BCE (TSX:BCE)(NYSE:BCE) is Canada’s largest telecom services company. It’s also one of Canada’s top dividend stocks. This is a spot that it has earned over the years. For example, BCE stock has provided investors with stress-free passive income for decades. Today, it’s yielding 5.5% and BCE’s stock price has performed exceptionally well over the long term.

BCE’s Q3 earnings were just released and demonstrate why it remains a must-own stock today.

BCE: Its leading telecommunications networks lift results

BCE has invested billions of dollars to build out its networks – and these investments are paying off. As of the third quarter, BCE is leading the industry in many financial and client measures. Also, the company’s revenue and EBITDA are back to pre-COVID levels. This reflects the strong demand for the speed and connectivity advantages of BCE’s networks.

Clearly, there’s a lot of good news to help convince us that BCE is a must-own stock. And the momentum continues to build. In the third quarter, retail internet net subscriber activations were the highest in 15 years. Also, residential internet revenue grew 9%. All of this came together in the third quarter with a 10% increase in earnings.

Next-generation infrastructure investments

The telecom industry is rapidly changing. New advances such as fibre optics and 5G are changing the landscape. Clearly, BCE is committed to keeping up with these changes. It’s a big commitment but consider the moat that BCE has built around itself. It, along with the two other big telecom giants, controls the market with a 90% market share. BCE’s position is pretty much untouchable.

BCE will be spending $1.7 billion in the next two years on network improvements and enhancements, laying the foundation for 5G growth. It will also connect more Canadians in rural areas. And finally, it will speed the rollout BCE’s fibre optic network. This fibre optic delivery brings the fastest speeds and a better overall experience.

BCE stock is the picture of dependability and consistency

A pristine balance, defensive revenue profile, and a 5.5% dividend yield make BCE a must-own stock. Consider this for a moment. BCE is one of the most cash flow-rich, steady companies out there. Also, it’s yielding 5.5%. Investors should pounce at the chance to get this yield from such a company. It’s a chance to build up a strong and resilient passive income portfolio.

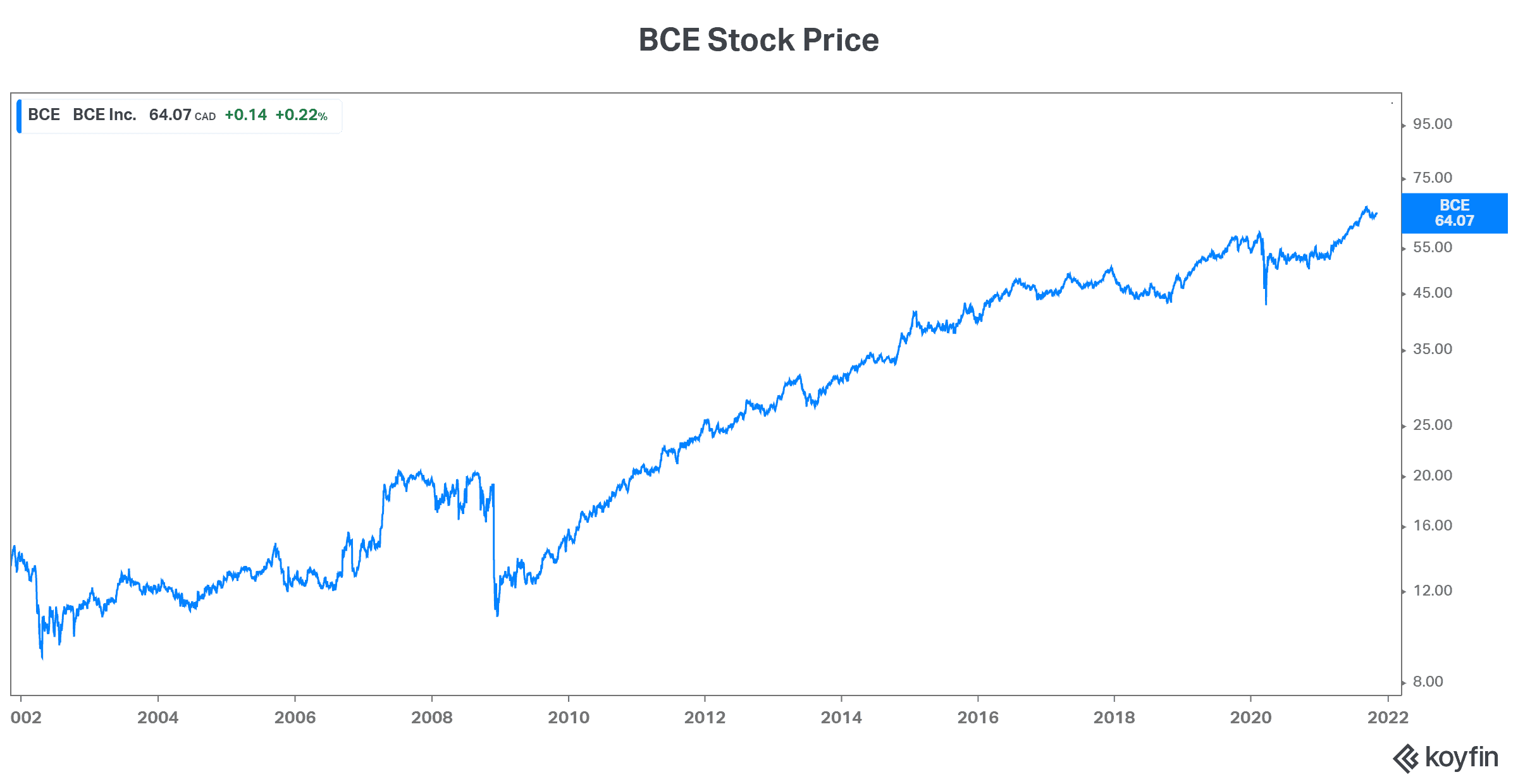

BCE’s business has proven to be extremely resilient and has been for a very long time. This has resulted in steadily growing dividends. In fact, 2020 was the 13th consecutive year of a 5% or higher dividend increase. It’s reflective of BCE stock and also a reflection of BCE management’s commitment to its dividend and dividend growth. Take a look at the following price graph of BCE stock. It shows investors have not only benefitted from dividend growth but also consistent capital gains. I expect this to continue.

The bottom line

BCE stock is steady today off strong Q3 results. And for good reason. This top stock is the picture of steadiness, reliability, and wealth creation. Consider adding it to your holdings if you’re looking for passive income.