Growth stocks are companies that investors expect to grow much faster than others. Growth stocks typically don’t pay dividends but, instead, choose to reinvest their earnings back into the company. Investors expect to benefit from the appreciation in stock prices. Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ) and Nuvei (TSX:NVEI)(NASDAQ:NVEI) are two Canadian growth stocks that have been doing well lately and should continue to deliver good returns in the near future.

Canadian Natural Resources

This company is one of the largest producers of oil and natural gas in Western Canada, supplemented by activities in the North Sea and offshore Africa. Canadian Natural Resources has a diversified crude oil portfolio, including heavy and light oil, natural gas, bitumen, and synthetic crude oil.

The company owns significant mining assets in the Horizon Oil Sands and the Athabasca Oil Sands, which hold leases containing approximately 7.5 billion barrels of proven and probable reserves of synthetic crude oil.

The oil and gas producer has a large portfolio of low-risk exploration and development projects. Its balanced and diversified production mix helps to facilitate its long-term value and considerably reduces its risk profile. Canadian Natural Resources also enjoys strong international exposure, driving long-term volume growth at above-average rates. Its low-cost structure, driven by the integration of its midstream pipeline assets, compares favourably with its peers.

Decreasing capital requirements and improving operational efficiency have enabled Canadian Natural Resources to generate strong free cash flow. In addition, its acquisitions have enabled the company to increase its competitive advantage, which increases its revenues and profits.

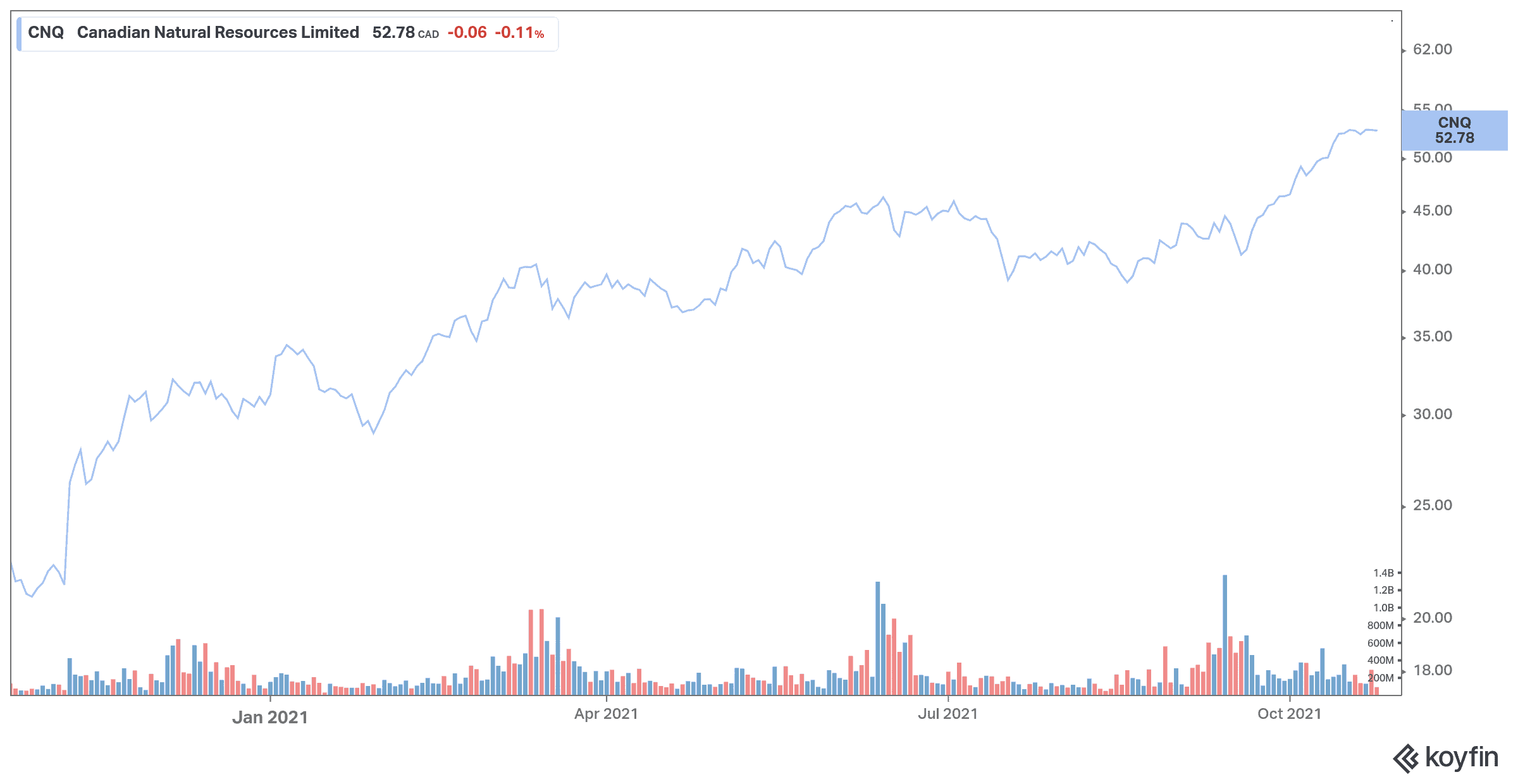

Analysts expect revenue to grow by 86.2%% year over year in the third quarter. Profits are also expected to rise, with a 1,336.4% year-over-year increase expected in the same quarter. Shares of Canadian Natural Resources have gained nearly 150% over one year.

Nuvei

Montreal-based payment management solutions company Nuvei has had its first year as a public company with accelerated growth.

Nuvei, which went public in September 2020 at a price of US$26 per share (approximately $34), had smashed a record for a Canadian technology company by raising a total amount of more than US$805 million, or more than $1 billion in Canadian dollars.

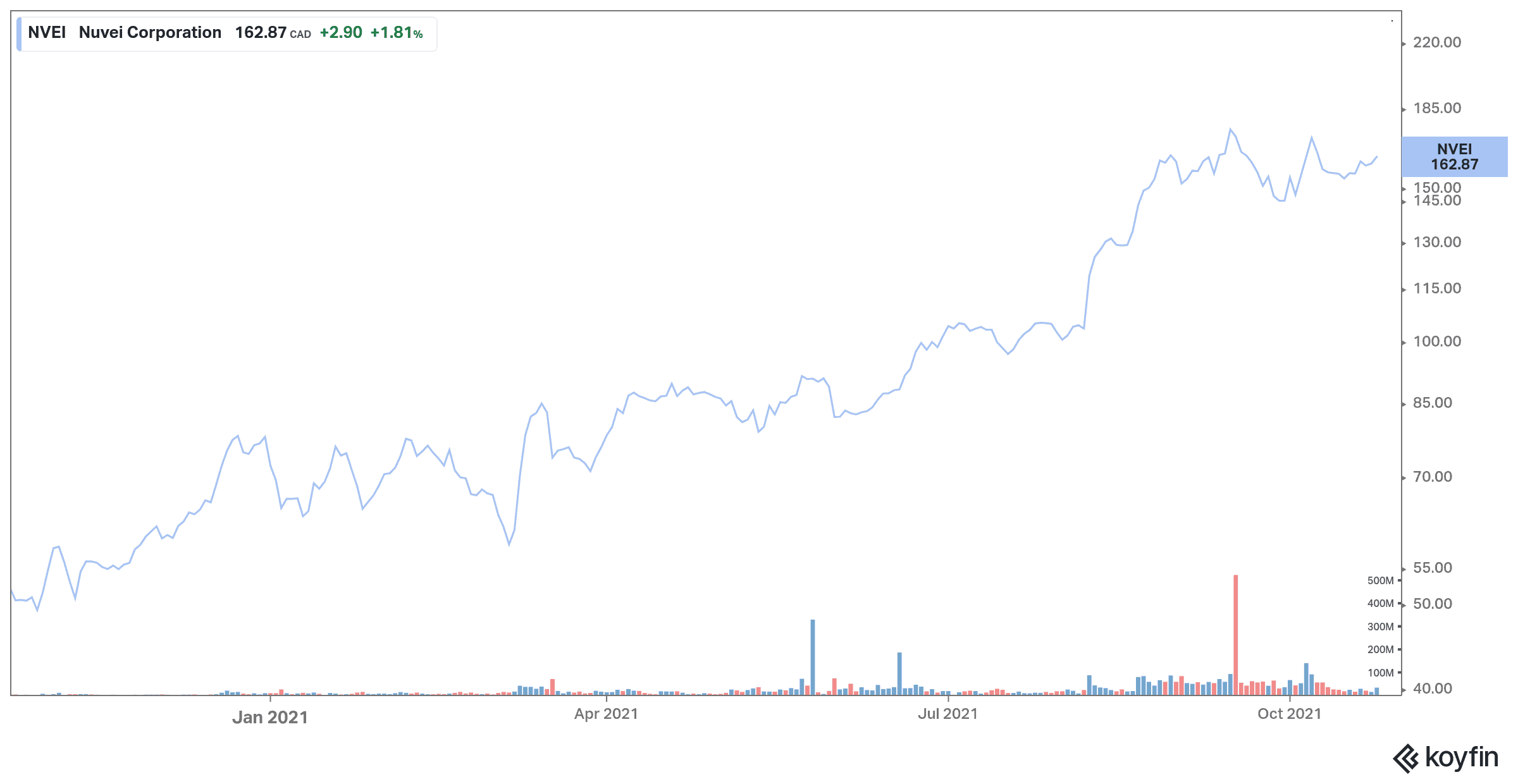

The stock has gained more than 220% over the past year, and its market capitalization is over $23 billion. The company just joined the Nasdaq under the ticker NVEI.

In August, during the conference call accompanying the release of its second-quarter financial results, Nuvei management said it is targeting 30% compound annual revenue growth over the medium term and increasing its profit margin from 44% to 50% over the long term.

Nuvei is well positioned to continue to grow through organic growth and acquisitions, keeping an eye out for opportunities that could increase its production and service capabilities.

In fact, the acquisition of Simplex on September 1, 2021, is an important step in its strategy to grow through alternative payment methods, such as cryptocurrency. This financial institution allows fiat payments in exchange for cryptocurrency to be accepted through credit and debit cards. In 2020, $500 million traded on the platform, and this figure is expected to reach $2 billion in 2021.

Nevertheless, the main goal of the payment facilitator is to increase its customer base and develop as many new markets as already existing ones.

The company, which also offers transactional tools for the online gaming industry, has also announced that it has been successful in handling transactions on the platform of the Netherlands’ first virtual casino, Holland Casino. It will ensure that the state institution reaches new players and will offer a payment and verification solution.

The company also announced that it has won a contract with PrizePicks, an online platform dedicated to sports betting that will use its Cashier solution to facilitate transactions on the platform and optimize its revenues.

Analysts expect revenue to grow by 136.6% year over year in the third quarter. Profits are also expected to rise, with a 182.4% year-over-year increase expected in the same quarter.