Crescent Point Energy (TSX:CPG)(NYSE:CPG) has had a rough decade. It went from a hot energy stock that everyone wanted a piece of to a dog that nobody would touch. Should you buy it after its Q3 earnings?

Crescent Point Energy stock: The history

For a long time, Crescent Point had been extremely successful in implementing its strategy of acquiring, exploiting, and developing high-quality, long-life reserves. It emerged as a low-cost producer with high-quality reserves. These two factors made all the difference. Its stock price more than doubled from 2007 to 2014. And that wasn’t even the whole picture. Crescent Point had also been paying a very attractive dividend, providing a regular stream of low-tax income for investors.

Well, this was when oil prices were high years ago. At that time, Crescent Point got caught up in the trappings of growth via acquisitions. This meant overpaying for acquisitions when valuations were high. It also meant taking on excessive levels of debt. And then when the industry fell to its knees in the mid-2010s, Crescent Point paid the price. The stock fell from highs of almost $50 to almost nothing in this period.

This energy stock is now soaring as oil and gas prices skyrocket

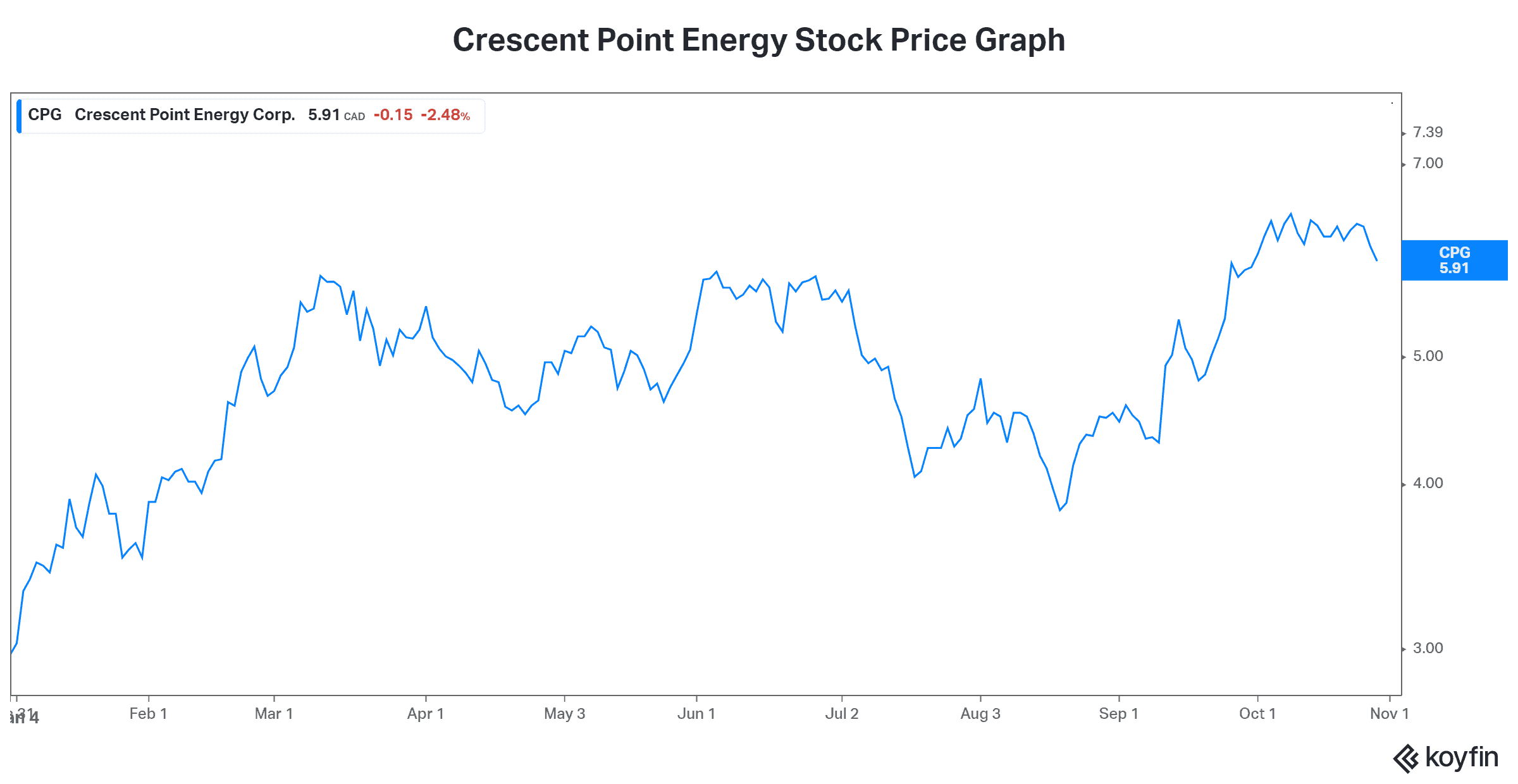

When oil and gas prices rise, it takes all oil and gas stocks with it. This is pretty much a given. And, it seems, it’s often regardless of a company’s quality. Crescent Point Energy stock has more than doubled in 2021. This is appropriate, as oil and gas prices have been skyrocketing.

There are always different options to get exposure to a sector. One would be buying a sector ETF. Another one would be creating a basket of the best stocks in the sector yourself. This way, you get to diversify your company-specific risk while also buying your best picks.

Crescent Point released its third-quarter results today. Let’s dig in to see what’s behind this company. Is it a good buy today? I mean, there are many energy stocks to choose from for energy exposure. Let’s do the work so we can put our money into the best possible ones.

Crescent Point Energy: Third-quarter earnings signify a possible return to the glory days

At the end of the day, Crescent Point’s assets have always been good assets. The trouble it got into was more financial in nature — that is, too much debt and too many acquisitions at the top of the market. Regardless of this, Crescent Point’s assets remain enviable. The bulk of the assets are in southeastern Saskatchewan, with others in Alberta and North Dakota. What makes Crescent Point’s assets special is that they’re low risk and high return. Also, they have long lives with a lot of new drilling opportunities.

Let’s look at how this has all translated into Crescent Point’s third-quarter earnings. Cash flow from operations rose 90%. Dividends were increased by 100%. And the company’s debt continues to fall. This extra cash is putting Crescent Point into a good spot to work on increasing shareholder returns.

A rising tide lifts all boats

Strong oil and gas prices will lift all energy stocks, Crescent Point included. The good thing is that the company is on the right path to cleaning up its balance sheet. Essentially, the company has done the right things to get out of the mess it was in. Investors can feel comfortable with this oil stock, as it will very likely continue to rise with the tide.

Motley Fool: The bottom line

Crescent Point Energy is re-emerging today with new management. It survived the brutal downturn only to start rising again this year, along with commodity prices. The company has the same prolific assets and potential as always. The upside here is real, and it’s significant.