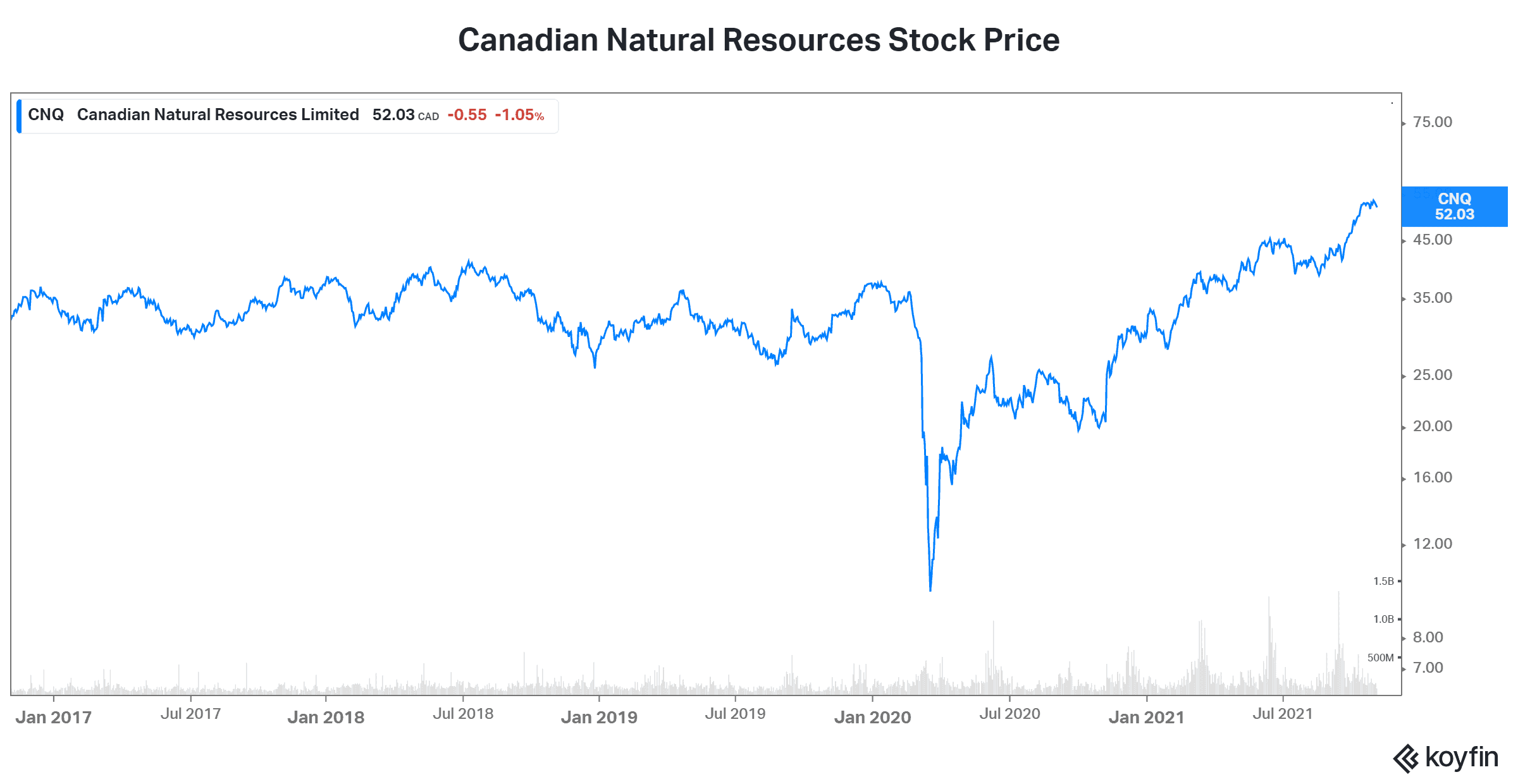

Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ) is a $62 billion, top-tier Canadian oil and gas company. It’s also an example of how a well-run and well-managed oil and gas company can create tons of shareholder value. As a result, Canadian Natural’s stock price has rallied big in 2021 to all-time highs.

Please read on to find out why this rally is not over yet – not by a long shot.

Canadian Natural Resources stock: Up big, but a long way to go

Not too long ago, oil and gas stocks were in the dumps. They were plagued with persistently low oil and gas prices. They were also plagued with negative sentiment. For example, investors, in general, shunned fossil fuel stocks in favour of clean energy stocks. Institutional investors did the “right” thing by divesting their oil and gas holdings.

Now I fully agree with this movement toward clean energy. The problem is that there’s a reality that we need to balance with this – namely, the reality that we NEED oil and gas to transition us to clean energy. The other very important reality is that Canadian oil and gas companies are among the cleanest in the world – with plans to be even cleaner. These are the factors that are fueling the rally in oil and gas prices and in turn, Canadian oil and gas stocks like Canadian Natural.

In short, this attitude of shunning the oil and gas industry has resulted in two major effects. First, it has resulted in underinvestment in production. This, in turn, has caused low supply levels. And we know from basic economics that lower supply drives up prices. Exacerbating this, demand in 2021 has been rebounding as the covid pandemic is resolving. Second, this also caused oil and gas stocks to trade at severely undervalued, unrealistic levels.

As investors see the strong results out of energy companies like CNQ, they will come back. This increased investor demand for the shares will increase the price. Again, it’s a simple economic supply/demand situation.

Canadian Natural stock increases shareholder returns as Q3 results show massive strength

Canadian Natural Resources just reported very strong Q3 results today, boosted by strong oil and gas prices and solid operational performance. With these phenomenal results, the company is paying down debt and generating massive amounts of cash flow. Today, they are at the point of redirecting a lot of this wealth to shareholders. For those of you who have stuck it out through the bad times, here is the payoff.

Today, the annual dividend was increased by 25% to $2.35 per share. With this, the stock’s dividend yield rises to 4.5%. This increase represents the 22nd year of consecutive increases. It’s also the largest one yet. Clearly, this increase can be maintained over time as Canadian Natural’s long-life assets will be able to support it. This is because cash flows associated with these assets are stable, steady, and resilient. In fact, these long-life, low decline assets are a real gem. They require comparatively low capital expenditures and provide a high degree of predictability. Its asset base is resilient, diversified, and flexible.

The bottom line

Canadian Natural Resources stock is finally getting the respect it deserves. I mean, it was always a very well-run company, but now, oil and gas prices are finally cooperating as well. As a result, we have the perfect storm.

Canadian Natural’s stock price is at all-time highs. Oil and gas cycles last years, not months, so you still have time to get in on the upcoming rally that I believe is yet to come.