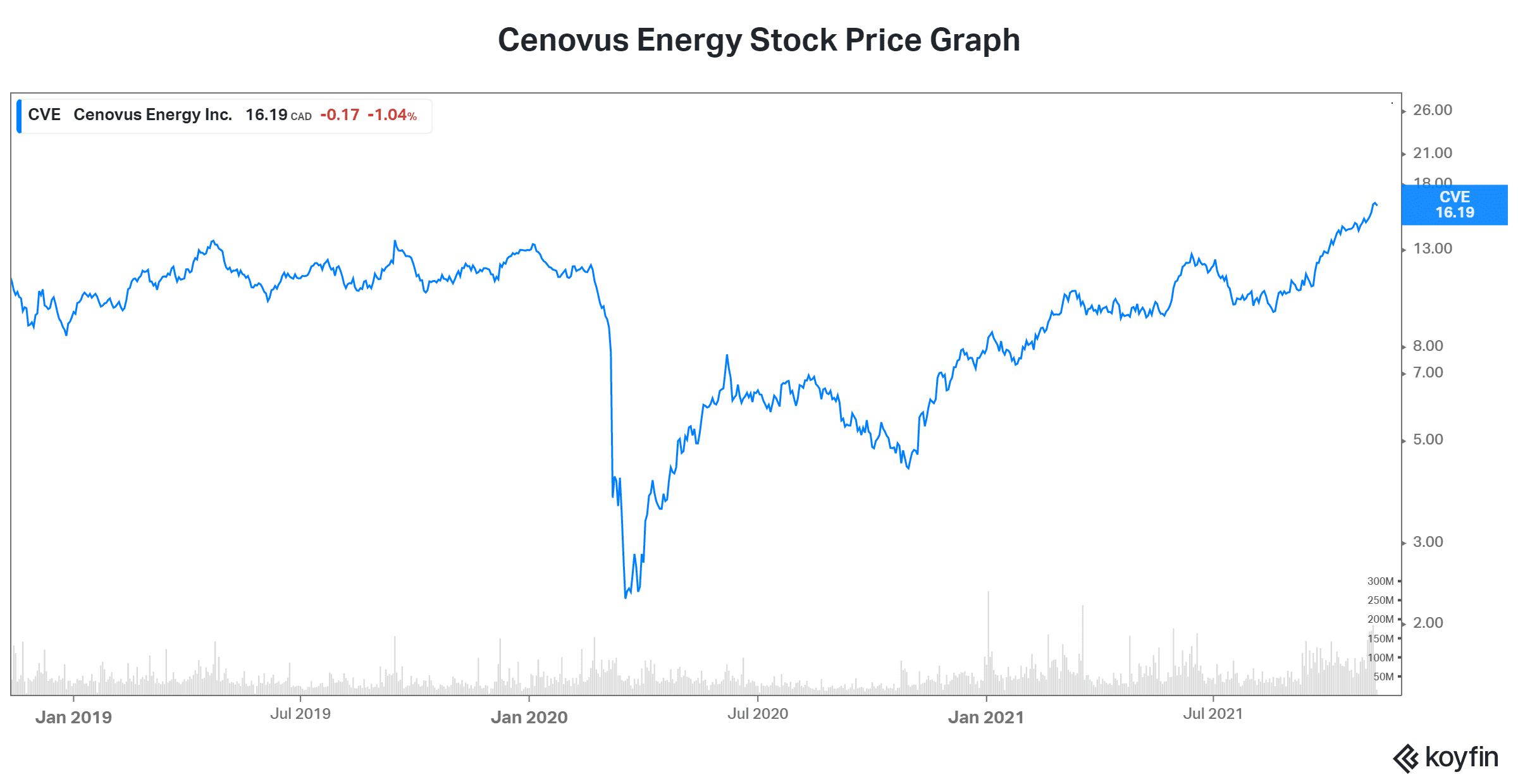

Cenovus Energy: An acquisition at rock-bottom valuations and a sweet spot

Cenovus Energy (TSX:CVE)(NYSE:CVE) is a leading Canadian oil sands producer with natural gas and conventional oil assets. This energy stock is in a sweet spot of its own. After having completed the acquisition of Husky Energy at rock -ottom prices, the company now stands to gain big off of the significant amount of synergies that will result. And rising oil prices will continue to drive Cenovus stock higher.

The bottom line

The rally in oil prices is far from over. A big supply/demand imbalance has finally hit home after years of underinvestment in the oil and gas industry. Oil prices today are around $85 with sights on over $100, so consider buying Cenovus.